Traders increase bets on Fed rate cut after U.S. job openings data released

U.S. short-term interest rate futures reportedly rose slightly after the release of U.S. job openings data, as traders increased their bets on a Federal Reserve rate cut.

The number of U.S. JOLTs job openings fell to its lowest level since early 2021 in September, and layoffs increased, in line with a slowdown in the labour market. The Bureau of Labor Statistics' Job Openings and Labour Turnover Survey (JOLTS), released on Tuesday, showed vacancies fell to 7.44 million in August from a downwardly revised 7.86 million in July.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Barcelona Football Club criticized for signing a $22 million sponsorship deal with crypto company ZKP

Swedish payment giant Klarna's first stablecoin, KlarnaUSD, has been launched ahead of schedule

Bitcoin OG opens 5x ETH short position worth $15.04 million

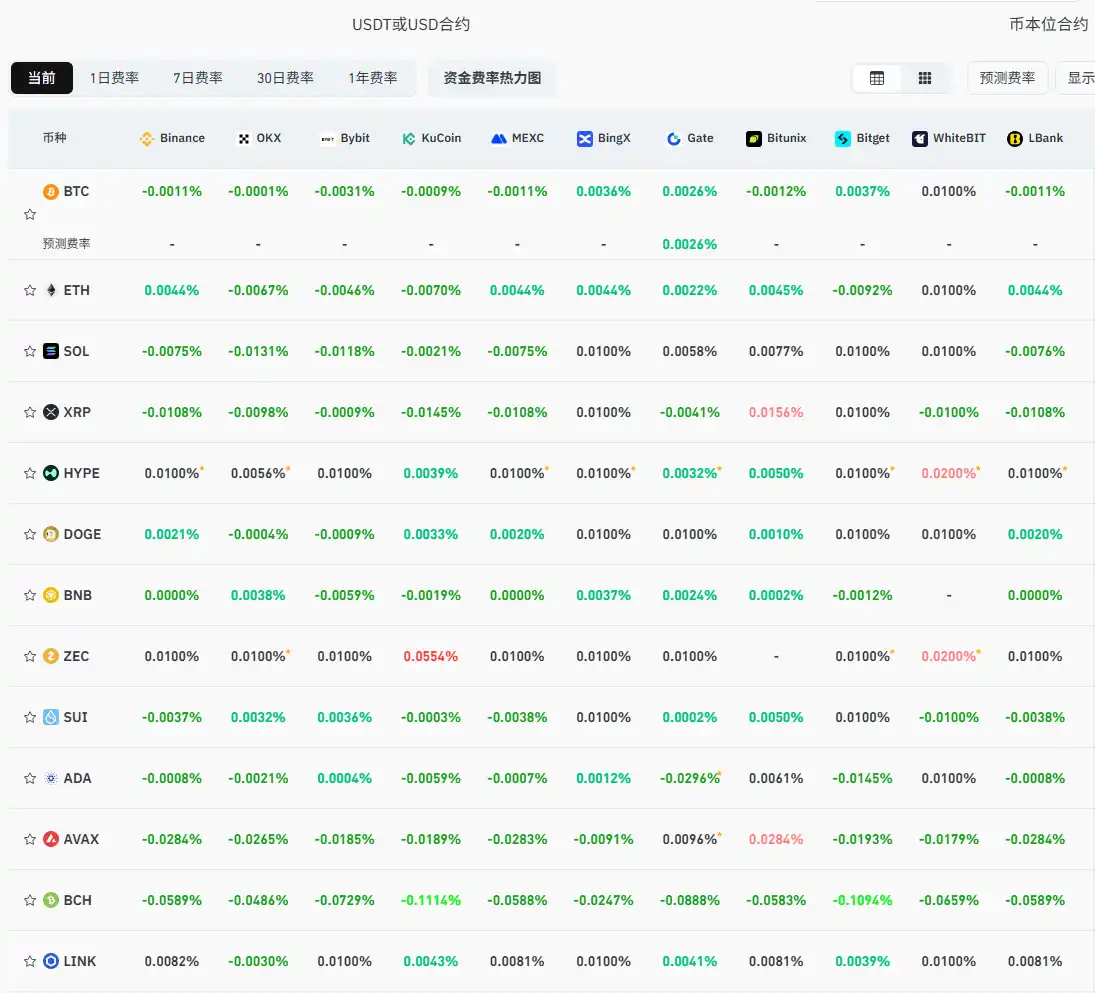

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish