Bitcoin ( BTC ) is benefiting from a surge in stablecoin “buying power” as their supply trends higher.

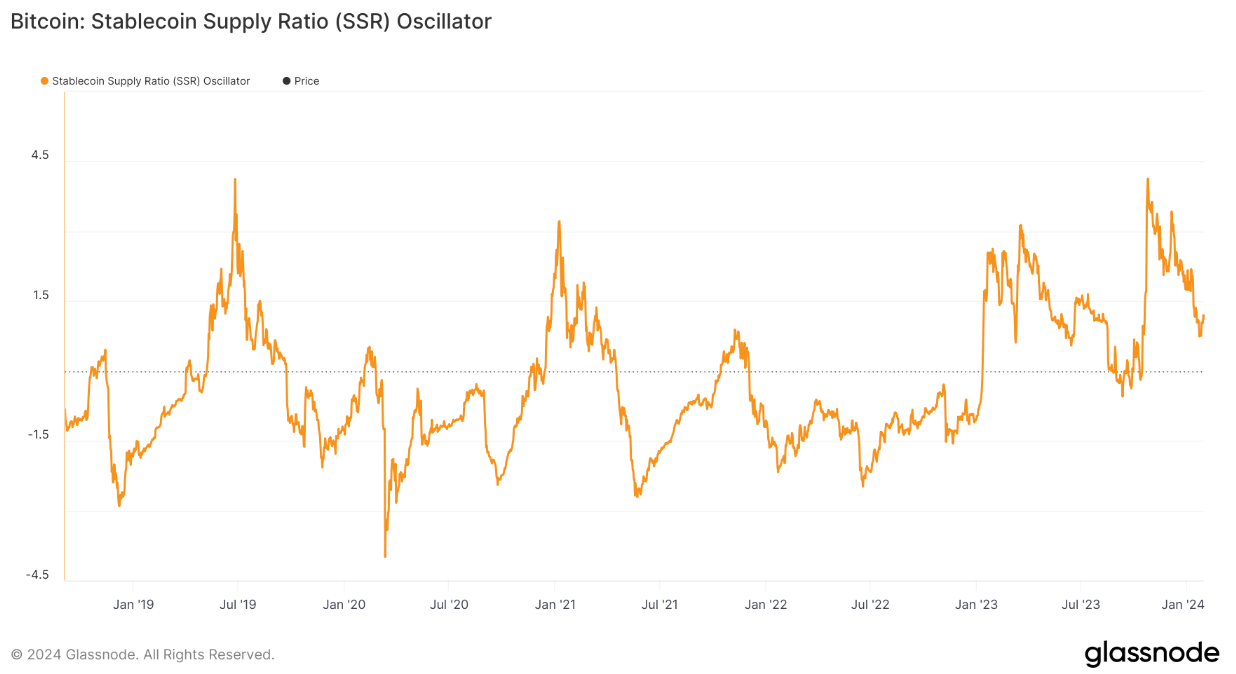

Data from on-chain analytics firm Glassnode shows an ongoing drop in the stablecoin supply ratio (SSR) oscillator.

Key stablecoin metric drops 80% from record high

Bitcoin headed to two-year highs this month after originally adding upside in October last year — and stablecoin data says that this is no coincidence.

The SSR oscillator tracks the ratio between the Bitcoin market cap and the combined value of all known stablecoins. As Glassnode explains , the tool “serves as a proxy for the supply/demand mechanics between BTC and USD.”

When SSR values are low, stablecoins have more purchasing power to buy up the BTC supply.

After hitting new all-time highs in October , the SSR oscillator has declined considerably — going from 4.13 on Oct. 25 to just 0.74 on Jan. 22.

![]() Stablecoin supply ratio (SSR) oscillator. Source: Glassnode

Stablecoin supply ratio (SSR) oscillator. Source: Glassnode

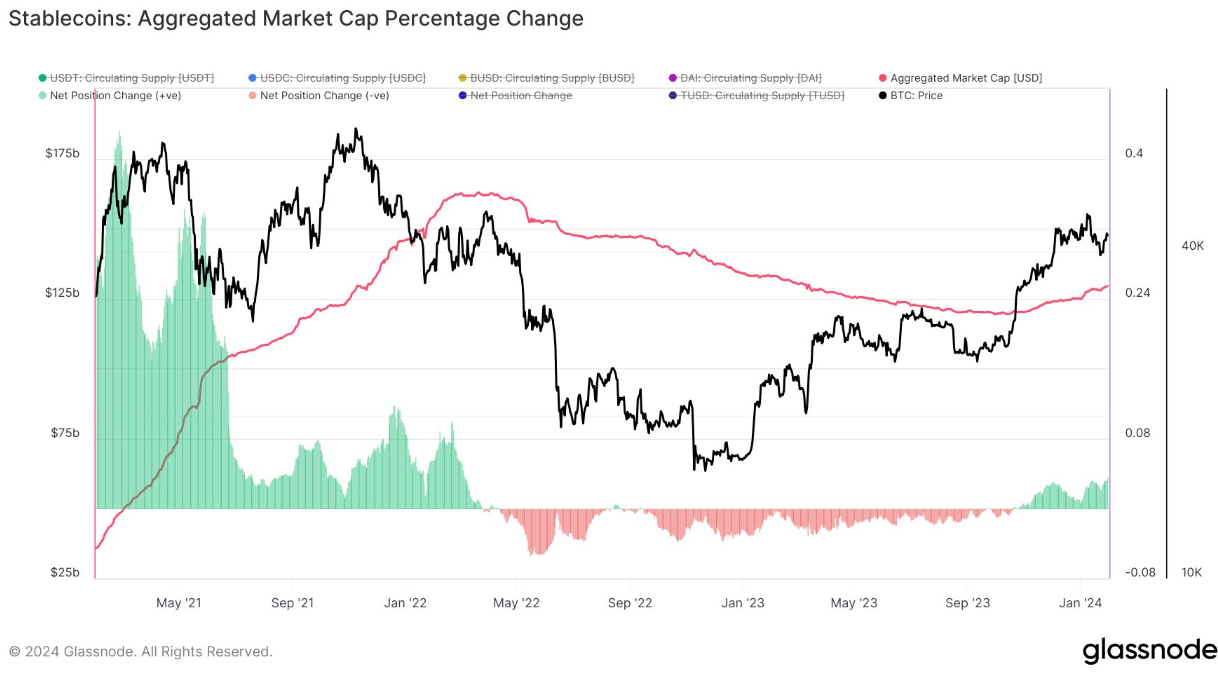

Analyzing changes in the overall stablecoin market cap, James Van Straten, research and data analyst at crypto insights firm CryptoSlate, flagged a boost in supply beginning in Q4 2023. This year, the trend continues.

“As we saw last week with the rotation of stablecoins moving into Bitcoin, that sent BTC above 42k,” he told subscribers on X (formerly Twitter) on Jan. 31.

“Stablecoin supply is now 10B higher from the low, and 3.5% higher in the past 30 days.”

![]() Stablecoin aggregate market cap change. Source: James Van Straten/X

Stablecoin aggregate market cap change. Source: James Van Straten/X

From May 2022 until October 2023, stablecoin supply was conversely in retreat.

Institutions add to on-chain BTC volumes

As Cointelegraph continues to report , Bitcoin currently faces its own changes in supply dynamics.

These are thanks to the newly-launched spot Bitcoin exchange-traded funds (ETFs), which have opened the door to institutional capital flows in the United States for the first time.

In addition, a major “rebalancing” is now underway from one ETF, the newly-converted Grayscale Bitcoin Trust (GBTC).

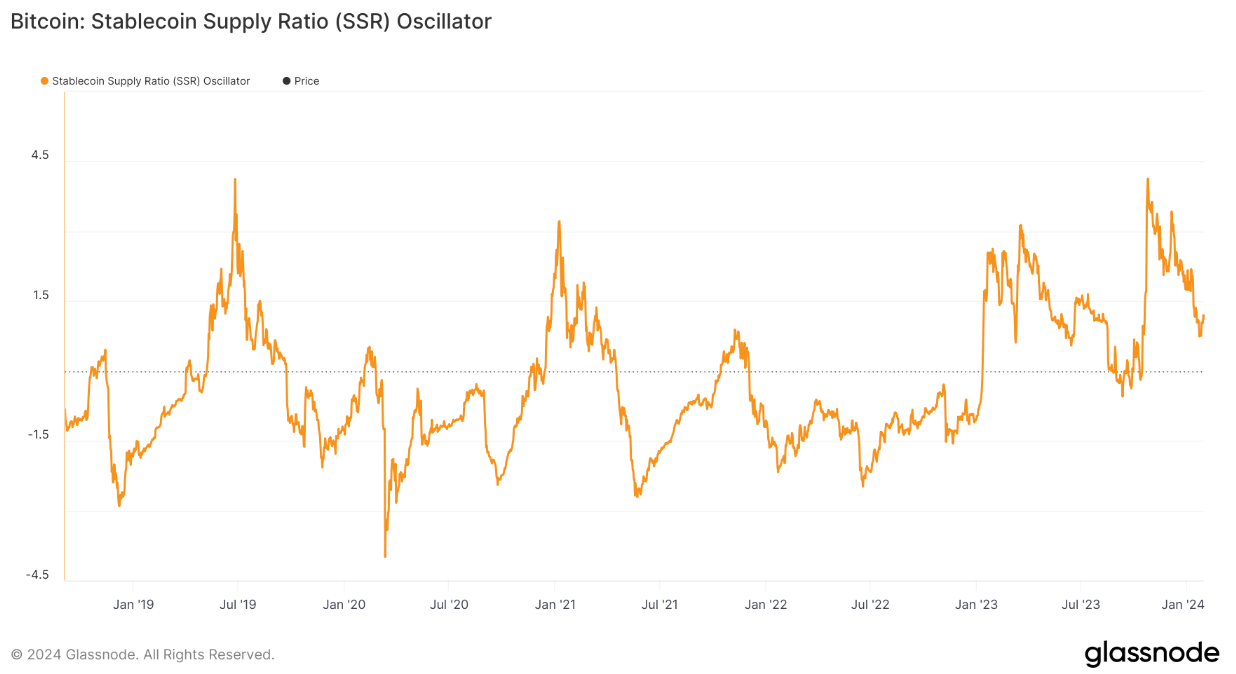

In the latest edition of its weekly newsletter, “ The Week On-Chain ,” Glassnode acknowledges that on-chain flows are still in a state of flux three weeks after the ETF launches.

“After many years of trading at a severe NAV discount (with a very high 2% fee), conversion to a spot ETF has triggered significant a re-balancing event,” researchers wrote.

“Around ~115.6k BTC have been redeemed from the GBTC ETF since conversion, creating significant market headwinds.”

![]()

Grayscale Bitcoin Trust (GBTC) outflows annotated chart (screenshot). Source: Glassnode

While these redemptions continue, forecasts see volumes reducing rapidly in the near future , reducing sell-side pressure.

Glassnode adds that institutional flows more broadly are increasing on-chain volumes.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.