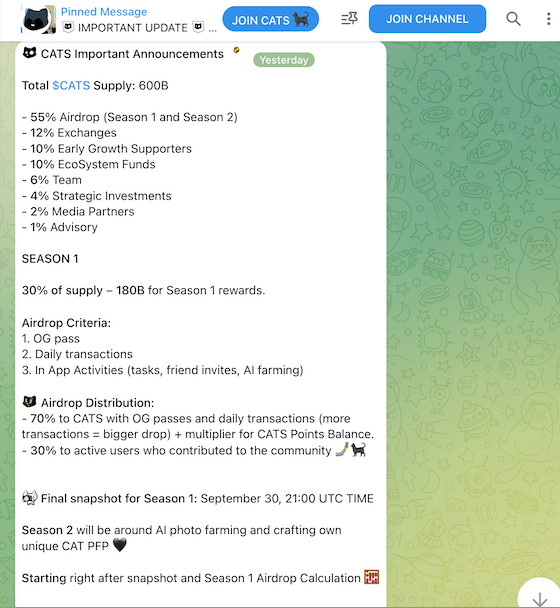

Important Announcements From CATS community

Total $CATS Supply: 600B

- 55% Airdrop (Season 1 and Season 2)

- 12% Exchanges

- 10% Early Growth Supporters

- 10% EcoSystem Funds

- 6% Team

- 4% Strategic Investments

- 2% Media Partners

- 1% Advisory

SEASON 1

30% of supply – 180B for Season 1 rewards.

Airdrop Criteria:

1. OG pass

2. Daily transactions

3. In App Activities (tasks, friend invites, AI farming)

Airdrop Distribution:

- 70% to CATS with OG passes and daily transactions (more transactions = bigger drop) + multiplier for CATS Points Balance.

- 30% to active users who contributed to the community

Final snapshot for Season 1: September 30, 21:00 UTC TIME

Season 2 will be around AI photo farming and crafting own unique CAT PFP

Starting right after snapshot and Season 1 Airdrop Calculation

At CATS, we value the clever cats who know that free cheese only comes in a mousetrap , far more than the mice and hamsters who just want to tap and expect millions. While some may believe they can earn big rewards with little effort, we reward those who truly understand the game and invest their time and resources wisely.

The bigger, juicier rewards are reserved for the real CATS — those who value the project and are ready to be part of it, growing together with the community in this new era of digital renaissance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Spirit Blockchain Faces Leadership Challenges as Interim CFO Navigates Regulatory Uncertainty

- Spirit Blockchain filed interim financial reports and MD&A for Q3 2025, with CEO Lewis Bateman serving as interim CFO after Inder Saini's departure. - The blockchain infrastructure firm focuses on recurring revenue through licensing and digital asset support, navigating regulatory risks and market volatility. - A separate SPIR-listed Spire Global faces NYSE delisting risks for missing filings, creating potential investor confusion between the two unrelated companies. - Bateman's dual role may streamline

ZEC drops 20.91% in a week as surging retail activity heats up the futures market

- Zcash (ZEC) rose 0.28% in 24 hours but fell 20.91% weekly amid volatile derivative markets and shifting demand. - Stagnant shielded pool activity, including the Orchard and Sapling pools, signals weakening demand for ZEC's privacy features. - Overheated retail-driven futures markets and declining open interest highlight risks of sharp corrections after historical patterns. - ZEC approaches critical $436 support level, with analysts warning of potential 30% declines if technical indicators break.

DASH Rises 54.08% Over the Past Year as Institutions Invest and Earnings Announced

- DoorDash (DASH) surged 54.08% in 12 months amid strong institutional buying, including Jefferies' 40.7% stake increase and Vanguard's $10.15B holdings. - Q3 earnings missed estimates ($0.55 vs $0.68) but revenue grew 27.3% to $3.45B, with analysts maintaining "Moderate Buy" ratings and $275.62 average price targets. - Insider sales totaling $15.4M contrasted institutional confidence, as DASH trades at $81.1B market cap with 95.47 P/E ratio, reflecting long-term growth bets in on-demand commerce.

Ethereum Updates Today: Vitalik Buterin: Privacy Should Be Considered Digital Hygiene, Not an Exclusive Privilege

- Ethereum co-founder Vitalik Buterin donated 256 ETH ($800,000) to privacy-focused messaging platforms Session and SimpleX, advancing metadata privacy in digital communication. - The platforms use decentralized infrastructure and avoid centralized identifiers, addressing vulnerabilities in traditional messaging systems through unique approaches like service nodes and user-controlled servers. - Buterin's move counters EU regulatory pressures on encrypted messaging, emphasizing privacy as a fundamental righ