New York Fed: inflation expectations fall slightly, labour market expected to improve

The Federal Reserve Bank of New York's Microeconomic Data Centre released its October 2024 Survey of Consumer Expectations, with US one-year inflation expectations falling to a four-year low of 2.87% in October. U.S. one-year inflation expectations fell to 2.87% in October, a new low since October 2020; the previous reading was 3.00%. The median three- and five-year inflation uncertainties fell. The median expectation of a rise in the U.S. unemployment rate over the next year slipped to 34.5 per cent, a new low since February 2022 The data showed a slight decline in households' short-, medium- and long-term inflation expectations, improved labour market expectations, and reports of lower unemployment and risk of job loss. Households surveyed reported an improved likelihood of finding a job if they were laid off. perceptions of credit access improved in October and expectations of future credit access rose. Households were less likely to report failing to make minimum debt payments on time in the next three months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Barcelona Football Club criticized for signing a $22 million sponsorship deal with crypto company ZKP

Swedish payment giant Klarna's first stablecoin, KlarnaUSD, has been launched ahead of schedule

Bitcoin OG opens 5x ETH short position worth $15.04 million

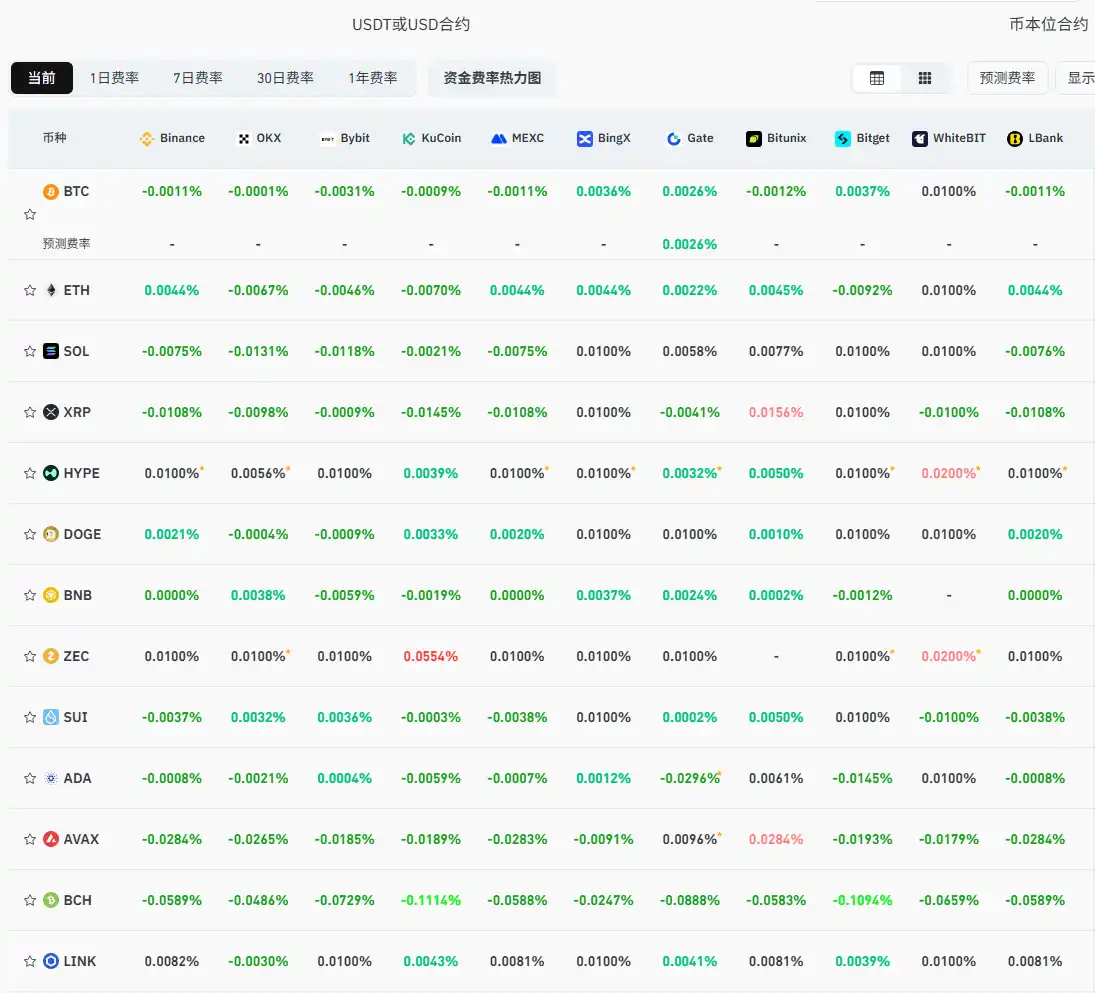

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish