Is SOL in Danger of Crashing to $78 Following 7% Daily Plunge? (Solana Price Analysis)

Solana’s selloff is intensifying. This puts the uptrend in question, and many are wondering when the bulls will come back into town.

Key Support levels: $78

Key Resistance levels: $104

1. Bears Dominate

Solana’s price fell by 7% in the past 24h and appears that it may make a lower low. This could see it reach the key support at $78, which is the first line of defense for bulls at this time.

2. Bearish Momentum Intensifies

Unfortunately, buyers were unable to stop this decline, and the selling momentum has intensified in the past few days. This is also reflected in the momentum indicators, such as the MACD and RSI, which are making lower lows.

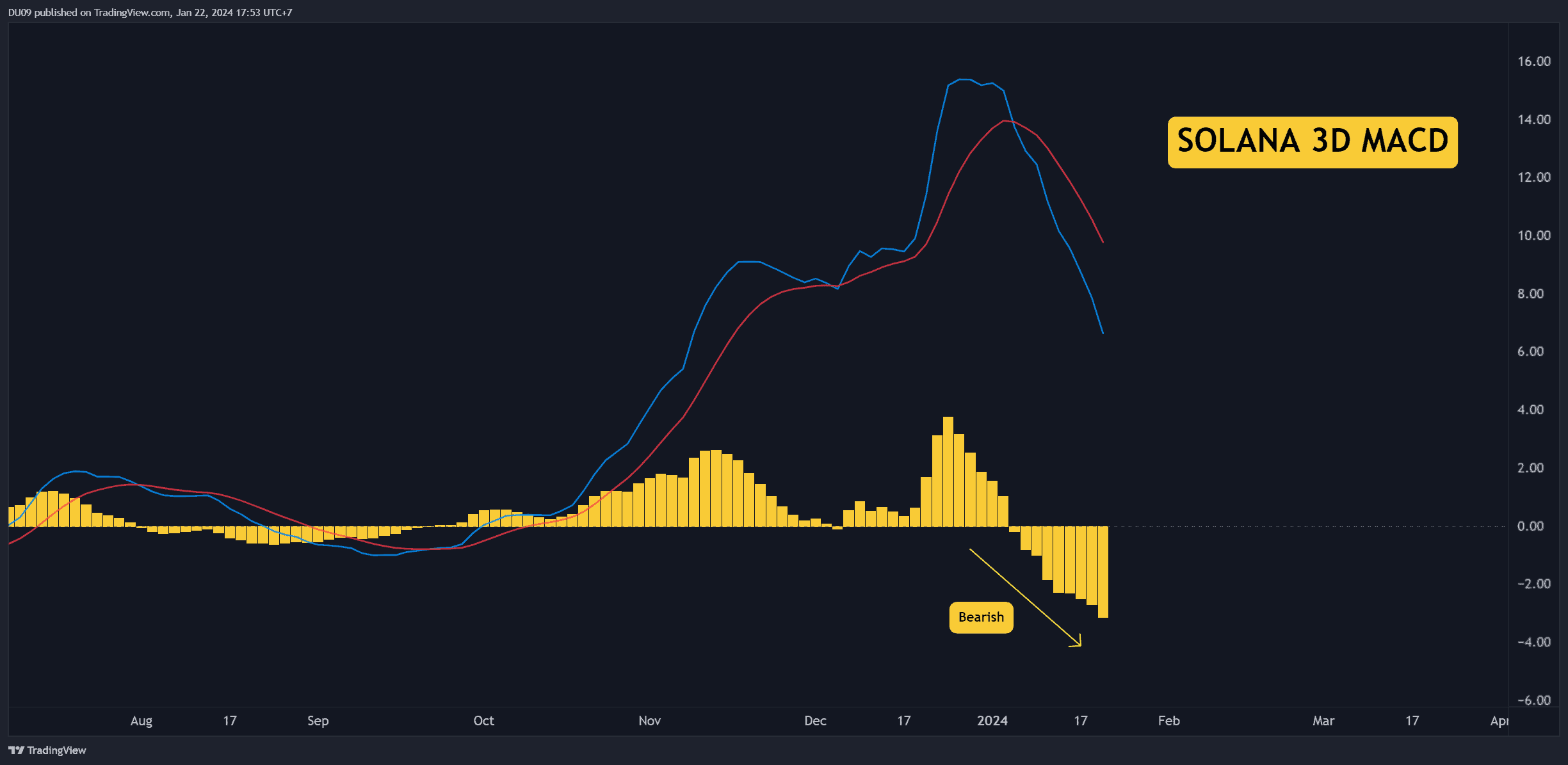

3. MACD Lower Lows

The 3-day MACD histogram is making lower lows, and the moving averages are expanding as they fall. This is bearish, and a recovery seems unlikely now.

Bias

The bias for SOL is bearish.

Short-Term Prediction for SOL Price

The most important level on the chart is the support at $78. It’s interesting to see if the bears will be able to take it down there.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

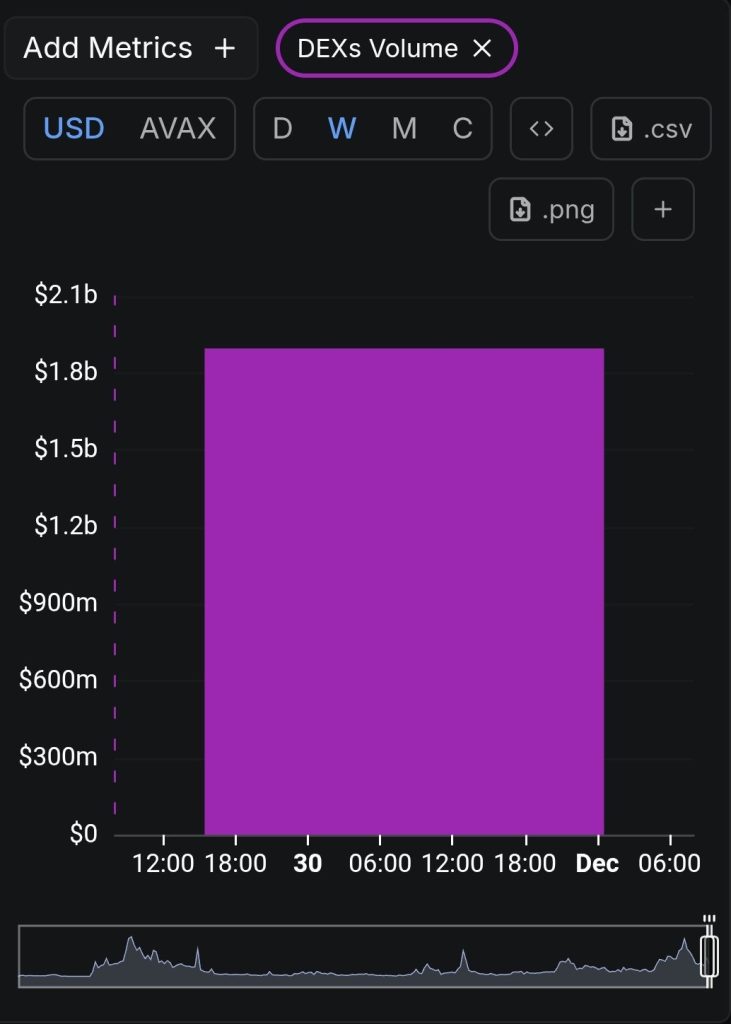

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak