Why Bitcoin is the Only True Free Market Currency

Jeff Booth, the author of "The Price of Tomorrow: Why Deflation is the Key to an Abundant Future," argues that Bitcoin (BTC) aligns with the natural state of the free market.

In a recent interview with Natalie Brunell, Booth emphasized that we should embrace a deflationary world, where technology enhances a currency’s purchasing power by reducing the cost of goods and services.

Booth views Bitcoin as revolutionary, seeing it as the only currency capable of fostering a system based on abundance.

He explains, “The natural state of the free market is deflation. Technology accelerates this deflation, allowing productivity to benefit us, enabling abundant lives. Anything that hinders this is a control system, not an economic or political system, essentially stealing from you.”

READ MORE:

Bitcoin Developers Unveil Historic Security FixesHe predicts that all fiat currencies will depreciate against Bitcoin indefinitely since Bitcoin is designed to eliminate inflation.

“Bitcoin is unique in protecting against inflation. It’s not just a coin but a protocol bound by energy – it is open, decentralized, and secure. It doesn’t matter if you value it through manipulated currency; it just keeps advancing. Compared to Bitcoin, all prices will continue to fall forever because it’s the only truly free market force,” Booth concludes.

Booth’s perspective highlights Bitcoin’s potential to transform our economic system by promoting deflation and abundance, standing in stark contrast to the inflationary nature of traditional fiat currencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monad mainnet launches tonight: key information you must know

Based on the pre-market price of around $0.032-0.034 at the time of publication, the public offering participants' notional returns are between 28% and 36%.

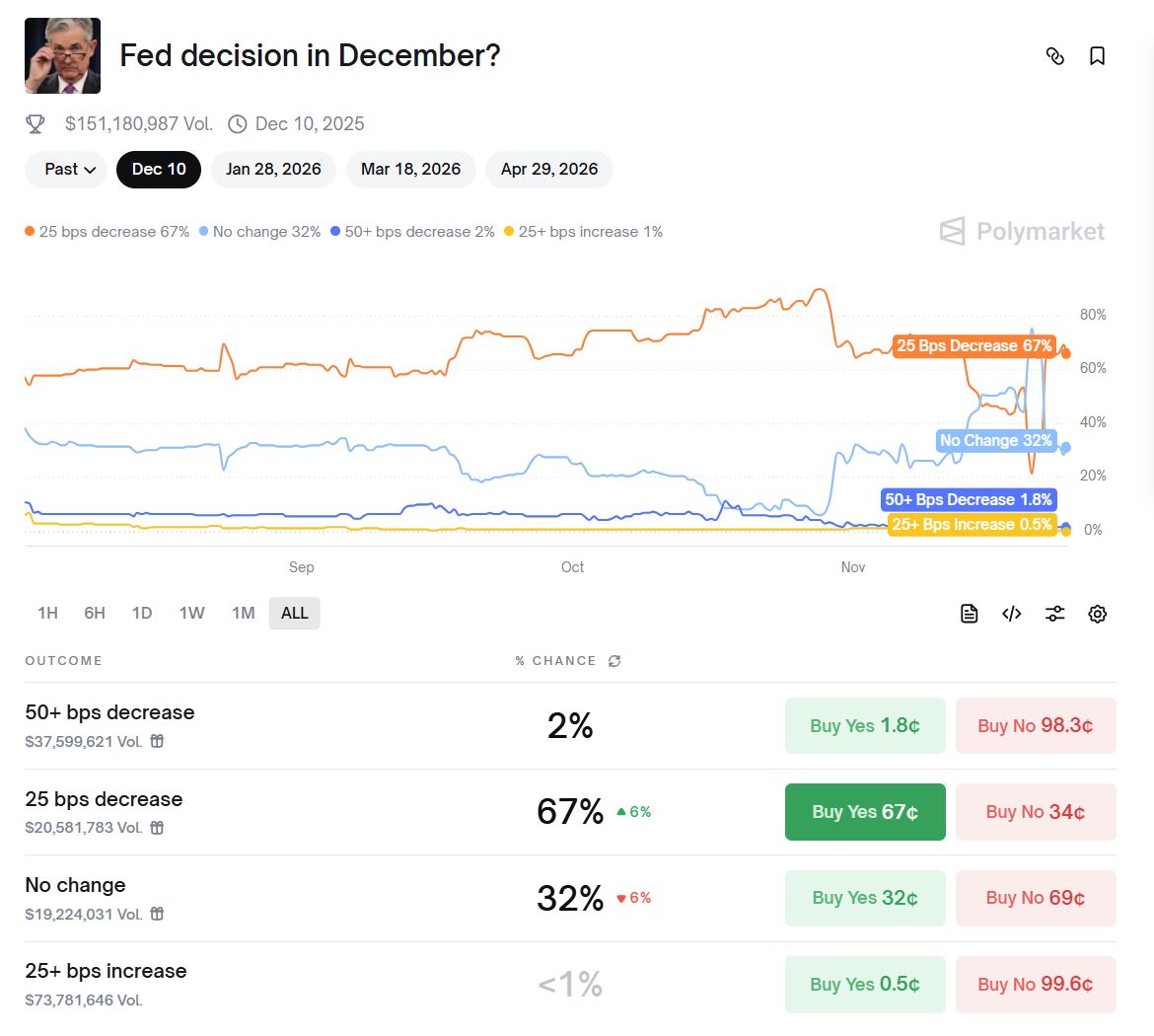

The Federal Reserve is deeply embroiled in an "internal war," making a December rate cut a "coin toss" bet.

Significant policy divisions have emerged within the Federal Reserve, making the question of whether to cut interest rates in December a key focus. Powell’s silence has increased market uncertainty, while political pressure and the lack of economic data have further complicated decision-making.

Filecoin Onchain Cloud: Application Case Analysis and Launch of Limited Edition NFT Program for Early CloudPaws Contributors

Filecoin is a protocol-based decentralized data storage network designed to provide long-term, secure, and verifiable data storage capabilities.

From Platform to Ecosystem, SunPerp Upgrades to SunX: Justin Sun Elaborates on DEX's "Long-termism" and Global Strategy

This upgrade marks SunX's transformation from a single trading platform to a self-circulating and self-growing decentralized ecosystem hub.