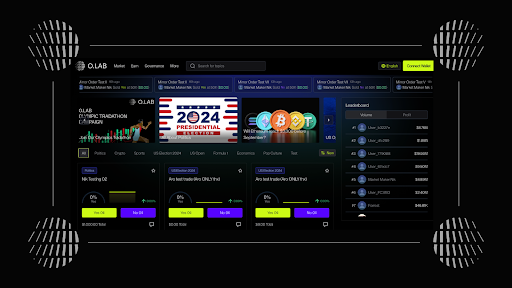

Opinion Labs Launches O.LAB Prediction Closed Beta Tradathon to Engage Onchain Community in Decentralized Trading

Sep 12, 2024 — Opinion Labs, backed by Binance Labs, is thrilled to announce the O.LAB Prediction Closed Beta Tradathon launch, which aims to gather trader insights and feedback onchain by offering early access to O.LAB's decentralized prediction market, ultimately to attract a wider crypto and traditional financial ecosystem.

Building on attracting over 1 million registered users across multiple blockchain networks and 670,000 active on-chain users via its 1st entertainment opinion market, AlphaOrBeta, Opinion Labs is now ready to widen access to its next stage —— O.LAB.

Opinion Labs team looks forward to collaborating with community partners in the Binance ecosystem and others to explore the value of prediction markets and unlock the potential of decentralized infrastructure for greater transparency onchain.

Additional campaign details are provided below, and ongoing updates will be shared as the closed beta progresses.

Closed Beta Host

- The Closed Beta will be hosted on the following link: app.olab.xyz

Closed Beta Timing

- Opening Date: Sep 05, 2024

- Closing Date: TBA

How to Join the Closed Beta

- Invited participants can join by visiting olab.xyz.

Phase 1: AlphaOrBeta Community (Live Now)

- The AlphaOrBeta Community can access the O.LAB Prediction Closed Beta Tradathon using the designated referral code.

- [Insert link to AlphaOrBeta website with the referral code]

Phase 2: Opinion Labs Ecosystem Partners (TBA)

Weekly Leaderboard Ranking

- Top traders in the Closed Beta will be ranked on a weekly leaderboard.

- The top 100 will be featured on the Closed Beta Weekly Leaderboard and eligible for a weekly prize pool.

Additional Closed Beta Information

- All Closed Beta participants will receive an additional points multiplier when Alpha launches.

- TBA - We will introduce the bug bounty program during the closed beta phase. Participants who report any bugs during the Closed Beta will receive extra rewards as a token of appreciation. Stay tuned for further updates.

- O.LAB Prediction Closed Beta Tradathon's first phase development where only a limited, select group of traders are invited to test our product, our team envisions a fully decentralized top initiation in the next phase to have anyone onchain to be part of the future of the decentralized prediction market trading

About O.LAB

O.LAB is the world's first fully decentralized epistemic truth machine and a suite of tradable intelligence products developed by Opinion Labs. Its product matrix includes a decentralized prediction market, a dynamic opinion market, and an optimistic oracle. The O.LAB ecosystem provides transparent and objective global information to decision-makers, empowering them with the insights needed to make informed and strategic decisions.

About Opinion Labs

Opinion Labs is the developer and driving force behind O.LAB ecosystem, led by a founding team with extensive experience from Citadel, JP Morgan, McKinsey, Amazon, and ByteDance. The team brings deep expertise in algorithmic trading and large-scale consumer application development. Opinion Labs envisions a future where decision-making is democratized, transparent, and driven by real-time, reliable data from a decentralized and globally inclusive ecosystem.

For more information and updates, visit olab.xyz or follow us on Twitter @OpinionLabsXYZ .

Media Inquiries: [email protected]

This post is commissioned by Blockman and does not serve as a testimonial or endorsement by The Block. This post is for informational purposes only and should not be relied upon as a basis for investment, tax, legal or other advice. You should conduct your own research and consult independent counsel and advisors on the matters discussed within this post. Past performance of any asset is not indicative of future results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CARV In-Depth Analysis: Cashie 2.0 Integrates x402, Transforming Social Capital into On-Chain Value

It is no longer just a tool, but a protocol.

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation