Ethereum-based memecoins rally as market reacts to potential spot ether ETF approvals

Memecoins on the Ethereum blockchain have surged amid a change in sentiment regarding the approval of spot ether ETFs in the U.S.PEPE’s price has risen 16% in the past 24 hours, while LADYS and DOGE increased roughly 30% and 6%, respectively.

Several prominent memecoins on the Ethereum blockchain rallied between 5% and 30% on Tuesday, shortly after the U.S. Securities Exchange Commission reportedly requested at least three securities exchanges revise their applications to list spot ether ETFs.

Pepe PEPE +19.49% has risen 16% in the past 24 hours, The Block's price page shows, while LADYS +25.86% surged about 28% and DOGE +3.86% ticked up about 6%. ETH is up about 4.6% to $3,746.93 in the same period.

It remains unclear if regulators will approve spot ether ETFs. The first deadline for a proposed spot ether ETF is May 23, with VanEck's proposal up first. Nevertheless, the market has responded to issuers’ and security exchanges' recent actions to prepare for a potential rubber-stamping of the crypto-based investment vehicles.

Fidelity Investments amended its S-1 registration with regulators on Tuesday morning. In the updated statement, the would-be issuer removed language about ether-related staking from its application. Grayscale Investments also dropped its staking proposal in its proposed spot ether ETF.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

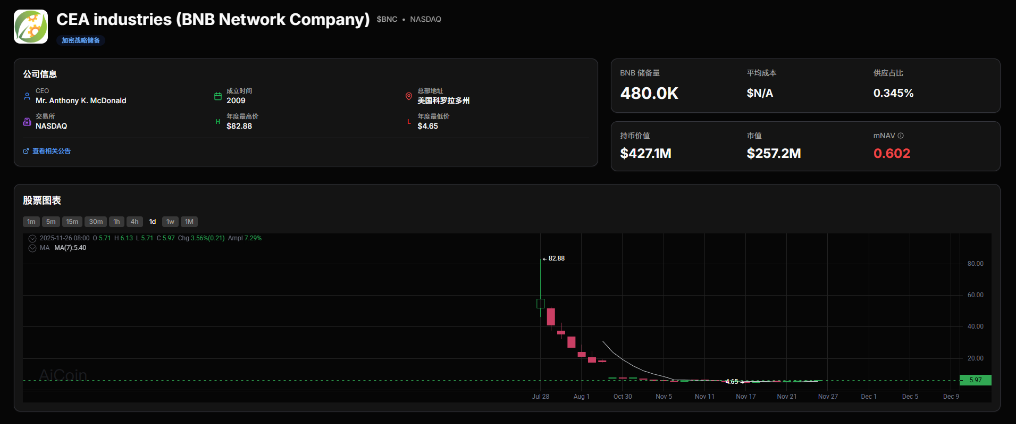

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage