- XRP offers key buying opportunities with potential for substantial growth in the near term.

- RSI trends hint at volatility, aligning with a projected market cycle peak in the coming years.

- XRP’s market surge reflects growing demand and strong investor confidence in its potential.

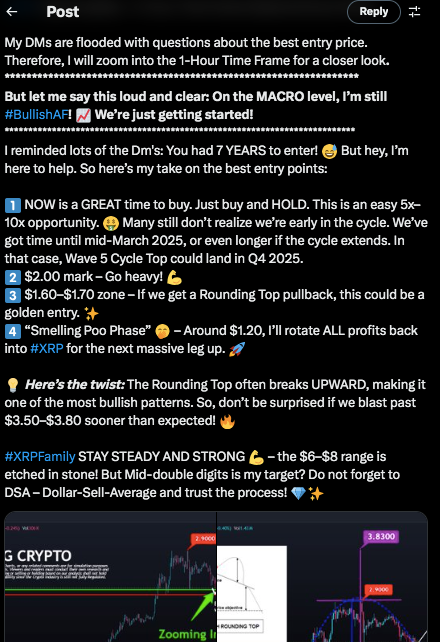

XRP has emerged as one of the best-performing crypto assets in the past month, climbing from an underperformer in early November to a market leader. According to market analyst EGRAG, the rally is expected to continue despite a recent dip, presenting fresh opportunities for investors.

EGRAG identified key entry levels for XRP, with $2.00 highlighted for aggressive buying amid market uncertainty. He also pointed to the $1.60–$1.70 range as a prime zone for strategic purchases if XRP retraces further.

Source: X

Source: X

EGRAG also noted that a dip to $1.20 could be a moment to reinvest profits into XRP, showing strong confidence in the cryptocurrency’s growth.

He believes that XRP could break above the $3.50–$3.80 range, potentially leading to a short-term rally targeting $6 to $8. He predicts the current market cycle could peak by mid-March 2025, with a possible extension into late 2025, aligning with wave 5 cycle top projections.

Technical Analysis and RSI Insights

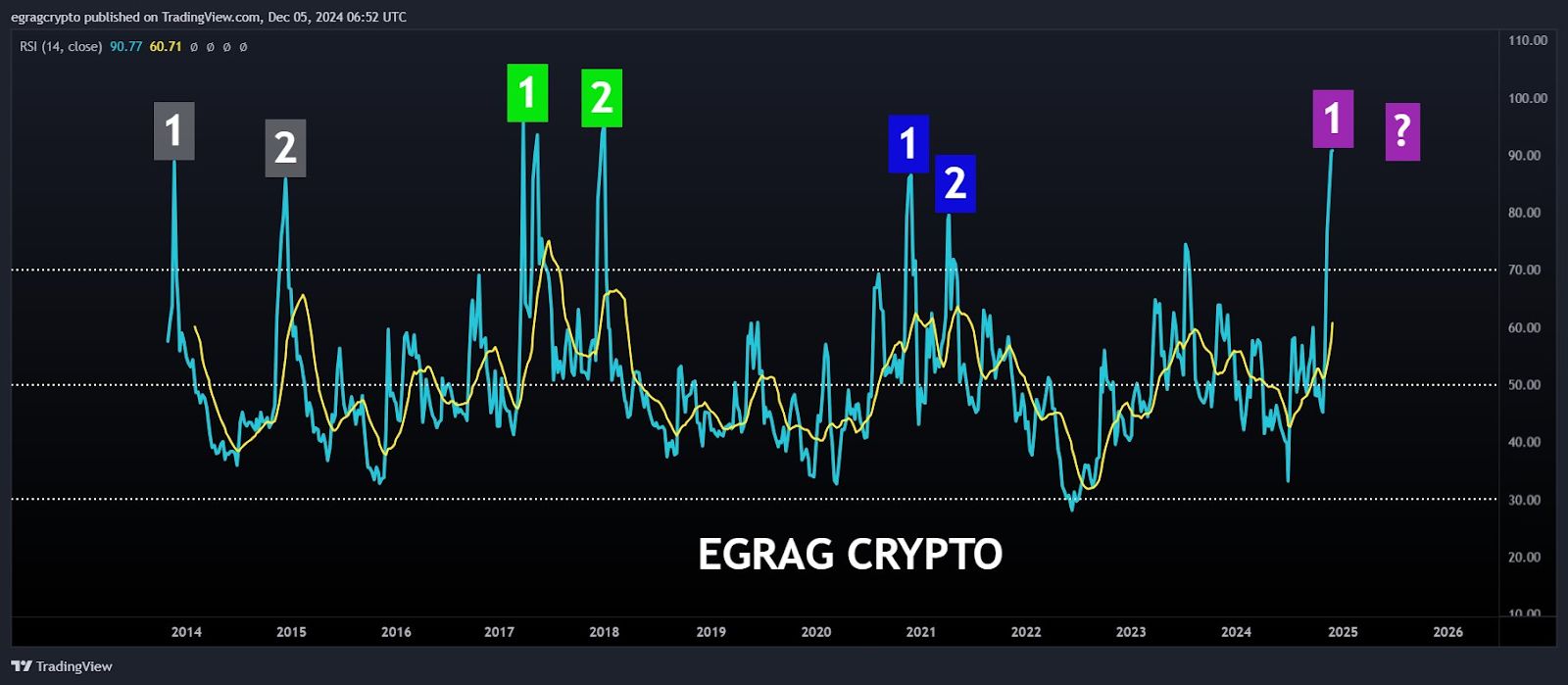

The technical analysis from EGRAG includes a detailed examination of the Relative Strength Index (RSI) for XRP, charted from 2014 with projections extending to 2026. The RSI shows volatility with sharp peaks in 2017, 2019, 2021, and a projected spike in 2025.

Source: X

Source: X

These peaks indicate potential overbought conditions that may lead to price reversals. The spike in RSI towards 2025 suggests possible upcoming market behavior, showing the importance of historical RSI patterns in anticipating market trends.

Current Market Performance

As of press time, XRP was trading at $2.43 , up 4.35% over the past day. The cryptocurrency is ranked third in market capitalization, which has risen to $138.75 billion, a 4.33% growth.

Read also: How XRP’s $10 Target Could Create 2025’s Crypto Millionaires

With a total supply of almost 100 billion XRP and about 57.12 billion XRP already in circulation, market participants are watching supply constraints alongside broader market sentiments.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.