Bitcoin ETPs Lead Inflows with $1.01B Weekly, What About Ethereum? (CoinShares)

Digital asset investments have reached year-to-date inflows record, hitting an all-time high of almost $15 billion.

For the third consecutive week, digital asset investment products attracted impressive inflows, as this time, they totaled $1.05 billion. The latest figures contributed to a record-breaking year-to-date cumulative flow of $14.9 billion.

According to the latest edition of CoinShares’ Digital Asset Fund Flows Weekly Report, the recent surge in prices has driven total digital asset exchange-traded products (ETPs) to $98.5 billion. Meanwhile, weekly ETP trading volumes have increased by 28% to $13.6 billion.

- The majority of inflows were directed towards Bitcoin ETPs, which attracted $1.01 billion, while short-BTC products experienced outflows totaling $4.3 million, indicating a broadly positive sentiment despite recent price hikes.

- This shift in sentiment is likely influenced by investors interpreting the FOMC minutes and recent macro data as mildly dovish.

- Investment products offering exposure to Ethereum witnessed inflows of $36 million, marking the highest since March. As per the asset manager, this figure was largely driven by early reactions to the approval of spot Ether ETFs in the United States.

- The bullish sentiment extended across the altcoins board, with Solana attracting $8 million in inflows last week.

- Litecoin also witnessed inflows of $2.8 million during the same period, followed by Chainlink and XRP with $0.6 million and $0.4 million.

- On the other hand, Cardano observed weekly outflows of $1.2 million.

- In terms of geographical distribution, the majority of inflows were concentrated in the United States, which experienced $1.03 billion in inflows over the past week. Notably, Grayscale witnessed a significant reduction in outflows to just $15 million for the week.

- Germany and Switzerland also saw inflows of $48 million and $30 million, respectively.

- However, despite the initial enthusiasm surrounding the launch of spot Bitcoin ETFs in Hong Kong, there were disappointing outflows of $29 million last week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

Overview of major market events on November 10.

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?

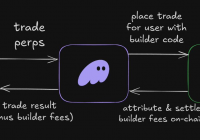

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

Trending news

MoreMorning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?