Bitcoin funds draw fifth-largest weekly inflow

Key Takeaways

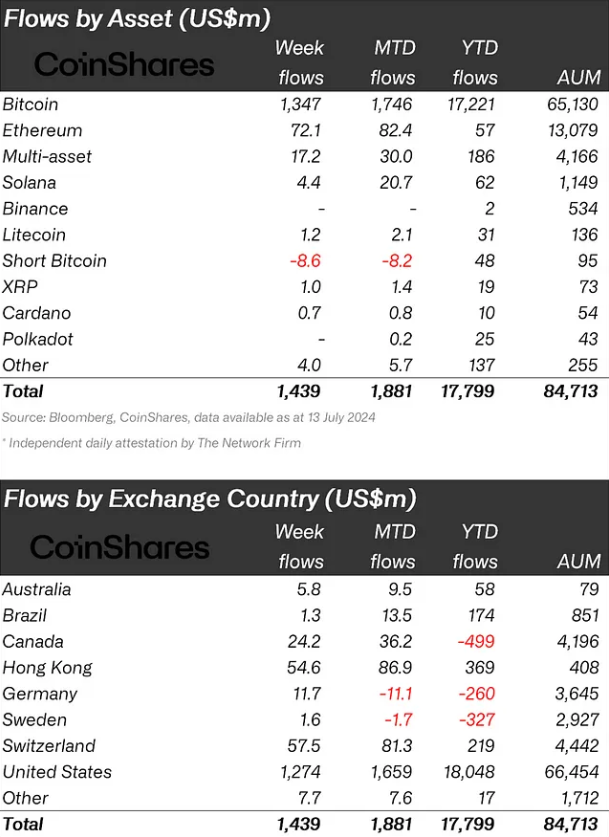

- Digital asset investment products saw $1.44bn inflows, pushing YTD total to $17.8bn.

- Bitcoin led with $1.35bn inflows, marking the 5th largest weekly inflow on record.

Digital asset investment products saw $1.44 billion in inflows last week, pushing year-to-date (YTD) inflows to a record $17.8 billion, surpassing the 2021 total of $10.6 billion. Bitcoin (BTC) led with $1.35 billion in inflows, marking the 5th largest weekly inflow on record.

Additionally, the funds indexed to short Bitcoin positions saw outflows of nearly $9 million, signaling a positive sentiment by investors last week.

Ethereum (ETH) attracted $72 million in deposits, its largest inflow since March, likely due to anticipation of a US spot-based exchange-traded fund (ETF) approval. Notably, the inflows made ETH’s YTD netflows positive again, amounting to $57 million.

Moreover, the multi-asset funds registered $17.2 million in inflows, the second-largest weekly amount for altcoin-indexed funds. This could sign an appetite for diversification by investors.

Other altcoins saw modest inflows, with Solana at $4.4 million, Avalanche at $2 million, and Chainlink at $1.3 million.

Image: CoinShares

Image: CoinShares

Regionally, the US dominated regional inflows with $1.3 billion, followed by Switzerland, Hong Kong, and Canada with $58 million, $55 million, and $24 million respectively. Switzerland’s inflow marked a record for the year.

Despite the significant inflows, trading volumes remained low at $8.9bn for the week, compared to the year’s average of $21 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services