Bitcoin ( BTC ) stayed under $43,000 at the Jan. 31 Wall Street open as risk assets dipped into a key United States economic policy update.

![]() BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

FOMC nerves quash crypto performance

Data from Cointelegraph markets Pro and TradingView showed BTC price action sticking to a range around $1,000 lower versus the previous day’s local high.

Markets were wary in the hours leading up to the Federal Reserve decision on benchmark interest rate changes, this coming in tandem with a speech and press conference from Chair Jerome Powell.

The latter is apt to spark risk-asset volatility, and as Cointelegraph reported , commentators were already primed for snap moves both up and down.

“Open Interest grinding up while we have FOMC later today,” popular trader Daan Crypto Trades noted on X (formerly Twitter), referring to the meeting of the Federal Open Market Committee.

“Often means that people will get chopped up and as always we tend to see a decently sized wick towards both sides around the event.”

![]() BTC/USDT order book data summary. Source: Daan Crypto Trades/X

BTC/USDT order book data summary. Source: Daan Crypto Trades/X

Daan Crypto Trades added that the 200-period simple and exponential moving averages, or SMA and EMA, were the near-term resistance line to overcome.

#Bitcoin I'm still seeing this as a bigger 40.2-44.5K range.

Currently trying to hold on to the 4H 200MA/EMA which acted as resistance last week. pic.twitter.com/a0SzK2LaY0

— Daan Crypto Trades (@DaanCrypto) January 31, 2024

Popoular trader and analyst Rekt Capital meanwhile also spied a rangebound construction in place on longer timeframes, predicting that BTC/USD would remain within in it “for the foreseeable future.”

#BTC

Bitcoin has indeed formed that Lower High

Still going to be range-bound for the foreseeable future $BTC #Crypto #Bitcoin https://t.co/f5KYbfK089 pic.twitter.com/C0x98wcL3n

— Rekt Capital (@rektcapital) January 31, 2024

“I'm not getting overly excited here,” trader and crypto educator Nebraskan Gooner continued in part of his own X coverage of the daily chart.

“My expectations are low and I'm feeling neutral at these levels. Might just get some chop.”

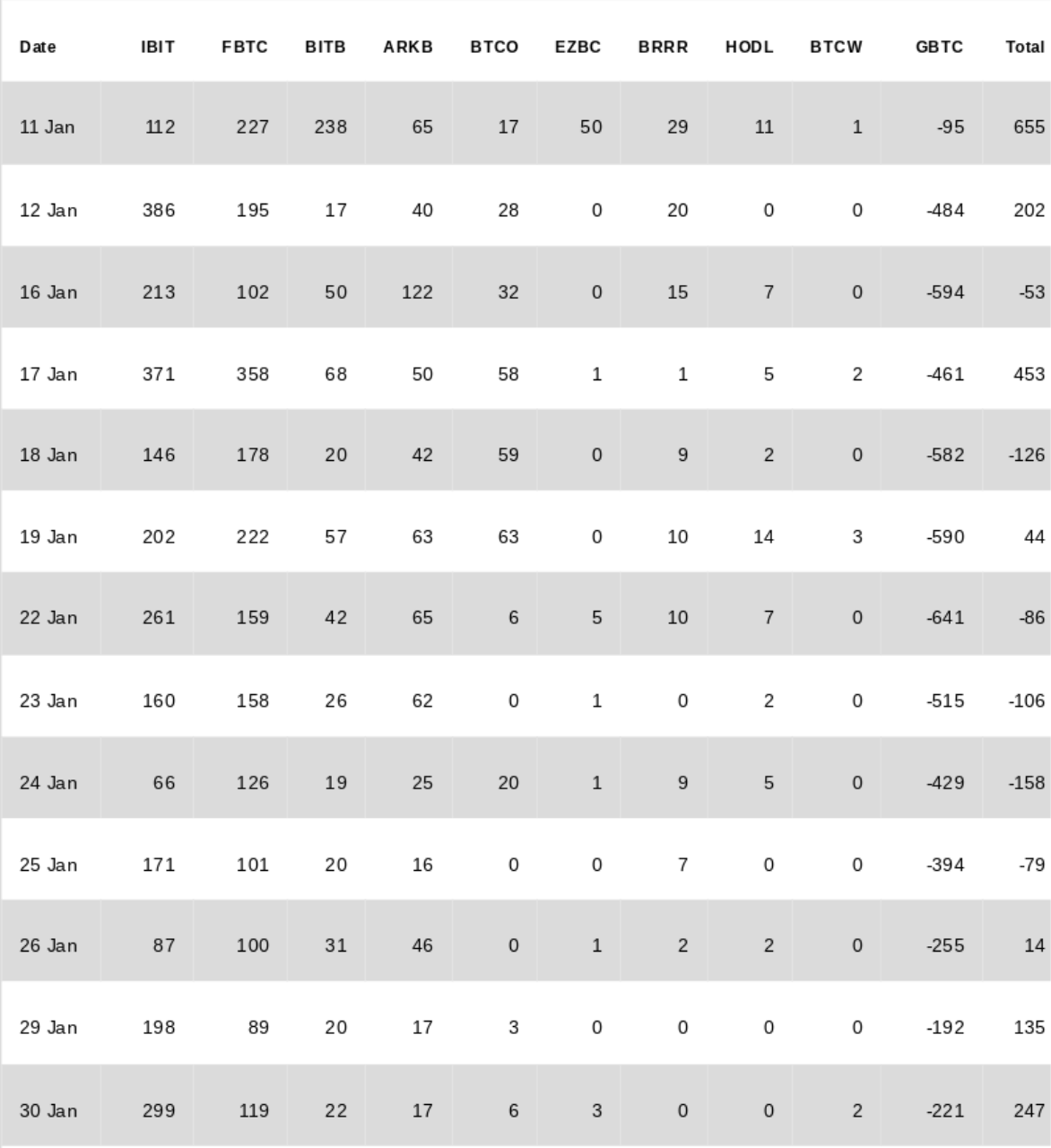

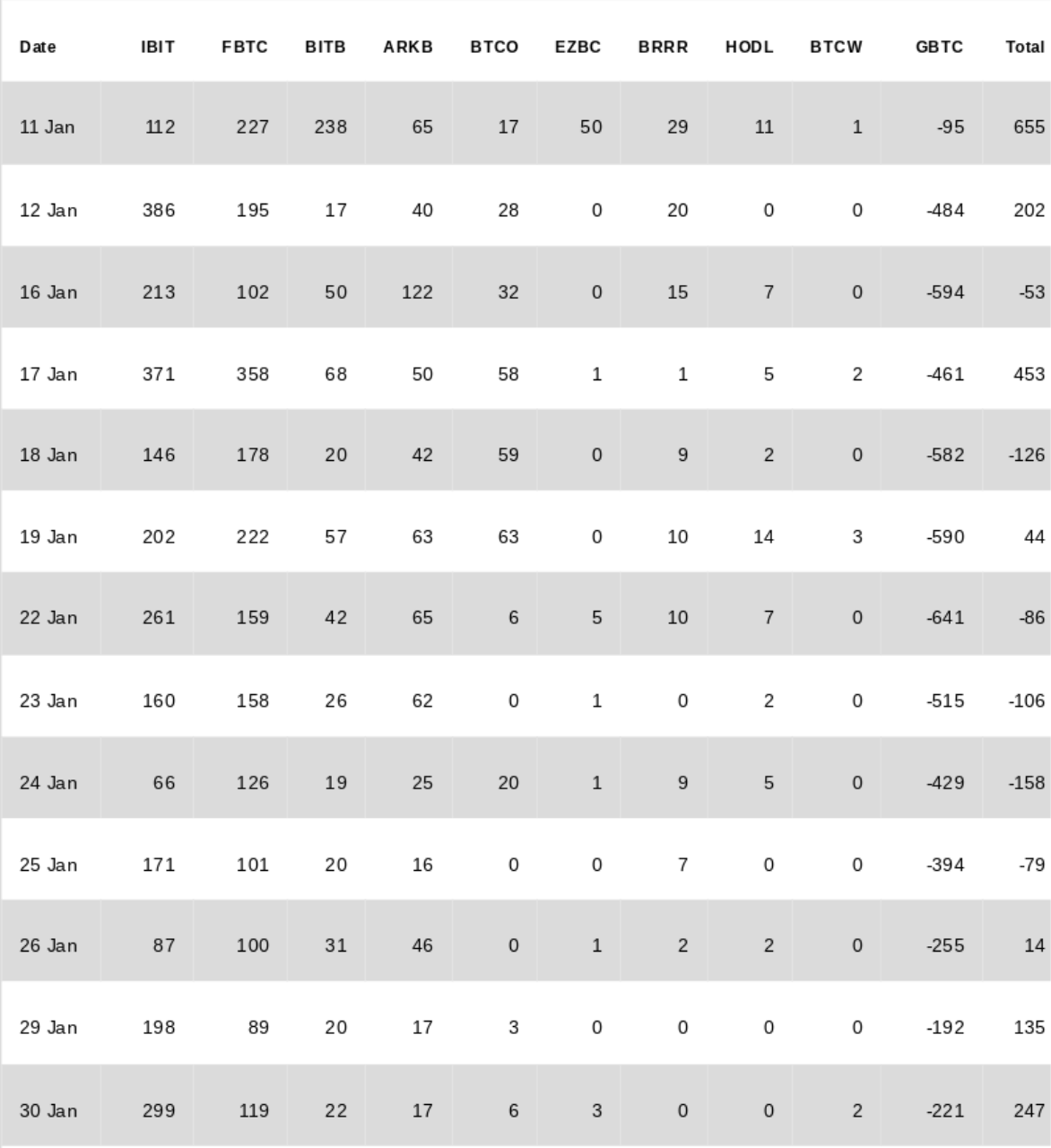

GBTC sees another 8,000 BTC outflow in modest uptick

The day’s spot Bitcoin exchange-traded fund (ETF) developments included heavier outflows from the Grayscale Bitcoin Trust (GBTC) than the two days prior.

These totaled around 8,000 BTC ($343 million) at the time of writing, per live data from intelligence firm Arkham .

“Slightly up from yesterday. Yesterday was another good day of +$247.2M in inflows. $IBIT also matching $GBTC in daily volume now,” Daan Crypto Trades commented in part of a reaction.

Optimistic views on the ETF flows increasingly focused on their size relative to the supply of newly-mined bitcoins being created per day.

Another day of the ETFs eating supply equal to 6 days worth of block rewards.

Bitcoin CEO has to print more bitcoin soon to meet demand. https://t.co/cNOOvF4oLH

— hodlonaut 80 IQ 13%er ⚡ (@hodlonaut) January 31, 2024

“2 days of $250 million inflow, price didn't really rally much yesterday but a couple of days like this and you'll see what kind of supply shock this will have on BTC,” popular commentator WhalePanda added on Jan. 30 alongside provisional inflow data from United Kingdom-based investment firm Farside .

![]() Spot Bitcoin ETF flows (screenshot). Source: Farview Investors

Spot Bitcoin ETF flows (screenshot). Source: Farview Investors

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.