The Ethena price surged 10% in the last 24 hours to trade at $0.48 as of 03:51 a.m. EST on trading volume that skyrocketed 84% to $193 million.

This comes after spot Ethereum ETF (exchange-traded funds) products debuted in the US to robust investor interest, sucking in $107 million in net inflows.

Meanwhile, Ethena has announced plans to allocate a portion of its $235 million USDT stablecoin collateral and $45 million surplus reserve into yield-generating real-world asset (RWA) offerings. The move is seen as a means to diversify its investment portfolio and enhance returns for its investors.

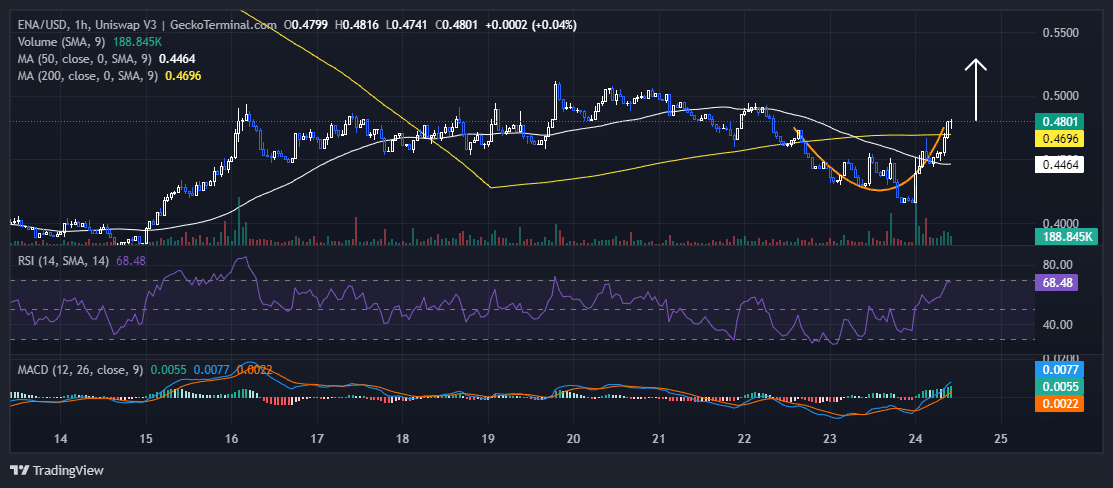

From July 20, the price of Ethena went through a retrace to find support at around $0.42, according to data from GeckoTerminal .

After the ETH ETFs debuted, ERC-20 tokens have seen massive gains, with ENA soaring from the $0.42 support to climb up, forming a rounding bottom pattern on the last day.

Ethena Price To Continue Surging Over The Rounding Bottom

ENAUSD Chart Analysis Source: GeckoTerminal.com

ENAUSD Chart Analysis Source: GeckoTerminal.com

The Ethena price aims for a sustained bullish rally as it trades well above both the 50-day and 200-day Simple Moving Averages (SMAs).

Moreover, the Relative Strength Index (RSI) is climbing up toward the 70-overbought region, which shows that buyers are actively buying, an indication of continued investor optimism.

The Moving Average Convergence Divergence (MACD) is trading up above the neutral line, a signal of the bullish stance by the bulls. The blue MACD line is also crossing above the orange signal line, forming a bullish crossover. A bullish crossover could encourage the bulls to buy more, which may push the token over the rounding bottom as they target $0.53.

The RSI and MACD could encourage optimistic investors to buy more, which could push the token up.

However, the 200-day SMA crosses below the 50-day SMA, forming a death cross at $0.46. A death cross may prompt the bears to take control of the price, which may push the token back to the next support, around $0.44 (50-day SMA).