Crypto recent pullbacks are five times softer than the Covid crash: CoinGecko

Key Takeaways

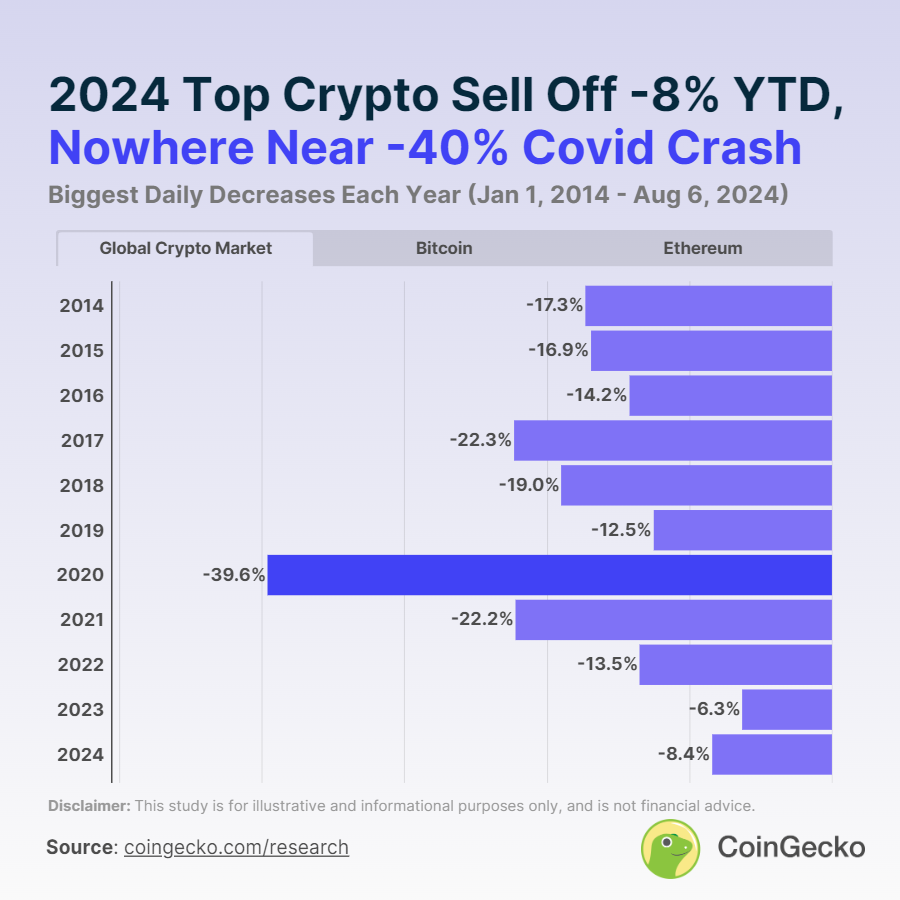

- The largest crypto market sell-off in 2024 was -8.4%, significantly less than the -39.6% Covid-19 crash.

- Crypto has not recorded a single day of market correction since the FTX collapse in November 2022.

Despite Bitcoin’s (BTC) recent dip of 29% in two weeks, the crypto market has shown resilience in 2024, with no significant corrections compared to historical downturns. According to a CoinGecko report , the largest sell-off this year was a relatively mild -8.4% on March 20, 2024.

In contrast, the most severe crypto market correction in the past decade occurred during the Covid-19 crash on March 13, 2020. Total crypto market capitalization plummeted -39.6% day-over-day, from $223.74 billion to $135.14 billion, highlighted the report.

Bitcoin experienced its biggest price correction of -35.2% on the same day, while Ethereum saw its second-largest drop at -43.1%.

Largest average crypto corrections. Image: CoinGecko

Largest average crypto corrections. Image: CoinGecko

The crypto market has not recorded a single day of correction since the FTX collapse in November 2022. Over the past ten years, the longest crypto corrections have lasted at most two consecutive days, occurring only three times.

From 2014 to date, the global crypto market has experienced 62 days of market correction, representing just 1.6% of the time during this period, with the average crypto market correction being 13%.

Notably, 2023 saw zero days of correction for the overall crypto market, Bitcoin, and Ethereum. While the global crypto market and Bitcoin have avoided corrections in 2024 so far, Ethereum has experienced two days of price correction this year: -10.1% on March 20 and -10% on August 6, 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MONUSDT now launched for futures trading and trading bots

Stock Futures Rush (phase 7): Trade popular stock futures and share $280,000 in equivalent tokenized shares. Each user can get up to $8000 TSLA.

Bitget Incentive Program: Win up to 1,300 USDT Per Week

Crypto Loan Carnival round 26: Borrow USDT, USDC to enjoy an APR discount of up to 40%