It’s been a rollercoaster start to the year for vol trading.

What’s happened in BTC vols?

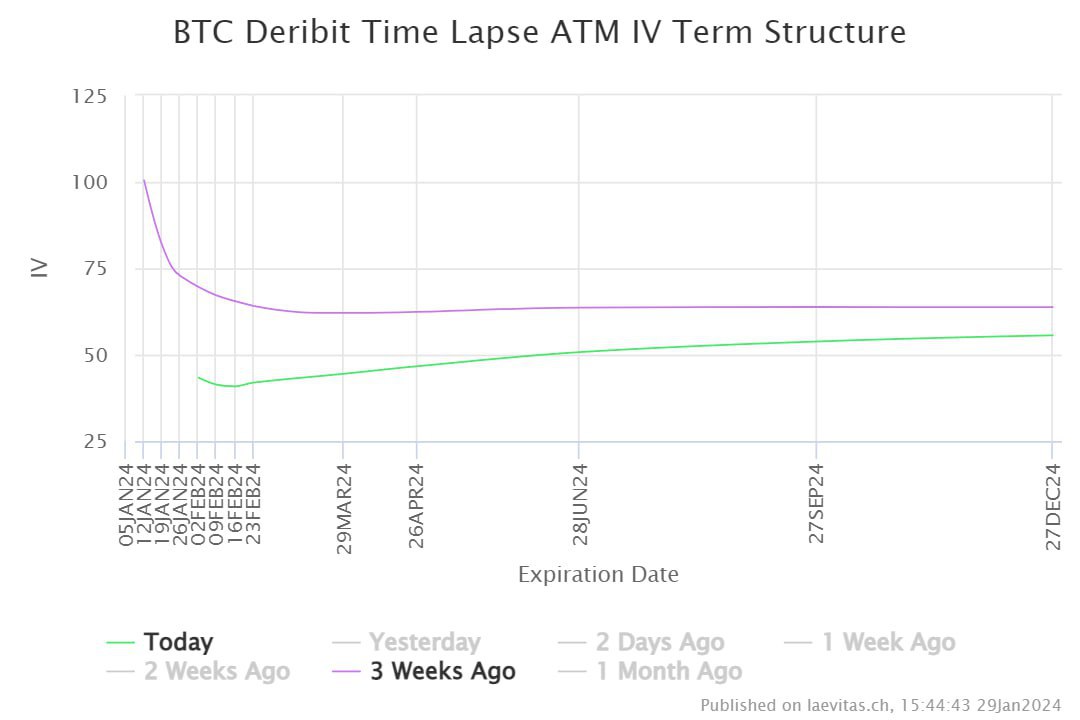

We went into the BTC spot ETF approval period with a high vol environment where the 7-day realized was at 75%. Post-ETF, it has tumbled down to 40% today.

The ETF approval high of 49,100 was quickly faded and BTC settled into a 39-43k range. Price rallies were sold down by GBTC outflows and dips were absorbed by inflows into the other ETFs and general accumulation ahead of the halving.

This caused front end vols to drop to 40% and the BTC vol curve to go from downward sloping to upward sloping today (Chart 1).

We have the quadrennial halving in April/May, which has been bullish historically.

The market seems to be in accumulation mode as we head into the event. Other than GBTC, the other ETFs continue to see decent inflows. Funding has also been fairly neutral which reflects a moderation of speculative positioning.

The Trade for BTC

Accumulators are one efficient way to take advantage of the short term spot ranginess and steep vol curve to build a long BTC position into the halving.

Indicatively, a weekly June accumulator allows you to buy BTC at 37,800 level every week until the end of June as long as spot price remains below 47,250.

ETH vs BTC

Post the BTC spot ETF approval, ETHBTC had a 20% rally from .05 to .06 in anticipation of the potential approval for spot ETH spot ETF down the road. Will ETH pull the same move as BTC (i.e. rally into the ETF and sell-off post the event)? Quite possible with ETHE’s 6b AUM.

There is a lot of uncertainty around the ETH spot ETF, mainly because its Proof-of-Stake could place it in a different asset classification from BTC. Greater uncertainty could also mean greater volatility.

In vols, we had the familiar ETH underwriters back on screens post the ETF, selling calls out till the March expiry, causing ETH front-end vols to trade at a discount to BTC. This is a significant discount because the 7-day realized vol for ETH is higher than BTC by 7-8%.

The Trade for ETH

Buying near-dated vs selling far-dated options to take advantage of the steep vol term-structure. For example, one can buy Feb expiry at 38-40% vs sell Sep expiry at 55% – indicative 26Apr24 ETH 2600 C : 107 USD per (19.7% ann. yield).