Institutions: stronger inflation could jeopardise Fed's December rate cut expectations

Higher-than-expected inflation in October will force traders to reassess whether the Federal Reserve will cut interest rates again next month, said Brent Donnelly, president of forex trading firm Spectra Markets. Otherwise, Wednesday's data will be tepid, ‘but the only outcome that could really drive the macroeconomy would be a sharp surprise to the upside,’ Donnelly wrote. ‘That would put a December Fed rate cut in jeopardy and put the starting point for Trump inflation risks even higher.’ Economists surveyed by The Wall Street Journal expect the data to show the CPI rose 0.2 per cent in October from a year earlier, and the core CPI, which excludes food and energy prices, rose 0.3 per cent.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Barcelona Football Club criticized for signing a $22 million sponsorship deal with crypto company ZKP

Swedish payment giant Klarna's first stablecoin, KlarnaUSD, has been launched ahead of schedule

Bitcoin OG opens 5x ETH short position worth $15.04 million

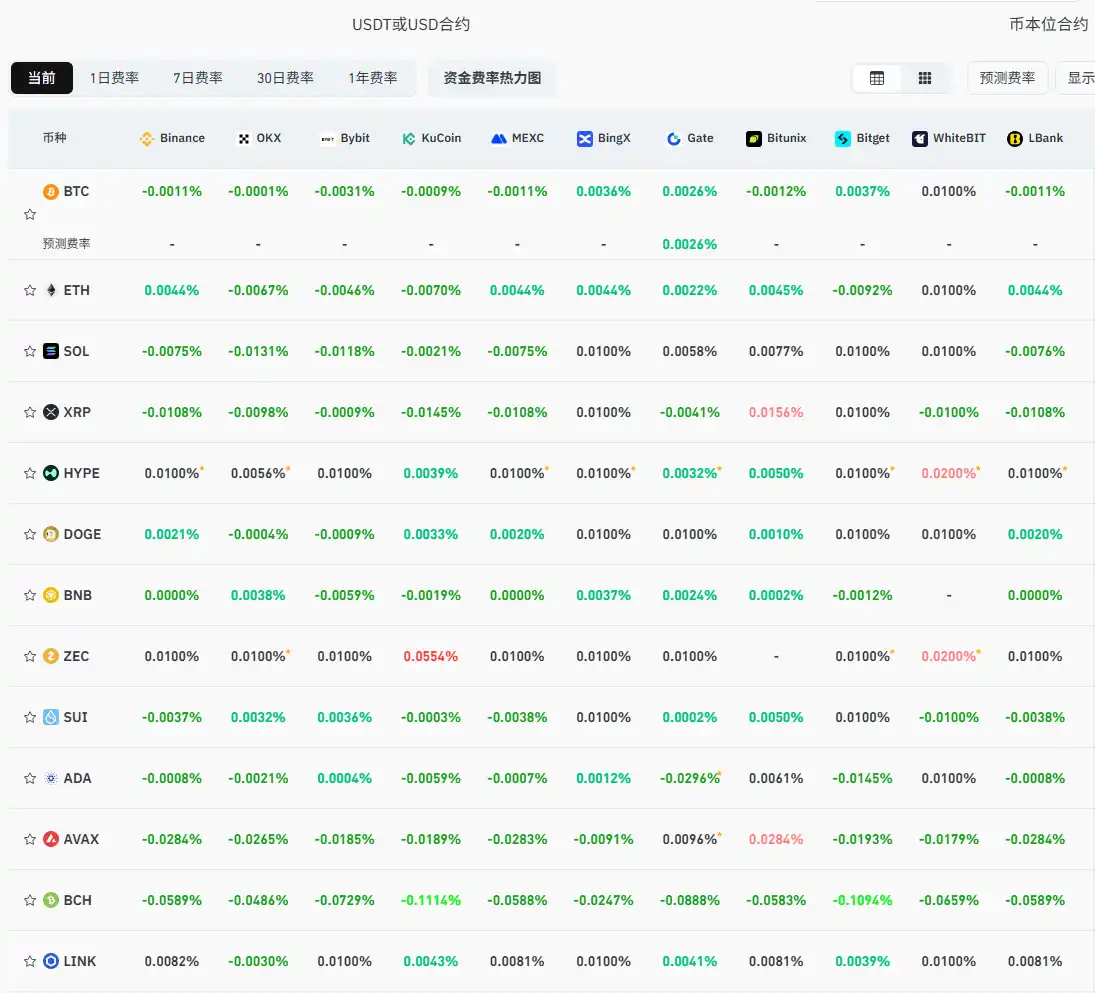

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish