- HBAR shows bearish momentum with rising volume, nearingthe key $0.3100 support zone.

- XRP consolidates near $2.45 as RSI signals oversold conditions, hinting at recovery.

- MACD trends for HBAR and XRP reflect short-term bearish pressure in volatile trading.

The cryptocurrency market has seen increased focus on utility-driven assets, with Hedera (HBAR) and XRP leading the way in adoption. Both tokens offer unique blockchain solutions, such as improved cross-border payments and decentralized applications. However, recent price movements reveal bearish sentiment dominating these assets, suggesting traders are reconsidering their positions.

HBAR Faces Pressure Amid Increased Trading Activity

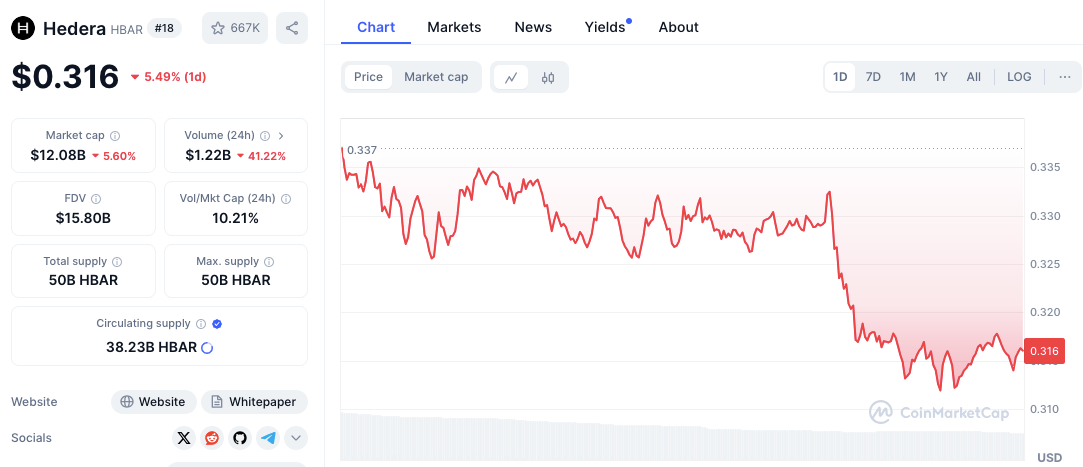

Hedera (HBAR) experienced a sharp decline of 5.69% within the last 24 hours, closing at $0.3155 . This decline followed consistent selling pressure, with the price dropping from a daily high of $0.3357. The significant 41.38% increase in trading volume highlights heightened market activity, suggesting bearish dominance.

Read also: Which Cryptocurrency ETF Will Be Approved First: XRP, ADA, DOGE, or HBAR?

Source: Coinmarketcap

Source: Coinmarketcap

Key support is identified at $0.3100, where buyers may attempt to stabilize the price. If this level fails, HBAR could test the critical threshold of $0.3000. On the upside, immediate resistance stands at $0.3200, while reclaiming the previous high of $0.3350 would signal renewed bullish momentum.

HBAR/USD 1-hour price chart, Source: Trading view

HBAR/USD 1-hour price chart, Source: Trading view

Additional technical indicators reveal that HBAR’s 1-hour RSI is at 38.85, approaching oversold territory. This metric suggests a potential buying opportunity if selling pressure diminishes. However, the MACD trading below the signal line reflects continued downward momentum, emphasizing caution for bullish entries.

XRP Holds Near Support Amid Low Trading Volume

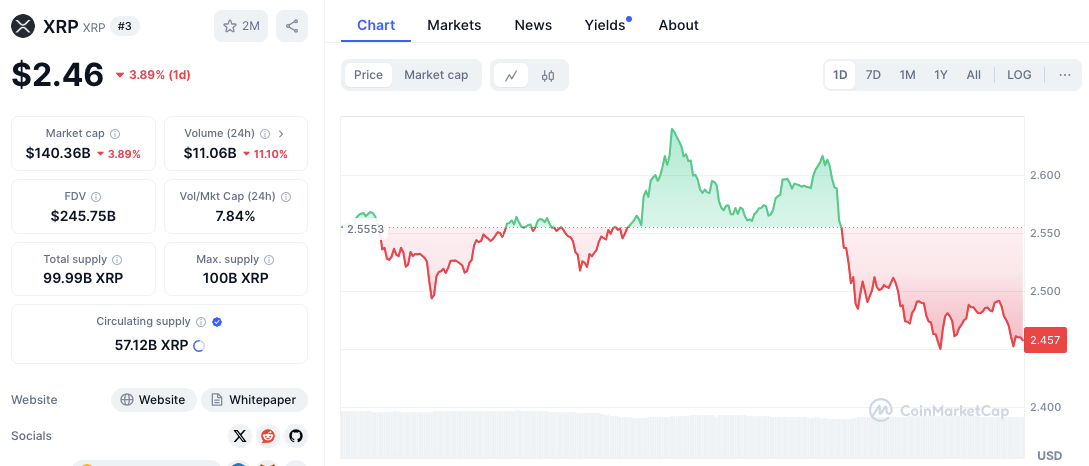

XRP, currently priced at $2.46 , shows a 3.77% daily decline, primarily driven by early bullish momentum that peaked at $2.5553. A subsequent sell-off brought the price to consolidate near $2.45, indicating cautious trader activity. Trading volume fell by 11.56%, pointing to reduced engagement and possibly limited volatility ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Immediate support rests at $2.45, a crucial level to watch for downside continuation. Breaking this could lead XRP toward $2.40, a historical and psychological support zone. On the upside, reclaiming $2.50 would signal initial recovery, while $2.55 remains a pivotal resistance for sustained bullish moves.

XRP/USD 1-hour price chart, Source: Trading view

XRP/USD 1-hour price chart, Source: Trading view

Short-term technicals show bearish conditions, with XRP’s 1-hour RSI at 38.75, nearing oversold territory. Similarly, the MACD below the signal line underscores continued selling pressure, reinforcing the need for strategic caution in bullish trades.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.