Get Ready for Puffer UniFi — Charting New Waters for Ethereum’s Ecosystem

Puffer UniFi, the pioneering Based Rollup, is set to address fragmentation, enable interoperability, and bring 100 milliseconds transactions to Ethereum.

In the evolving landscape of Ethereum’s scalability, the adoption of Layer 2 solutions has significantly advanced the network’s capabilities. However, these developments have also led to a fragmented ecosystem, characterized by liquidity fragmentation that dilutes asset efficiency across platforms, poor user experience due to the reliance on cumbersome bridges, and increased developer friction from the complexity of integrating and maintaining dApps across numerous Layer 2 solutions. These challenges undermine Ethereum’s potential for broader scalability and efficiency.

Recognizing this, Puffer develops UniFi, a Based Rollup designed to streamline Ethereum’s L2 solutions, enhance value flow back to Layer 1, and provide a unified, efficient platform conducive to mass adoption.

What is UniFi?

UniFi is Puffer’s flagship Based Rollup, designed to tackle the challenges of fragmentation by enhancing the value flow back to Layer 1 and ensuring credibly neutral transaction sequencing. This platform is engineered to transform the Ethereum ecosystem by enabling interoperability, making transactions faster, safer and overall user experience.

Why a Based Rollup?

Puffer has strategically chosen a Based Rollup for UniFi, drawing on insights from Justin Drake’s research, to optimize both security and operational efficiency. By integrating with Ethereum’s Layer 1 validators, these rollups process transactions with the same reliability as the main chain, ensuring robust security and decentralization.

This architecture also supports synchronous composability, enabling seamless interactions between different based rollups in the same block, enhancing user experience by removing the need for bridges and reducing delays. Such an approach not only simplifies operations but also mitigates the ecosystem’s fragmentation, contributing to a more unified and efficient Ethereum network.

How Puffer’s UniFi Works?

Based Sequencing: UniFi uses based sequencing that leverages Ethereum’s decentralized validators directly on the L1. This allows transactions to be sequenced in a way that is credibly neutral, without relying on a centralized sequencer . It means that validators on the L1 are responsible for the ordering of transactions within the UniFi rollup.

Preconfirmations (Preconfs): UniFi integrates a preconfirmation system that provides users with quick, reliable confirmations (~100ms) of their transactions before they are finalized on the blockchain. These preconfs are issued by Puffer’s restaked validators, which are incentivized to behave correctly or face penalties, such as slashing.

Decentralized Sequencers: The architecture is designed to scale from a single centralized sequencer to tens of thousands of decentralized sequencers. This is achieved by leveraging the validator set from Puffer, which means as the number of validators increases, the network becomes more decentralized.

Synchronous Composability: Transactions within UniFi can directly interact with other based rollups, facilitating seamless interactivity without the need for bridges, reducing both complexity and security risks associated with asset transfers between rollups.

What Puffer UniFi Offers?

- Native Yield and Gasless Transactions: By generating native yield through pufETH, Puffer’s Liquid Restaking Token, UniFi enables gasless transactions across based app-chains. Gas fees can be subsidized by the native yield generated from the network activities and shared among stakeholders.

- Enhanced Security and Reduced Complexity: Leveraging Ethereum’s validators for sequencing, UniFi inherits robust security and decentralization, reducing potential points of failure and simplifying network structure.

- unifiETH as the Universal Gas Token: Complementing pufETH, unifiETH serves as the universal gas token within the UniFi ecosystem. It is designed to generate rewards through market-risk-free strategies set by the DAO.

- Economic Benefits: The based rollup structure allows sequencing fees to flow back to Ethereum’s block proposers, which helps align Ethereum L1 economics by potentially reducing the net issuance of Ether. This realignment of economic incentives supports the long-term sustainability of Ethereum’s ecosystem.

- Based App-Chain Integration: UniFi empowers dApps to launch their own based app-chains, enabling them to capture direct economic benefits. Each app chain is interoperable, inherits Ethereum’s security and decentralization, and contributes to long-term sustainability.

UniFi’s Vision and Future

UniFi represents a strategic and technological breakthrough designed to overcome critical challenges such as fragmentation and inefficiency within the Ethereum ecosystem. By harnessing based sequencing from Ethereum’s Layer 1, UniFi not only aims to restore cohesion and streamline transaction processing but also ensures that value continuously flows back to Ethereum’s foundational layer.

As we continue to refine and expand UniFi, we invite developers and users to join us on this transformative journey toward a more unified and robust blockchain community. Together, we can catalyze a shift that benefits all stakeholders and solidifies Ethereum’s position in the blockchain landscape.

Navigating Together

If you are a user interested in a summary of what Puffer UniFi does, please check out our introductory thread.

For Ethereum enthusiasts, we recommend reading our comprehensive litepaper.

Developers interested in contributing to this innovative project are encouraged to fill out our onboarding form.

For a sneak peek into what’s coming, visit our teaser website at unifi.puffer.fi

Stay tuned for more updates and prepare to be part of a more unified, efficient, and equitable blockchain ecosystem. Don’t hesitate to contact us at our Twitter, Discord, and Telegram. The future is bright; stay puffing! 🐡😎

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA

Tesla’s AI team creates a patent that addresses AI “drift” in positional encoding

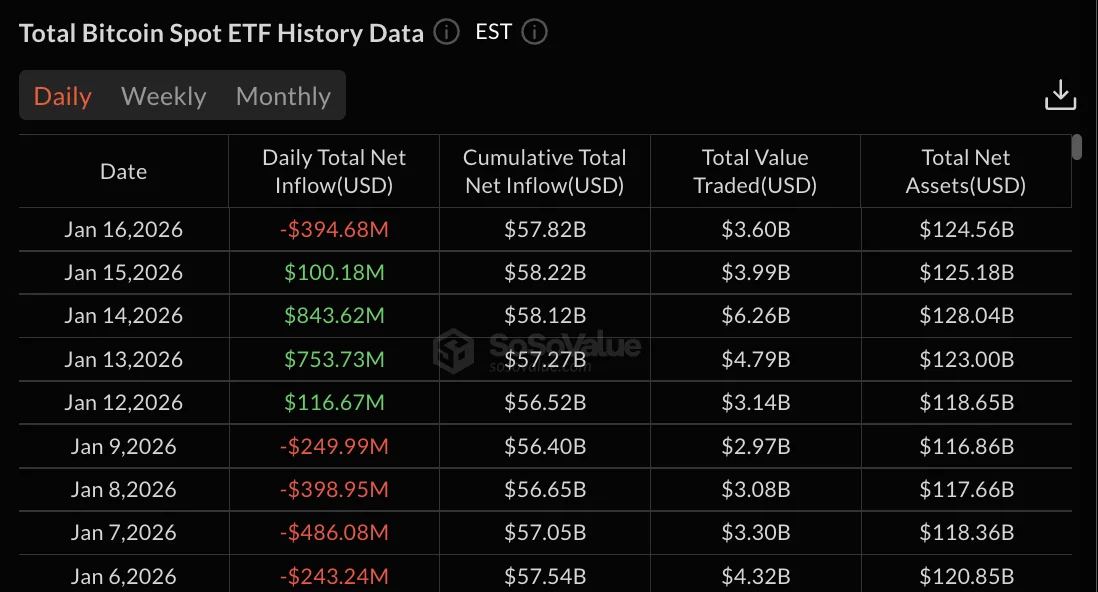

Bitcoin ETFs turn red after four days of inflows, post $394.68M outflow

Critical minerals ETFs hit new all-time high market cap above $750 billion