Bitcoin ( BTC ) edged closer to $42,000 into the Jan. 21 weekly close with time almost up on a grim week for bulls.

BTC price recovers from $40.3K lows with Bitcoin volumes 'decimated'

BTC price awaits fresh cues

Data from Cointelegraph markets Pro and TradingView showed BTC price action stabilizing above $41,000 over the weekend. The pair had previously dipped to $40,270 on Bitstamp — its lowest since Dec. 11.

While not delivering major downside, Bitcoin offered little hope to those seeking new highs, with market participants looking ahead to the weekly close and return of Wall Street trading.

“Bitcoin has indeed dropped into the Weekly Range Low after flipping black into new resistance,” popular trader and analyst Rekt Capital warned on X (formerly Twitter).

“Weekly Close below the Range Low would be bearish and could begin the breakdown process.”

#BTC has indeed dropped into the Weekly Range Low after flipping black into new resistance

— Rekt Capital (@rektcapital) January 19, 2024

Weekly Close below the Range Low would be bearish and could begin the breakdown process $BTC #Crypto #Bitcoin https://t.co/ZIgcdyyiIe pic.twitter.com/SXQ5BfQ4Ds

Fellow trader Crypto Tony maintained the possibility of a trip below $40,000 to come between now and April’s block subsidy halving.

$BTC / $USD - Update

— Crypto Tony (@CryptoTony__) January 21, 2024

Mid range at the moment, but $38,000 i expect as we grind towards the halving in April legends pic.twitter.com/n3t3a33kXW

Joe McCann, founder of crypto fund Asymmetric, meanwhile noted just how little trading volume Bitcoin was now seeing.

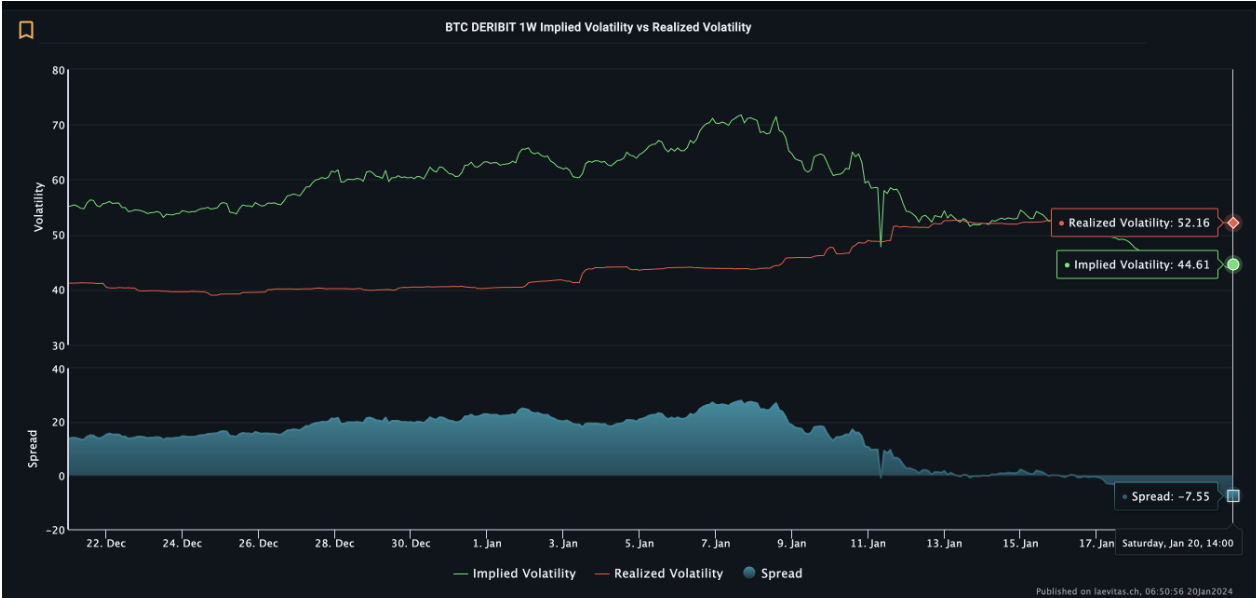

“Bitcoin vols have been absolutely decimated post ETF launch (as expected),” he told X subscribers alongside data from derivatives exchange Deribit.

“The spread between implied and realized vol is the widest it's been in a very long time.”

"All eyes on" GBTC sales

The United States’ spot Bitcoin exchange-traded funds (ETFs) continued to be a source of particular interest.

As Cointelegraph reported, these increased their assets under management to nearly $4 billion since their Jan. 11 launch, helping reduce the impact of selling from the Grayscale Bitcoin Trust (GBTC).

The latter, itself now an ETF, saw outflows as a result of both high maintenance fees and a desire for existing investors to cash out at par versus spot. Previously, GBTC shares traded at up to a 48% discount versus BTC/USD.

GBTC saw outflows of $1.17b since its conversion from a Trust to an ETF,” trading firm QCP Capital wrote in its latest market update on Jan. 17.

“This is not surprising since GBTC has traded at a discount since 2020 (as low as -48% at the start of 2023). This ETF conversion has been a long awaited chance for GBTC holders to exit at par value. The question is how much more of GBTC's current $25.4b AUM will exit.”

QCP added that “all eyes” were on GBTC outflows going forward.

“The next major crypto events are BTC halving (mid-Apr), and potential ETH Spot ETF approvals from May. In the meantime, crypto might take some direction from macroeconomic events,” it predicted.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.