The eighth trading day of all Bitcoin spot ETFs in the United States saw a net outflow of 106 million US dollars

BitMEX Research stated that all Bitcoin spot ETFs in the United States had a net outflow of $106 million on the 8th trading day. The total inflow of funds within 8 days was $982.8 million.

According to the shared data, on the 8th trading day, Grayscale's GBTC had a net outflow of approximately $515.3 million, BlackRock's IBIT had a net inflow of $160.1 million, Fidelity's FBTC had a net inflow of $157.7 million, Bitwise's BITBC had a net inflow of $26.3 million, Ark 21Shares' ARKB had a net inflow of $61.8 million, Franklin's EZBC had a net inflow of $1.1 million, VanEck's HODL had a net inflow of $2.2 million; JPMorgan's BTCO and Valkyrie's BRRR as well as WisdomTree’s BTCW experienced small changes in funds and are not included.

In addition, based on Bitcoin calculations, the total influx for all ETFs within 8 days was equivalent to 21,362.5 BTC while GBTC saw an outflow totaling 98,296 BTC within the same period.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

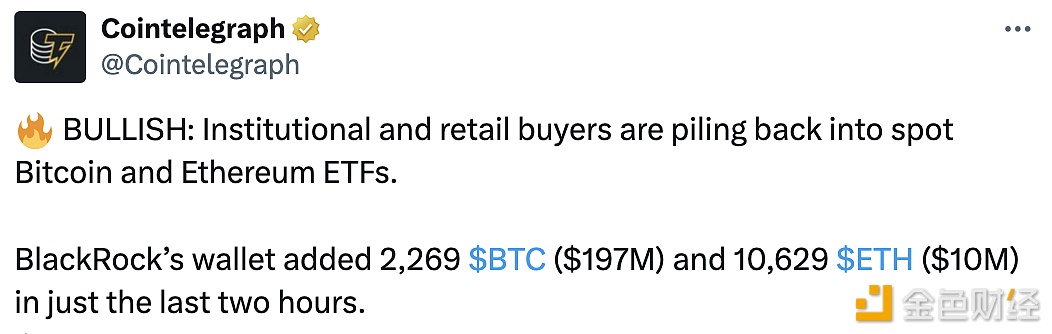

BlackRock wallet adds 2,269 BTC and 10,629 ETH

Federal Reserve official Daly supports a rate cut in December