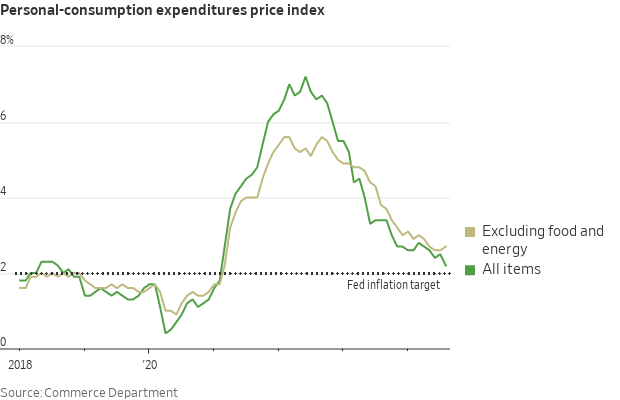

Fed's Mouthpiece: The PCE index favored by the Fed is not far from the Fed's target

"Federal Reserve mouthpiece" Nick Timiraos stated that the inflation indicator favored by the Federal Reserve, the Personal Consumption Expenditures Index (PCE), shows that in the 12 months up to August, this index has risen by 2.2%, not far from the Fed's target of 2%.

A year ago and two years ago, this index was at 3.4% and 6.6% respectively. The core PCE (excluding volatile food and energy items) rose by 2.7% year-on-year in August. The core inflation rate for the previous twelve months a year ago was at 3.8%, while it stood at 5.4% two years prior.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The BlackRock address received 16,629 ETH and 300 BTC in the past 10 minutes.

Data: BlackRock received BTC and ETH worth $78.15 million from an exchange in the past 10 minutes

BitMine increases holdings by 20,532 ETH, worth approximately $63.32 million