Institution comments on US retail sales data: The claim of unexpectedly strong US economy is shattered

After retail sales unexpectedly dropped, the yield on the two-year US Treasury bonds fell to 4.5%, shattering the notion of an unexpectedly strong US economy. Tuesday's CPI data delayed traders' bets on rate cuts, while today's data indicates that consumers are slowing down, signaling a dovish stance. This will weigh on the US dollar and potentially boost rate-sensitive stocks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Web3Labs: Official X account hacked and false information posted, full recovery efforts underway

U.S. tech giants spark a bond issuance boom

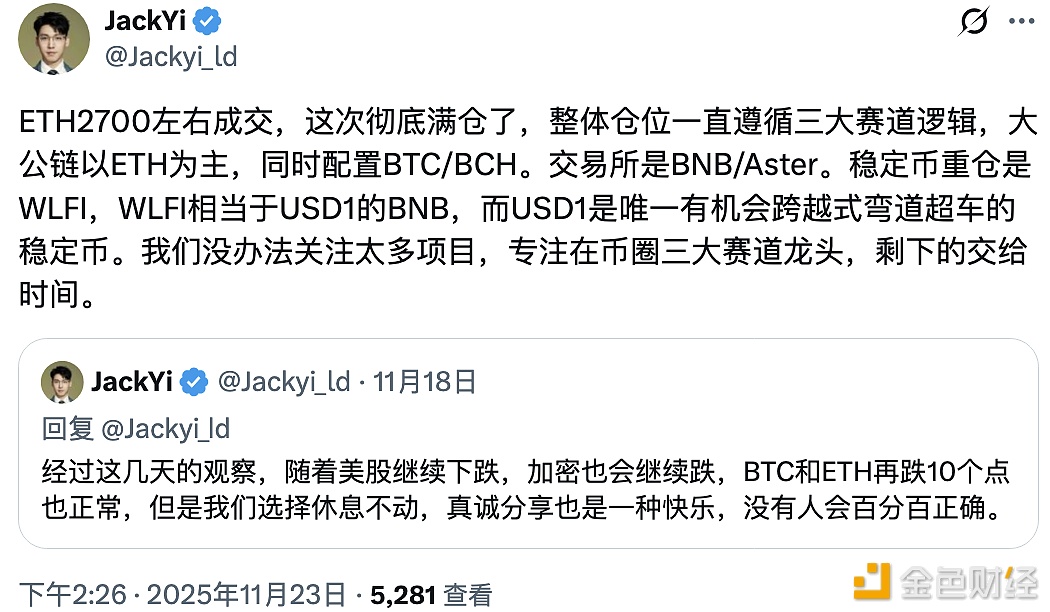

Jack Yi: Went all in on ETH at around $2,700

Data: 3.3338 million WLD were transferred out from a certain exchange, worth approximately $20.41 million.