Chainlink’s LINK Climbs as Whales Add to Holdings Following Protocol Release

The CCIP protocol is designed to help build cross-chain applications and services and went live for early access users on the Avalanche, Ethereum, Optimism and Polygon blockchains this week.

Chainlink tokens surged Thursday as wealthy investors swapped ether for link (LINK) following the (CCIP) earlier this week, data shows.

LINK exchanged hands for $8 around midday in Europe as trading volume more than doubled to $580 million, helping extend weekly gains to over 25%.

shows some whales – or large holders of an asset – added upward of $6 million to their link holdings during the morning, with the increased demand lifting prices as much as 6%.

CCIP is designed to help build cross-chain applications and services. It was being tested by at least 25 partners that are now beginning to move to the mainnet, and was pushed live for early access users on the Avalanche, Ethereum, Optimism and Polygon blockchains.

On Thursday, CCIP will become available to all developers across five testnets: Arbitrum Goerli, Avalanche Fuji, Ethereum Sepolia, Optimism Goerli and Polygon Mumbai.

Prices of some other oracle protocols also rose, CoinGecko . In the past 24 hours, Band Protocol’s BAND added 9% while Uma’s UMA and API3 both jumped 5.4%.

Oracles are blockchain-based services that fetch data from outside a blockchain. Blockchains, by design, are immutable stores of data, but can’t verify the veracity of information. This is where oracle networks like Chainlink help – they refer multiple sources of information to provide reliable data to blockchain-based services and products for users.

Edited by Sheldon Reback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

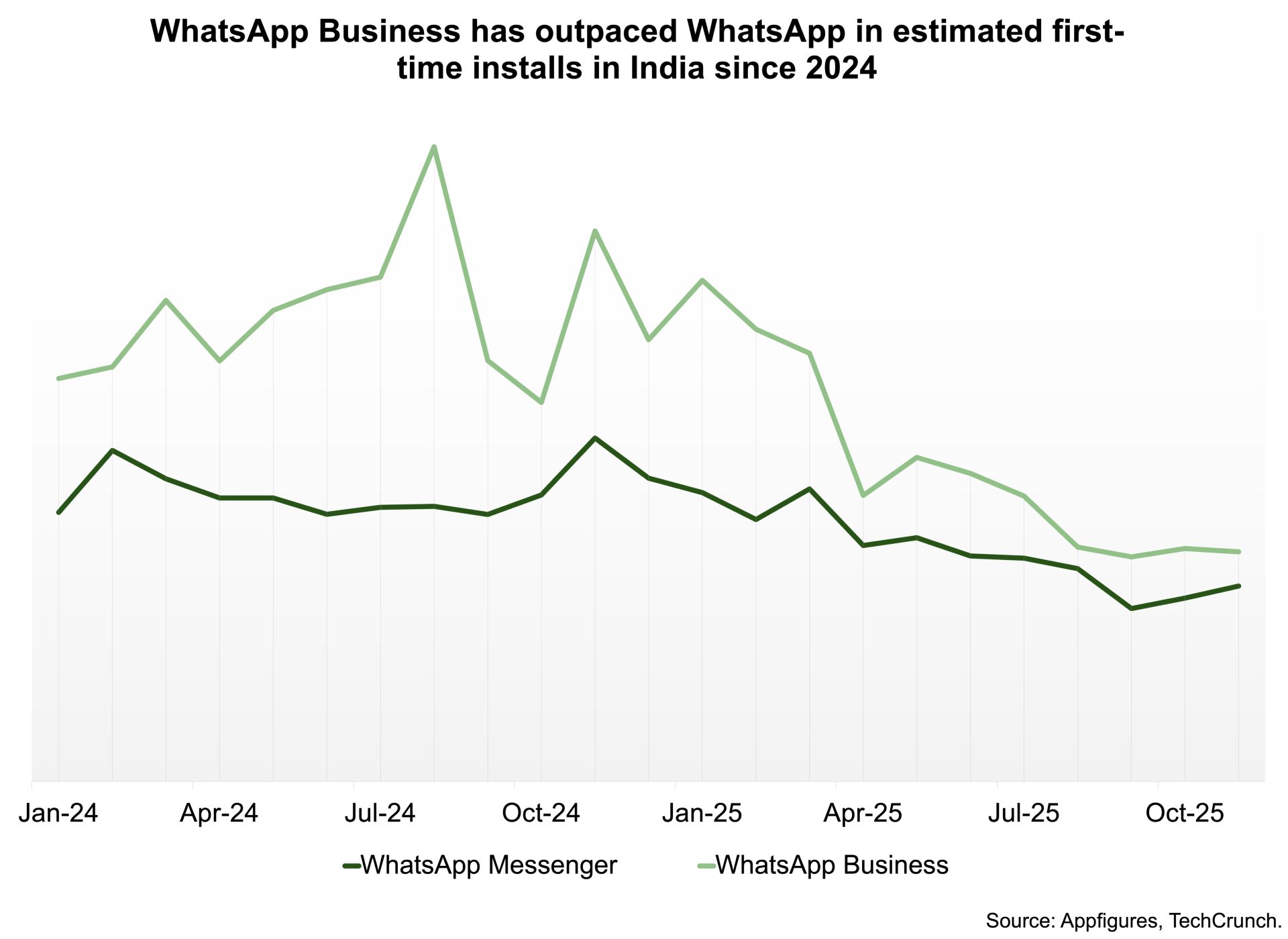

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026