Market research and analysis of encrypted payment solution CoinbarPay (CBPAY)

Bitget2024/06/20 08:25

By:0xCarlos

I. Project introduction

CoinbarPay is a project dedicated to providing B-end users with encrypted payment solutions for euro fiat currency deposits and withdrawals. It is deployed on the XDB chain and has a close cooperative relationship with the XDB project party, sharing community resources. CBPAY has been certified by Italy OMA virtual asset service provider, ensuring the legitimacy and credibility of its business.

II. Project highlights

1. XDB chain deployment has many advantages. The CBPAY project is deployed on the XDB chain, which is a high-performance blockchain with fast transaction processing capabilities and high security, suitable for large-scale commercial applications. By deploying on the XDB chain, CBPAY can provide users with an efficient and secure payment solution to ensure that users' transactions can be completed quickly and reliably. In addition, the XDB chain itself has extensive community support and development resources, which provide technical support and guarantee for the development of the CBPAY project.

2. Encrypted payment business has high market demand. CBPAY focuses on helping B-end users open encrypted payment solutions, with the main goal of enabling users to conveniently deposit and withdraw euro fiat currency. Traditional fiat currency payment systems often have problems such as long processing time, high fees, and complex cross-border transfers, while CBPAY's encrypted payment solutions greatly simplify these processes. Through CBPAY, users can enjoy the efficient and low-cost advantages of cryptocurrency payment, while still easily converting to euros and other fiat currencies when needed. This solution not only improves the efficiency of the payment process, but also reduces user transaction costs and enhances project competitiveness.

3. Certification qualification. CBPAY has obtained the certification of Italy OMA virtual asset service provider. This not only enhances users' trust in CBPAY, but also provides strong support for its promotion and business expansion in the market. Obtaining certification qualification means that CBPAY can better protect users' rights and reduce compliance risks when providing services.

III. Market value expectations

The deposit and withdrawal encrypted payment solution has market demand. As a newcomer in this field, CBPAY can utilize the technical advantages of XDB chain and the existing community foundation. The project party has obtained the certification of Italy OMA virtual asset service provider, and as an XDB incubation project, it can be seen as having the endorsement of official and well-known projects to some extent. At the same time, the project's token economic model is reasonable, the release cycle is long, and the initial circulation ratio is low. We have reason to believe that CBPAY will have excellent performance in the future.

IV. Economic model

CBPAY tokens are minted on XDB CHAIN and integrated into CoinbarPay. Users can use CBPAY tokens for various services, including peer-to-peer transfers, merchant payments, and access to advanced features on the platform. The project also incentivizes users through rewards and loyalty programs. The tokens are built on top of XDB CHAIN, exclusively minted on the chain, and published, distributed, and promoted by XDBee Labs LTD. CBPAY's token economic model is well-designed, with a total token amount of 40 billion and an initial circulation market value of 1.44 million USD. The specific distribution is as follows:

Marketing: 10%, TGE (token generation event) 6.25%, 48-month linear release

Partner: 10%, TGE 3.75%, 48-month linear release

Treasury Reserve A: 10%, TGE 2.5%, 48-month linear release

Treasury Reserve B: 7.5%, TGE 13.33%, 48-month linear release

Bonus: 35%, TGE 0%, 60-month linear release

Team and consultants: 15%, TGE 0%, 3-month lock-up, 48-month linear release

XDB chain: 2.5%, TGE 0%, 48-month linear release

Seed round investment: 5%, TGE 0%, 3-month lock-up, 48-month linear release

Airdrop reward: 5%, TGE 35%, 48-month linear release

V. Team and financing

CBPAY was incubated by the XDB project, and the project team includes multiple professionals in the blockchain and fintech fields. However, the specific information of the team members has not been disclosed. Nevertheless, with the endorsement of the XDB project, CBPAY has a certain degree of credibility. In addition, the project has no public financing records, which may mean that the project's operating funds mainly come from the support of the XDB project or the team's self-financing, and may have independent funds.

VI. Risk Warning

1. The cryptocurrency market is volatile, and investors need to be cautious about the risks brought by market fluctuations

2. The encrypted payment solution market is highly competitive, and CBPAY needs to continue to invest in technology and marketing activities to remain competitive.

VII. Official link

Website:

https://pay.coinbar.io/

Twitter:

https://x.com/CoinbarOfficial

Telegram:

https://t.me/xdbchain

0

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

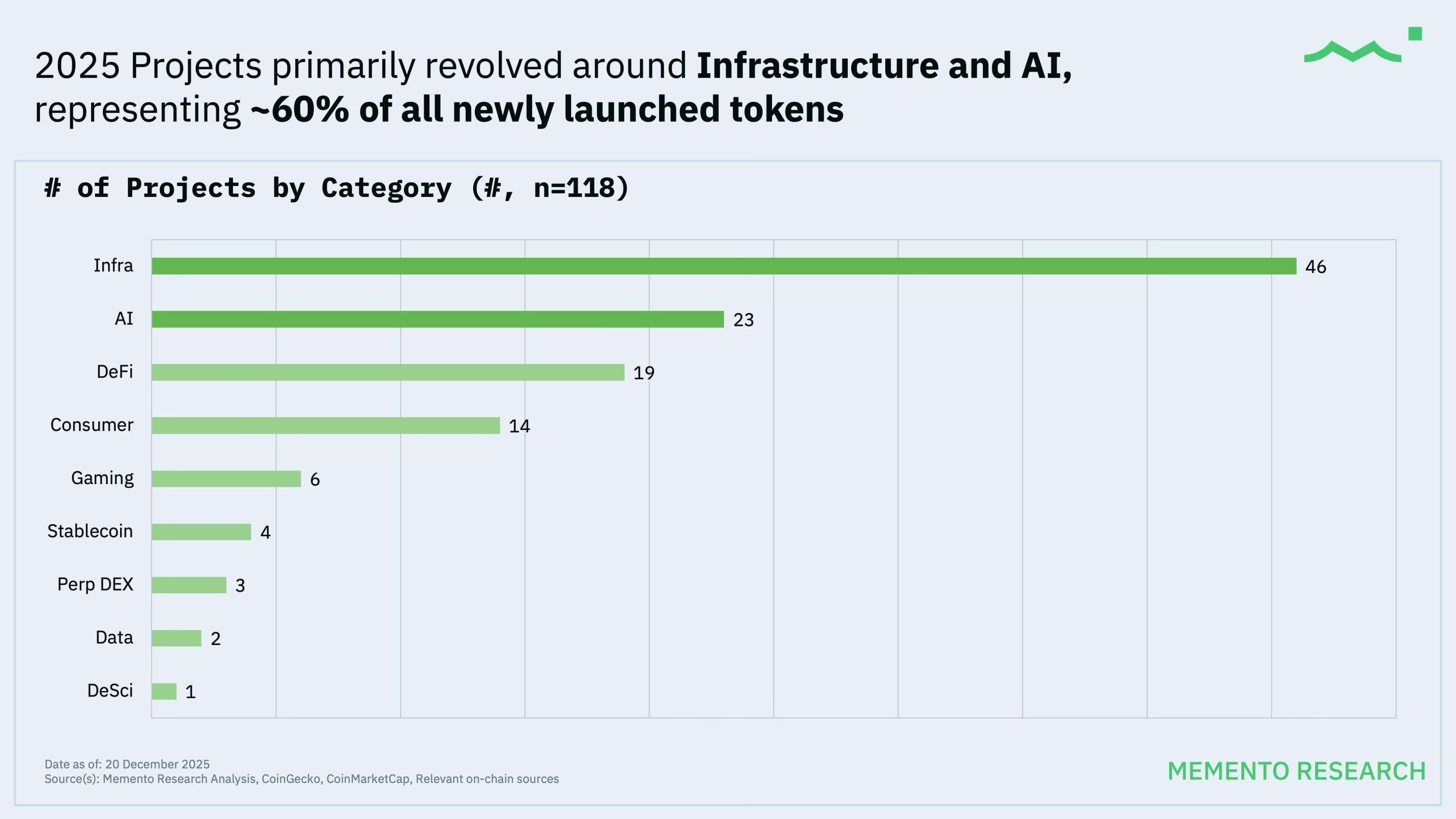

2025 TGE Annual Report: Over 80% of 118 Projects Fell Below Issue Price, Higher FDV Suffered Greater Declines

ForesightNews•2025/12/23 08:13

Atlaspad Partners With Helix Labs to Link Crypto Launchpad with Cross-chain Liquid Staking: A Gateway for DeFi Liquidity

BlockchainReporter•2025/12/23 08:00

Bitcoin Hashrate Drops as Miner Stress Builds: VanEck Data

Cryptotale•2025/12/23 07:57

Annual Review of the Pump.fun Lawsuit: Piecing Together the Truth Behind 15,000 Chat Records

Odaily星球日报•2025/12/23 07:49

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,518.76

-1.69%

Ethereum

ETH

$2,963.1

-2.12%

Tether USDt

USDT

$0.9993

-0.04%

BNB

BNB

$848.81

-1.13%

XRP

XRP

$1.88

-2.30%

USDC

USDC

$0.9997

-0.02%

Solana

SOL

$124.13

-1.64%

TRON

TRX

$0.2837

-1.38%

Dogecoin

DOGE

$0.1304

-1.17%

Cardano

ADA

$0.3646

-0.91%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now