Ethereum layer 2 networks struggle with increased transaction failures

The Dencun upgrade in March 2024 was a pivotal moment for Ethereum (CRYPTO:ETH), doubling transaction volumes on its Layer 2 (L2) networks.

However, this increase in activity has also led to unintended consequences, including a significant rise in failed transactions, primarily attributed to bot activity.

According to a recent analysis by Christine Kim, a researcher at Galaxy, the Dencun upgrade, which aimed to reduce fees, has inadvertently spurred an uptick in transaction failures across Ethereum’s L2 networks.

Her report, titled “150 Days After Dencun,” reveals that the daily transaction count on L2s grew by 6.65 million within 150 days of the upgrade.

Despite the growth, the surge in transaction failures has raised concerns.

Kim’s research indicates that the failure rates are particularly high among addresses with a large volume of transactions, which are likely operated by bots.

The lower fees on L2 networks may be encouraging these bots, leading to increased transaction failures.

For average users with typical transaction volumes, the failure rates have only slightly increased compared to pre-Dencun levels.

Among the affected networks, Arbitrum (CRYPTO:ARB), Base, and OP Mainnet have seen significant increases in failed transaction rates.

Base experienced a failure rate increase to 21%, Arbitrum to 15.4%, and OP Mainnet to 10.4% within 150 days following the Dencun upgrade.

In contrast, addresses with low activity (fewer than five daily transactions) across all networks experienced a maximum failure rate of 4.02%.

Notably, Arbitrum saw a 545% surge in failure rates for low-activity addresses post-Dencun, while OP Mainnet's rate for these addresses decreased, and Base's rate saw a slight increase.

The rise in failures among high-activity addresses, driven by bots, underscores the challenges posed by the reduction in rollup transaction costs.

Interestingly, similar issues are not confined to Ethereum's L2 networks.

Solana (CRYPTO:SOL), a popular Layer 1 network, also faces a high rate of transaction failures.

A recent Coinbase report highlighted that between 25% and 45% of Solana's non-vote transaction fees are spent on failed transactions, indicating that transaction failures are a broader issue in the blockchain space.

At the time of writing, the Ethereum (ETH) price was $2,761.02.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

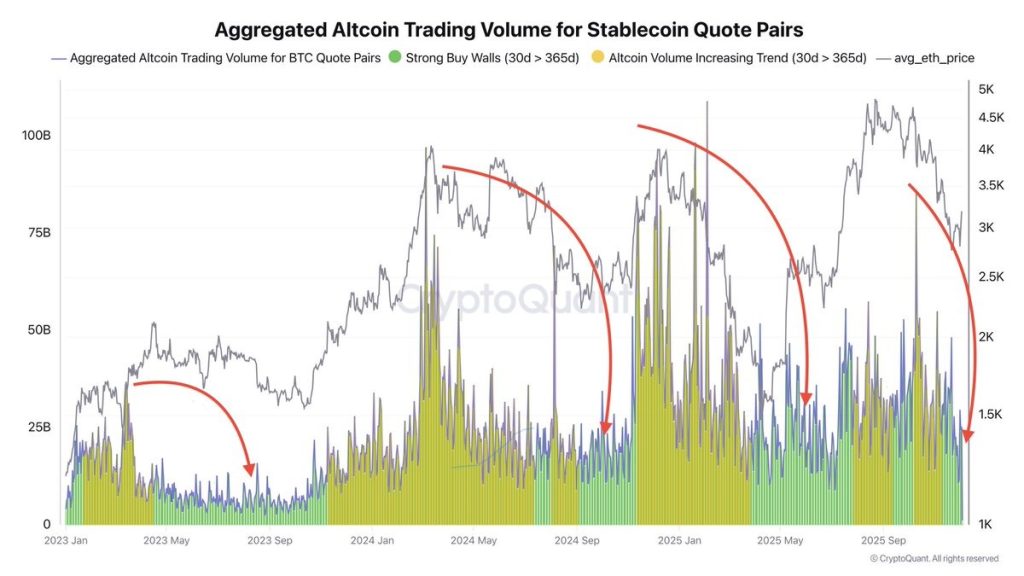

Altcoin Market Enters Historic Buying Zone — 5 Coins to Watch Before the Next Breakout

Crypto News: CZ Denies Trump Ties, But His Bitcoin Moment With Schiff Breaks the Internet

Russia to Include Crypto Payments in Balance-of-Payments Data

Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?