Markets Focus on Core Personal Consumption Expenditures as Forward Guidance on Fed Rate Cut Missing

Seema Shah, chief global strategist at Principal Asset Management, said the Fed was reluctant to provide forward guidance for a rate cut after a series of strong economic data releases and easing price pressures. markets are concerned that core personal consumption expenditures have converged around 2 per cent and want to understand what policymakers need to be confident that inflation will continue to move towards 2 per cent. Does the Fed need a few months of data with core personal consumption expenditures at 2% or clear evidence of a cooling labour market? Powell's stance is unclear, and the views of other officials in the coming weeks will be equally important and may try to retract Powell's comments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

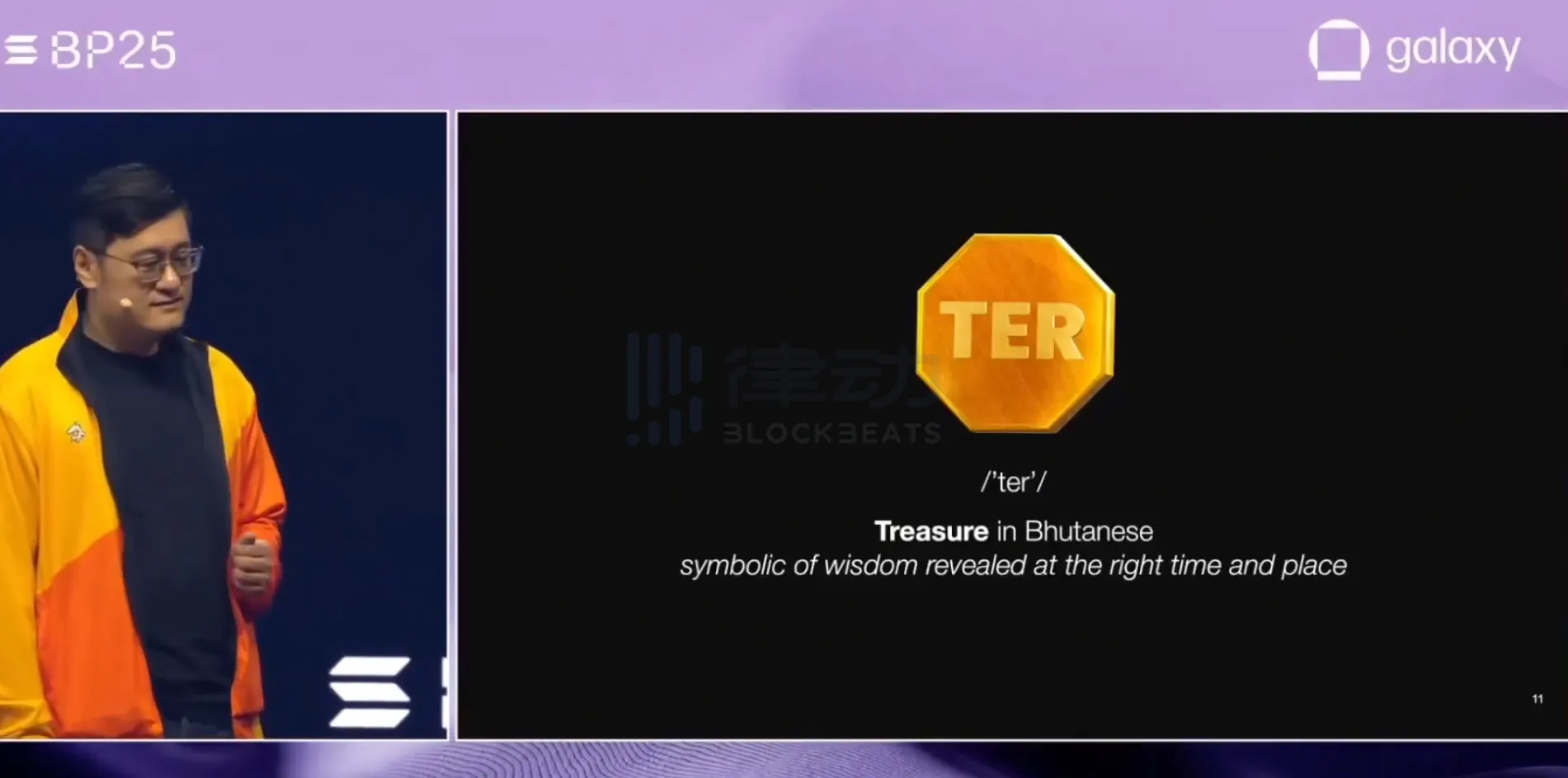

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network