Bitcoin Primed for ‘Some Sort of Thanksgiving Rally,’ According to Crypto Analyst – Here Are His Targets

A closely followed crypto analyst says he believes Bitcoin ( BTC ) may be on the verge of a Thanksgiving breakout.

In a new thread on the social media platform X, crypto strategist Ali Martinez tells his 91,000 followers that Bitcoin may surge by nearly 4% during the holiday.

He believes that Bitcoin holders will convince family members at holiday gatherings to buy the flagship digital asset, sending its price higher. The trader also says that Bitcoin may be flashing a bullish signal on its daily chart.

“Tonight, coiners are going to tell their families about Bitcoin, triggering some sort of Thanksgiving rally. This is why I think BTC is bound for a rebound to $99,000, and the technicals support it. I could be wrong, which is why I’m leaving a tight stop-loss.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Next up, the trader uses the In/Out of the Money Around Price (IOMAP) metric – which classifies crypto addresses as either profiting, breaking even, or losing money – to determine a key support level for Bitcoin.

“One key demand zone for Bitcoin to watch is $93,580, where 667,000 addresses bought nearly 504,000 BTC. Staying above this support level is a must to prevent these holders from selling!”

Source: Ali Martinez/X

Source: Ali Martinez/X

Earlier this week, the trader suggested Bitcoin may be set up for a short squeeze. A short squeeze happens when traders who borrow an asset at a certain price in hopes of selling it for lower to pocket the difference are forced to buy back the assets they borrowed as momentum moves against them, triggering further rallies.

“Over $409 million in long positions have been liquidated in the past 24 hours [on November 25th]. Now, $772 million in short positions risk liquidation if Bitcoin rebounds to $98,000!”

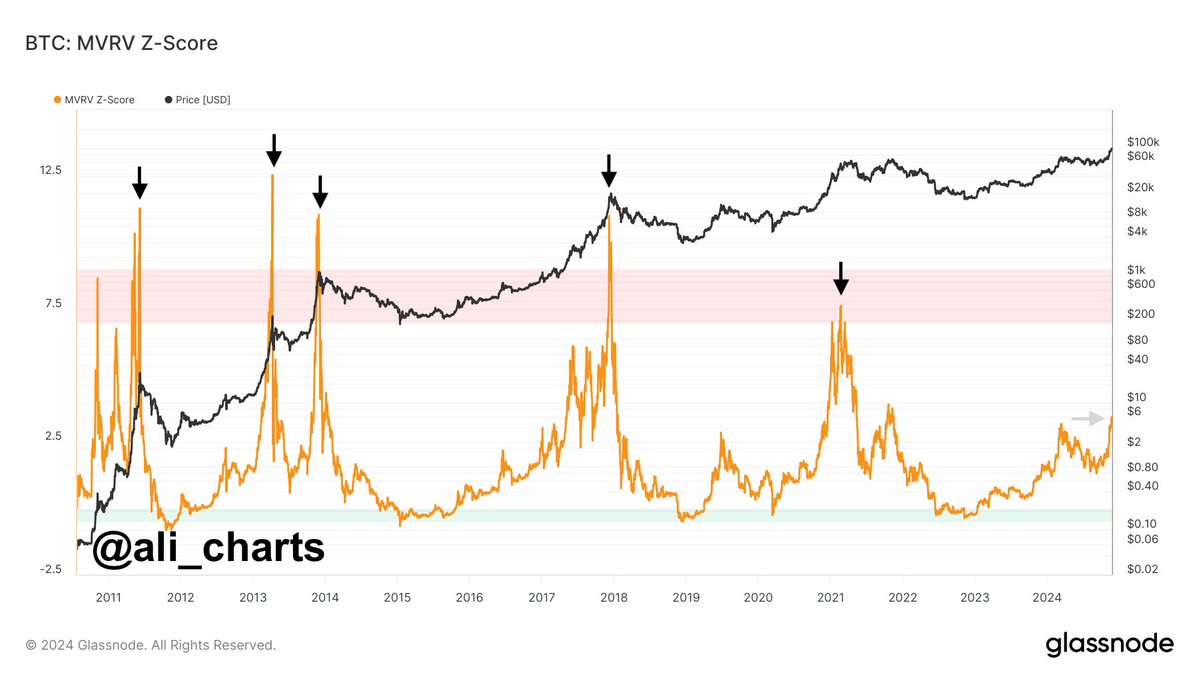

The trader also says that Bitcoin may be far from its cycle peak based on the MVRV (market value to realized value) Z-score, which aims to measure whether BTC is “undervalued” or “overvalued” by comparing its market value to its realized value. An asset tagged with a low MVRV Z-score is seen as undervalued while those with a high MVRV Z-score are viewed as overvalued.

“Bitcoin is far, far, far away from a market top!”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading for $95,228 at time of writing.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.