U.S. spot Bitcoin ETF weekly net inflows and trading volumes hit record highs last week

Last week, U.S. spot Bitcoin ETFs saw record weekly net inflows and trading volumes. Net inflows into 10 spot Bitcoin ETFs last week hit $2.57 billion, a 15% increase from the $2.24 billion in net inflows the previous week, according to data from BitMEX Research and Farside Investors. BlackRock IBIT continued its dominance, with inflows of $2.48 billion. Fidelity FBTC ranked second with $717.9 million, and VanEck HODL ranked third with $247.8 million. However, GBTC saw outflows of $1.25 billion, while Invesco BTCO also saw outflows of $29.4 million. Since trading in the Bitcoin spot ETF began on January 11, net inflows currently stand at just over $12 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

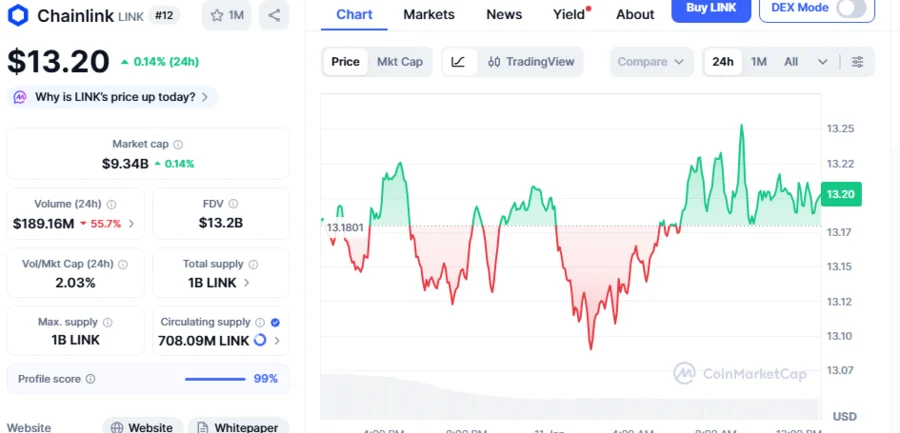

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026