Animoca-backed Gamee confirms major exploit of token contracts

Quick Take Gamee confirmed that its GMEE token contracts on Polygon suffered an exploit that resulted in the theft of 600 million tokens. The Gamee token fell 64% over the past 24 hours, with the exploiter converting the stolen tokens into ETH and MATIC.

In an X post , Gamee reported that its Polygon GMEE deployer address appeared compromised via unauthorized GitLab access earlier today, leading to a large theft of tokens, which were subsequently converted to ETH and MATIC. The impacted tokens were valued at $15 million at the time of the incident.

“Over the next few hours, the exploiter exchanged the compromised tokens via various DEXs, impacting the GMEE token price across various exchanges,” Gamee said — clarifying that all unauthorized access to the token contracts has been secured.

The price of the GMEE token has dropped 64% over the past 24 hours to below $0.01, according to CoinGecko data .

“The exploit affected proprietary team token reserves only, and no community-owned assets have been compromised,” Gamee continued. “Gamee does not custody or manage any community-owned assets.”

Gamee added it would identify impacted users and explore a plan to support its "loyal community through this challenging period.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

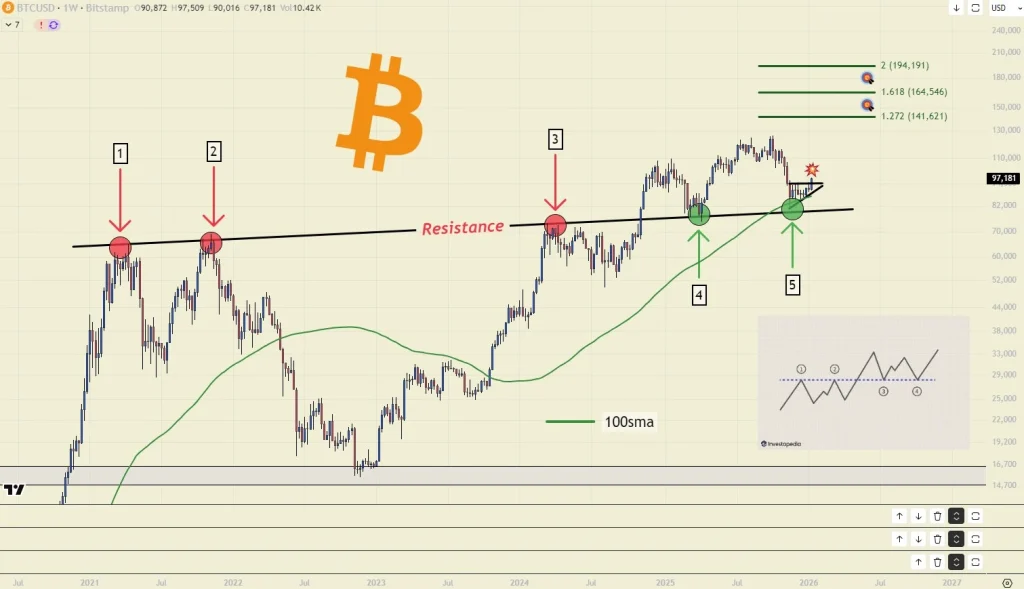

Bitcoin Spikes to a 2-Month High: Dead-cat-bounce or $100k Next? Experts Insights

Bitcoin (BTC) Price Hits $97,000 — Here’s Why Breaking $100K May Not Be Easy

Bitcoin Price Rises While Social Sentiment Stays Pessimistic—A Setup for the Next Bullish Move?