Ethereum Classic Achieves Golden Cross, Indicating Potential for Bullish Momentum Amid Market Uncertainty

-

Ethereum Classic (ETC) has achieved a significant milestone with the formation of a Golden Cross, igniting discussions about its potential bullish trajectory.

-

This technical indicator has historically signaled upward momentum, leading to speculation on whether ETC can sustain its recent price spike.

-

“The Golden Cross often encourages investors to consider long positions,” noted a COINOTAG analyst, emphasizing the potential for increased market interest.

Ethereum Classic’s recent Golden Cross could signal a new bullish phase, raising questions about price sustainability amid technical indicators.

Examining the Golden Cross and Technical Indicators in Detail

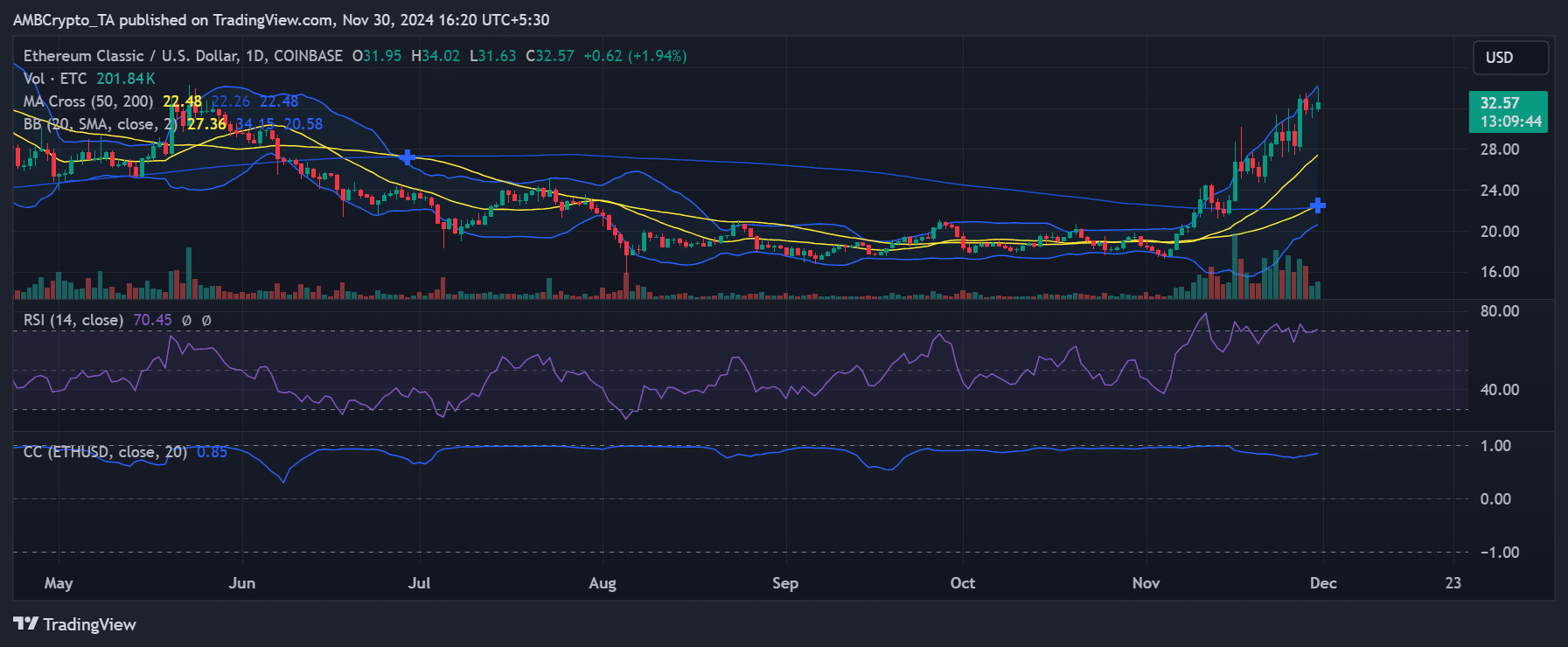

As Ethereum Classic reached a price high of $33.20, bullish sentiment has clearly taken root within the market. The formation of a Golden Cross, where the 50-day moving average crosses above the 200-day moving average, is a strong technical signal often interpreted as a bullish reversal. Analyzing ETC’s price movements shows a clear upward trend supported by technical advancements.

The Bollinger Bands also indicate expanding volatility, which suggests that the asset could continue to experience price fluctuations in the positive direction. Meanwhile, the Relative Strength Index (RSI) reading of 70.45 suggests that ETC might be entering the overbought territory. Without sustained buying pressure, a pullback could occur to recalibrate this momentum.

Source: TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens