Rekt Capital: 5 Phases of The Bitcoin Halving

5 Phases of The Bitcoin Halving

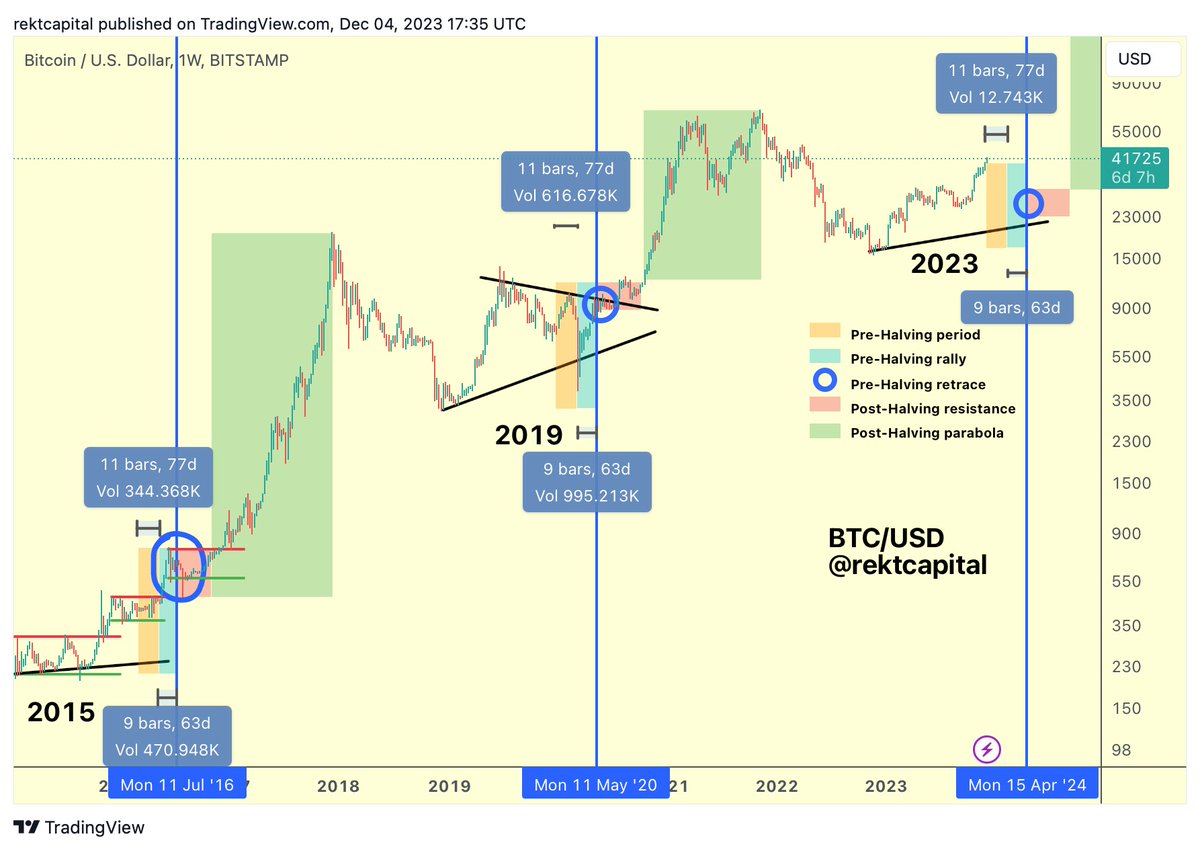

Pre-Halving period Approximately 4.5 months remain until the Bitcoin Halving in April 2024 Historically, any deeper retraces that occur during this period tend to generate fantastic Return On Investment for investors in the several months after the Halving

Pre-Halving rally Then ~60 days before the Halving, a Pre-Halving rally tends to occur (light blue) In anticipation of the Halving, investors "Buy the Hype" in an effort to "Sell the News"

Pre-Halving retrace A Pre-Halving retrace tends to occur around the Halving event itself (dark blue circle) In 2016, this Pre-Halving retrace was -38% deep In 2020, this Pre-Halving retrace was -20% deep This Pre-Halving retrace makes investors question whether the Halving was a bullish catalyst on price after all

Re-Accumulation The Pre-Halving retrace is followed by multi-month re-accumulation (red) Many investors get shaken-out in this stage due to boredom, impatience, and disappointment with lack of major results in their BTC investment in the immediate aftermath of the Halving

Parabolic Uptrend Once Bitcoin breaks out from the re-accumulation area breakout into the parabolic uptrend (green) It is during this phase Bitcoin experiences accelerated growth on its way to new All Time Highs

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes