BRETT Price Drops More Than 10% Following Twitter Hack

BRETT faces a 10% drop amid Twitter hacking concerns, but technical signals and ecosystem dominance suggest potential for rebound.

BRETT’s price has faced significant pressure following the hacking of its official Twitter profile, which posted suspicious links to an airdrop. The hacking event sparked panic among investors, with BRETT price decreasing more than 10% in the last 24 hours.

Despite this setback, BRETT remains the biggest meme coin on the Base ecosystem, commanding considerable attention and market share. While technical indicators suggest potential moderation in the downtrend, the coin’s dominance in the ecosystem could help it weather this storm and regain momentum.

BRETT’s Twitter Profile Hacking Sparked a Strong Correction

BRETT Twitter profile started posting a strange link to an airdrop a few hours ago. It kept posting again, and that tweet was inserted as a fixed one on its profile. After the market became aware of the possible hacking, BRETT price started to fall.

BRETT Airdrop Post. Source:

Twitter

BRETT Airdrop Post. Source:

Twitter

That price dump strongly impacted BRETT’s metrics. BRETT Average Directional Index (ADX) has decreased from 34 to 30.8, indicating a potential shift in trend strength.

The ADX measures the intensity of a market trend, helping traders understand whether an asset is experiencing a strong directional move or consolidating.

BRETT ADX. Source:

TradingView

BRETT ADX. Source:

TradingView

The ADX ranges from 0 to 100, with key interpretations at different thresholds. A reading above 25 suggests a strong trend, while values between 25-50 indicate a robust trend. BRETT’s current ADX of 30.8, though still indicating a strong trend, has slightly weakened from 34.

This subtle decline might signal a potential moderation in the current downtrend, suggesting the correction could be losing some momentum while still maintaining significant directional strength.

BRETT Is Not In the Overbought Zone Anymore

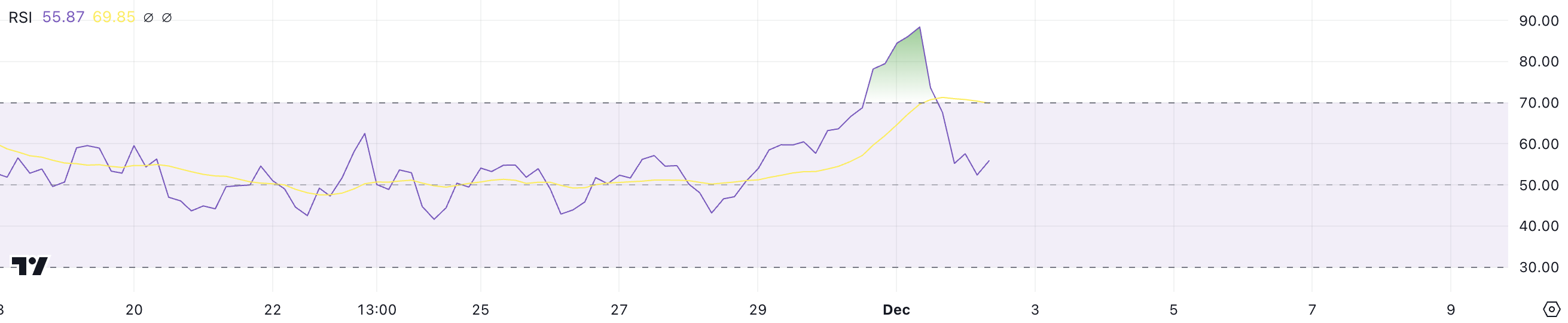

BRETT’s Relative Strength Index (RSI) plummeted from nearly 90 to around 55 in just 24 hours. This dramatic drop coincides with a price decline of over 10%.

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in a trading asset.

BRETT RSI. Source:

TradingView

BRETT RSI. Source:

TradingView

The RSI typically ranges from 0 to 100, with key thresholds at 30 and 70. An RSI below 30 suggests an asset might be oversold and due for a price rebound, while an RSI above 70 indicates potential overvaluation.

At 55, BRETT RSI suggests the asset is moving towards a more neutral territory after being previously considered extremely overbought.

BRETT Price Prediction: A Recover After The Recent Dump?

BRETT’s technical indicators suggest a potentially bearish scenario. If the price drops below its shortest Exponential Moving Average (EMA) line while short-term EMA lines remain above long-term lines, this could signal further downward momentum.

BRETT Price Analysis. Source:

TradingView.

BRETT Price Analysis. Source:

TradingView.

If the current downtrend continues, the potential support level at $0.158 might be tested, indicating a more severe market correction. However, even after the recent price dump, BRETT is still the biggest meme coin in the Base ecosystem.

Despite the recent negative sentiment potentially stemming from hacking news, BRETT price could experience a quick recovery. The market’s resilience might allow the asset to rebound and test the resistance level at $0.236 again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IoTeX launches the world's first on-chain identity solution ioID designed specifically for smart devices

ioID is revolutionizing identity management for smart devices, allowing DePIN to authenticate devices, protect data, and unlock next-generation application scenarios within a user-owned ecosystem compatible with any blockchain.

Mars Morning News | Last week, global listed companies made a net purchase of $13.4 million in BTC, while Strategy did not buy any Bitcoin last week

Expectations for a Federal Reserve interest rate cut in December have risen, with Bitcoin briefly surpassing $89,000 and the Nasdaq surging 2.69%. There are internal disagreements within the Fed regarding rate cuts, causing a strong reaction in the cryptocurrency market. Summary generated by Mars AI. This summary is generated by the Mars AI model and its accuracy and completeness are still being iteratively updated.

The covert battle in the crypto industry escalates: 40% of job seekers are North Korean agents?

North Korean agents have infiltrated 15%-20% of crypto companies, and 30%-40% of job applications in the crypto industry may come from North Korean operatives. They act as proxies through remote work, using malware and social engineering to steal funds and manipulate infrastructure. North Korean hackers have stolen over $3 billion in cryptocurrency to fund nuclear weapons programs. Summary generated by Mars AI. This summary is generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Which targets are Wall Street short sellers eyeing? Goldman Sachs reveals the short-selling undercurrents amid the AI wave

Data shows that short selling in the US stock market has reached a five-year high. However, investors are not recklessly challenging AI giants; instead, they are targeting so-called "pseudo-beneficiaries"—companies that have surged on the AI concept but lack core competitiveness.