Polymarket performs smoothly on Election Day, processes $240M in trading volumes

Polymarket’s underlying blockchain chugged along more or less smoothly, processing 2,921,668 transactions on election day

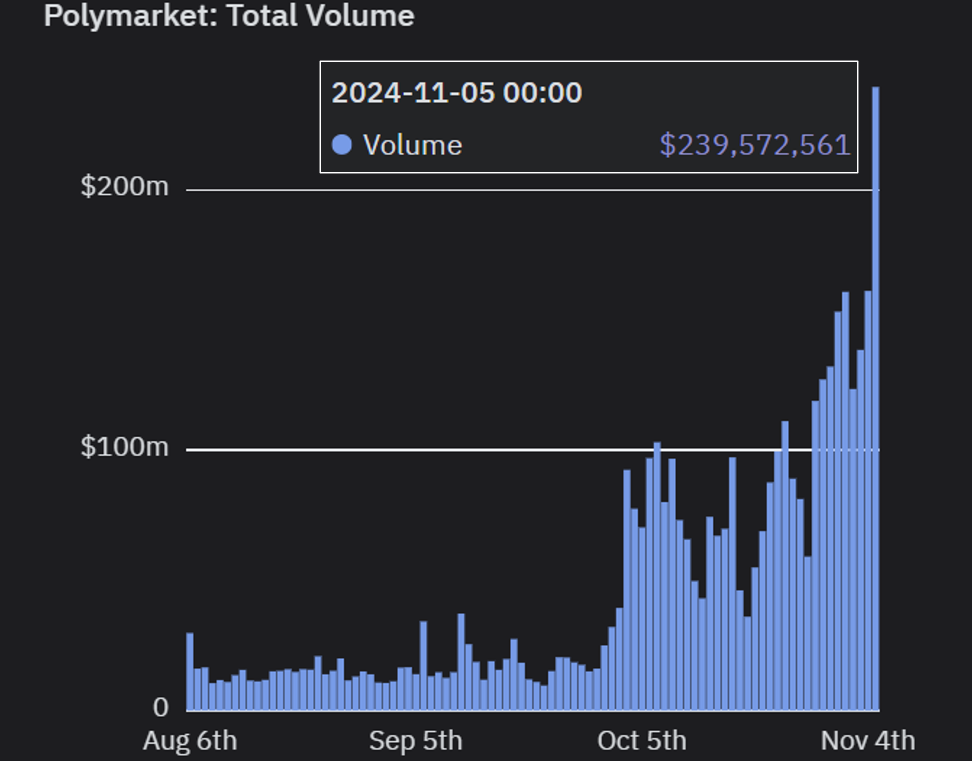

On the most important night of the year for Polymarket, crypto’s breakout star application processed a smooth $240 million in trading volumes without a hitch.

Source: Blockworks Research

Source: Blockworks Research

It’s an impressive feat for a dapp that is mostly onchain, representing perhaps one of crypto’s first “mainstream” tests.

Polymarket is designed as a “binary limit order book” ( BLOB ), a kind of hybrid-decentralized model that is common in many DEXs. Matching (i.e. placing limit orders) on Polymarket is offchain, while settlement and execution of trades goes onchain on Polygon’s PoS sidechain.

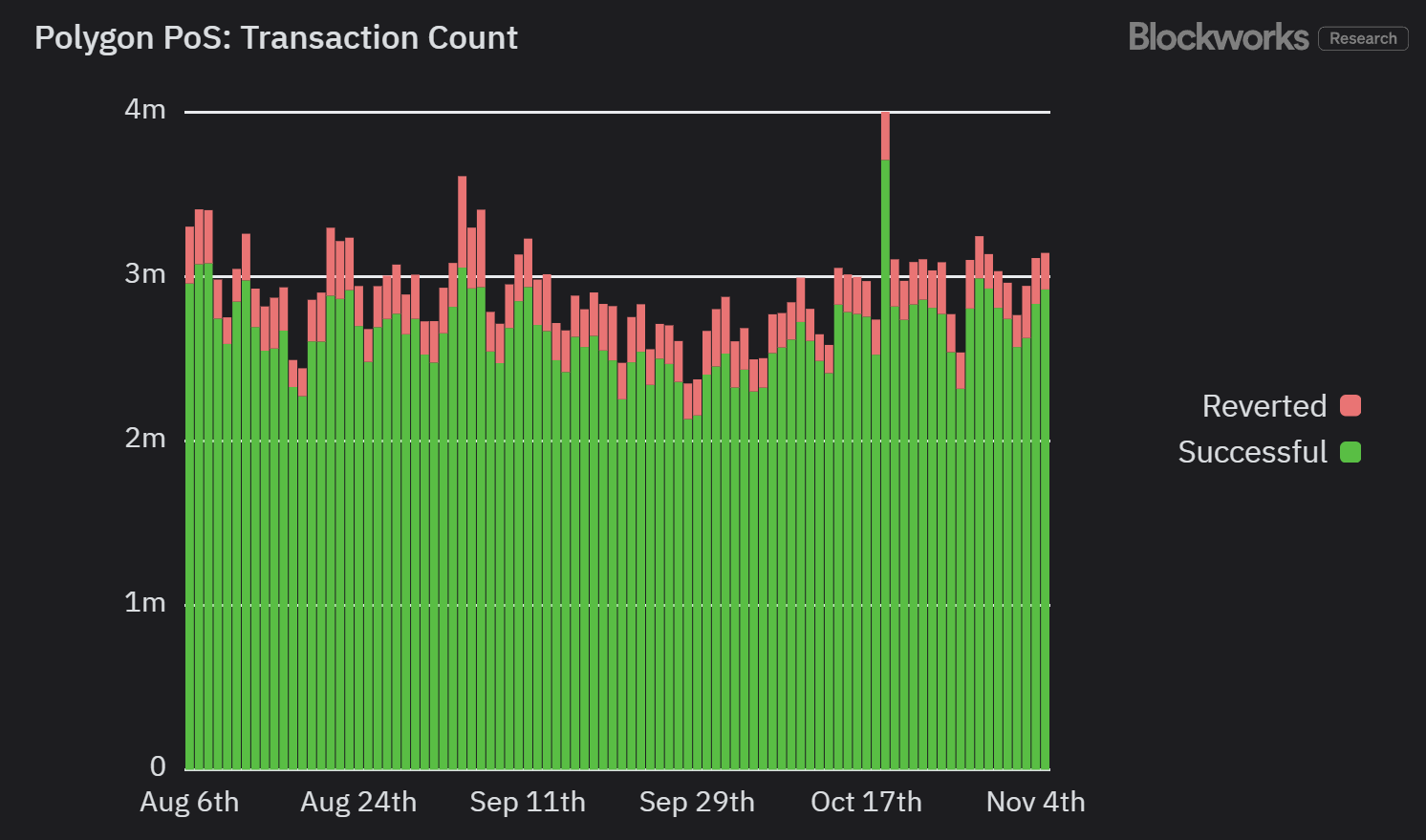

The underlying blockchain chugged along more or less smoothly, processing 2,921,668 transactions on election day, or about 33.8 TPS at a 7% reversion rate, Blockworks Research data shows.

Source: Blockworks Research

Source: Blockworks Research

Newsletter

Subscribe to Blockworks Daily

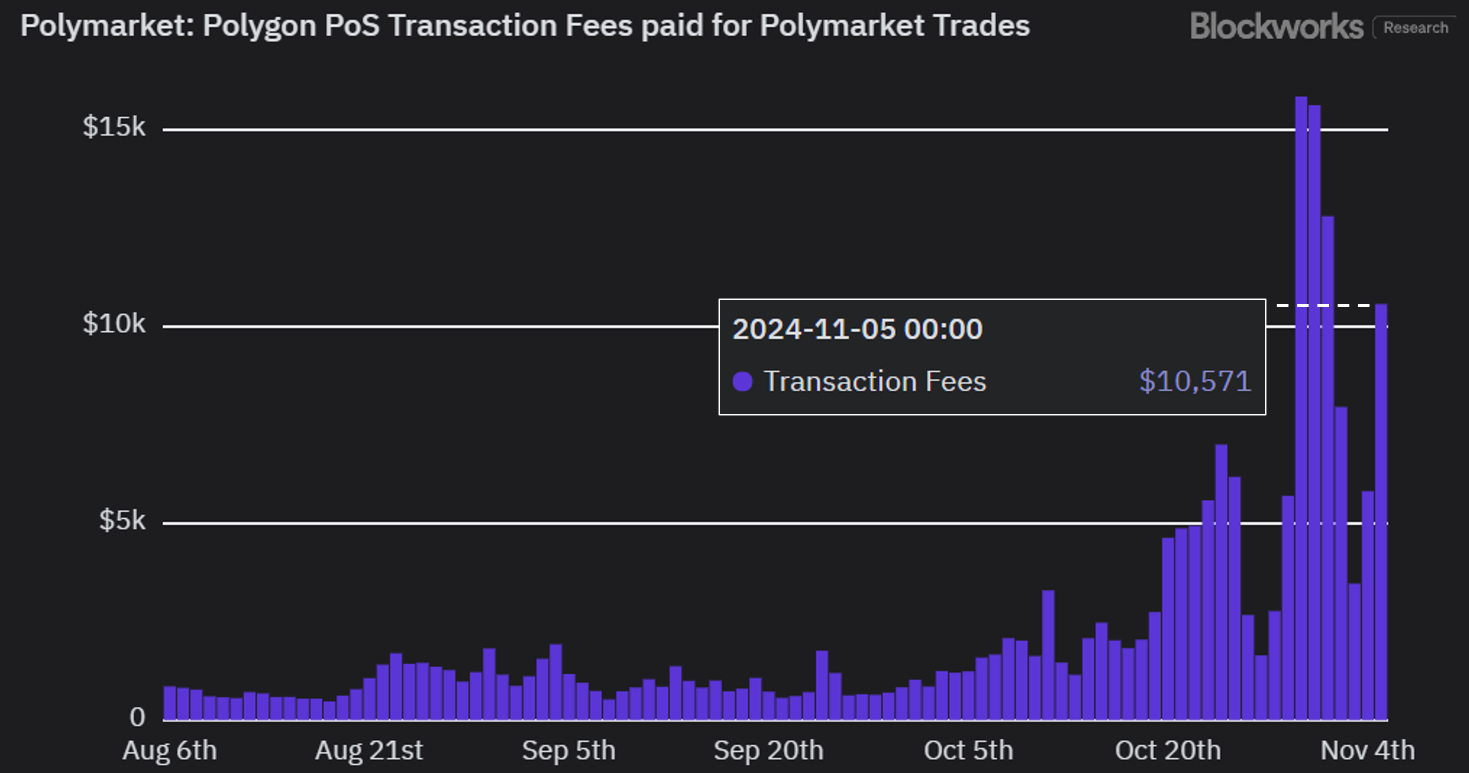

Polygon is taking many well-deserved victory laps , but what’s not talked about is how little value has accrued to its POL token despite Polymarket’s success. On election day alone, Polymarket users generated a pretty minor $10,571 in fees for Polygon.

The price of POL ( previously MATIC ) is up 7.2% on the day at $0.3, but still down about 54% year to date.

Source: Blockworks Research

Source: Blockworks Research

This is not a knock on Polygon; Polygon’s sidechain design was aimed at delivering ultra-low fees at a time when L2s were still relatively scarce.

Polygon’s bet on POL’s value accrual is aimed at the token’s utility in staking for various different Polygon-related services like block batching in the Agglayer, or providing data availability within its Staking Hub/Layer in 2025.

The plan is also to let POL stakers derive fee revenue from other Polygon CDK chains within its aggregated network of blockchains.

But back to Polymarket — where does the prediction market go from here?

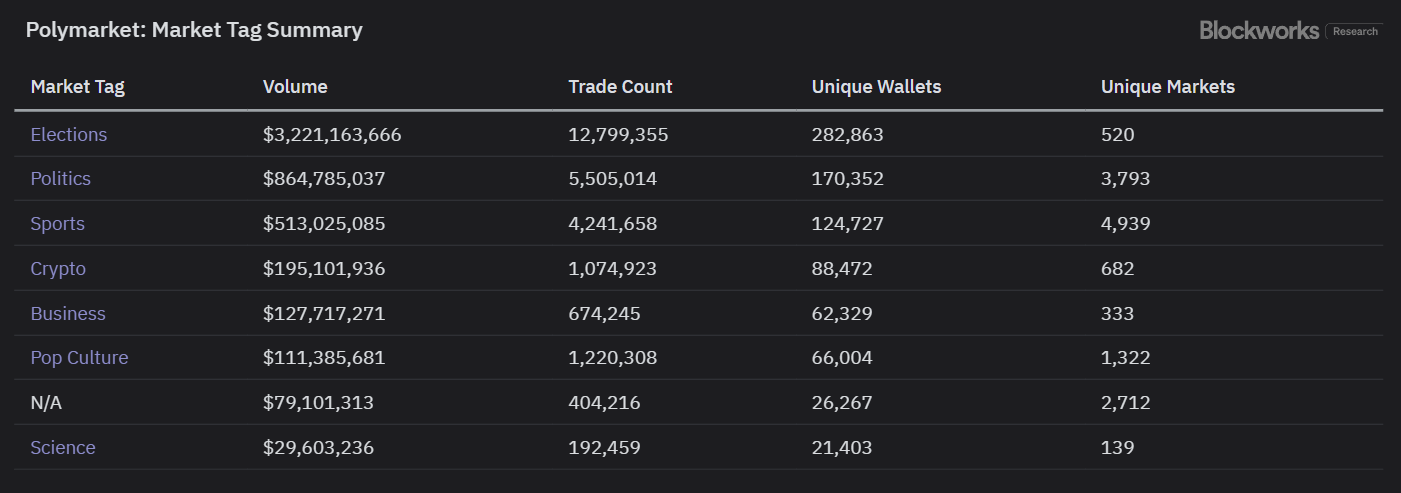

The majority of Polymarket’s usage comes from US political elections. Post-election, Polymarket’s continued success will have to rely on other areas of interest that can stoke the same kind of mainstream appetite as political gambling.

Source: Blockworks Research

Source: Blockworks Research

Sports, which makes up the third-largest category of open interest on Polymarket, is one possible demand driver, but that area of gambling is also saturated with existing crypto players like Shuffle, Gandom, Rollbit, Stake.com and more, as well as a slew of Web2 offerings.

For more on Polymarket’s next steps, plug into the latest 0xResearch podcast .

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter .

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the Forward Guidance newsletter .

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

- Polygon

- Polymarket

- US politics

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto cards have no future

Having neither the life of a bank card nor the problems of one.

MiCA regulation poorly applied within the EU, ESMA ready to take back control

$674M Into Solana ETF Despite Market Downturn