Bitget Futures Market Data: BTC Futures total open interest of 17.11 billion USD, long/short ratio of 50.19/49.81%

On February 1st, according to Coindesk data, the annualized three-month and six-month PCE indicators (US core personal consumption expenditure price index) have both fallen below the Federal Reserve's target of 2%, strengthening the possibility of another interest rate cut by the central bank. In terms of contract markets, in the past 24 hours, the futures market has experienced a series of long positions being closed out with a significant increase in trading volume. BTC and ETH, among other major cryptocurrencies, continue to dominate the market as investors maintain a balance between long and short contracts.

Regarding BTC contracts, total open interest is $17.11 billion (-5.05%), 24-hour trading volume is $46.88 billion (+23.71%), and 24-hour liquidation volume for long positions is $45.44 million while for short positions it is $13.66 million. The long/short ratio is 50.19%/49.81%.

As for ETH contracts, total open interest is $7.51 billion (-4.58%), 24-hour ETH trading volume is $19.67 billion (+7.53%), and 24-hour liquidation volume for long positions is $42.44 million while for short positions it is $6..33 million.The long/short ratio is48 .28%/51 .72%.

The top three increases in contract open interest are JUP—$32..70 million (+48558814%), RATS—$2..26 million (+65 .92 %), RON—$9 ..56million(+35 .33%).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

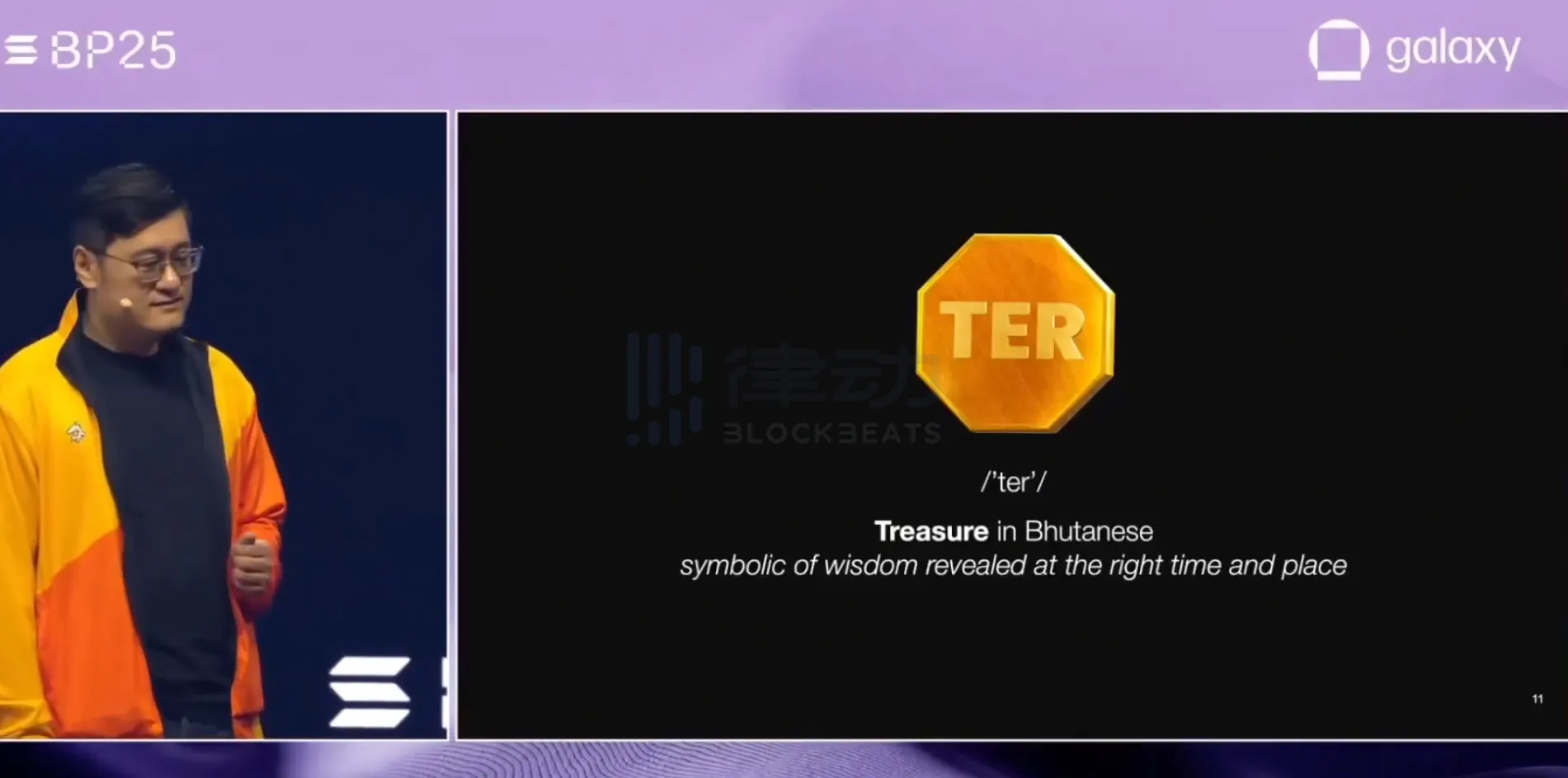

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network