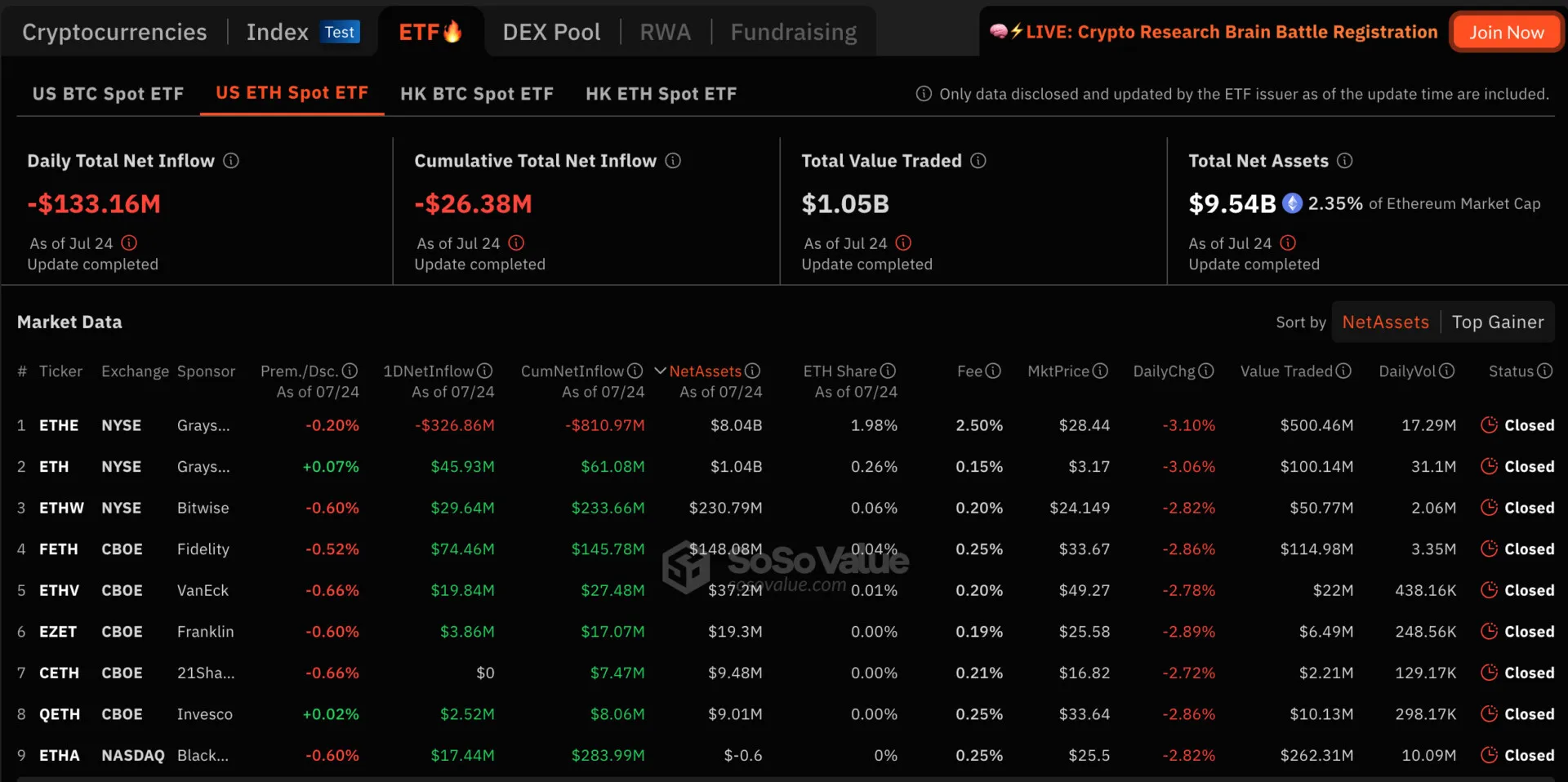

On the second day of trading for U.S. spot Ethereum ETFs turned out to be quite disappointing. These funds saw a big exit, with investors pulling out around $113.3 million in total.

The biggest hit came from Grayscale’s Ethereum Trust ETF, which saw over $800 million in net outflows.

The situation left many scratching their heads. While some Ether ETFs managed to stay in the green during the U.S. trading session, the overall mood was far from upbeat.

The sudden outflow had a noticeable effect on ETH’s price, which dipped by 1.8% on the same day. This decline likely fed into a cycle of negativity, with investors choosing to cut their losses.

Interestingly, this outflow came despite Ethereum ETFs generally performing well during the trading day. So, why the exodus? It seems that confidence in ETH’s near-term prospects is shaky.

This could be due to broader market trends or simply a reaction to the large sums being pulled from Grayscale’s fund.

It’s hard to ignore the elephant in the room. Bitcoin ETFs. When comparing the two, Ethereum ETFs seemed to attract less enthusiasm. On their first trading day, Ethereum ETFs captured only 16% of the first-day net flows that Bitcoin ETFs saw.

This lackluster performance could be a factor in the quick outflows seen on day two. At press time, Ether was worth $3,181 and has seen a 7.5% decrease in the past 24 hours.