Some bitcoin ETFs are doing better than others

And it might not be the ones you think

This is a segment from the Empire newsletter. To read full editions, subscribe .

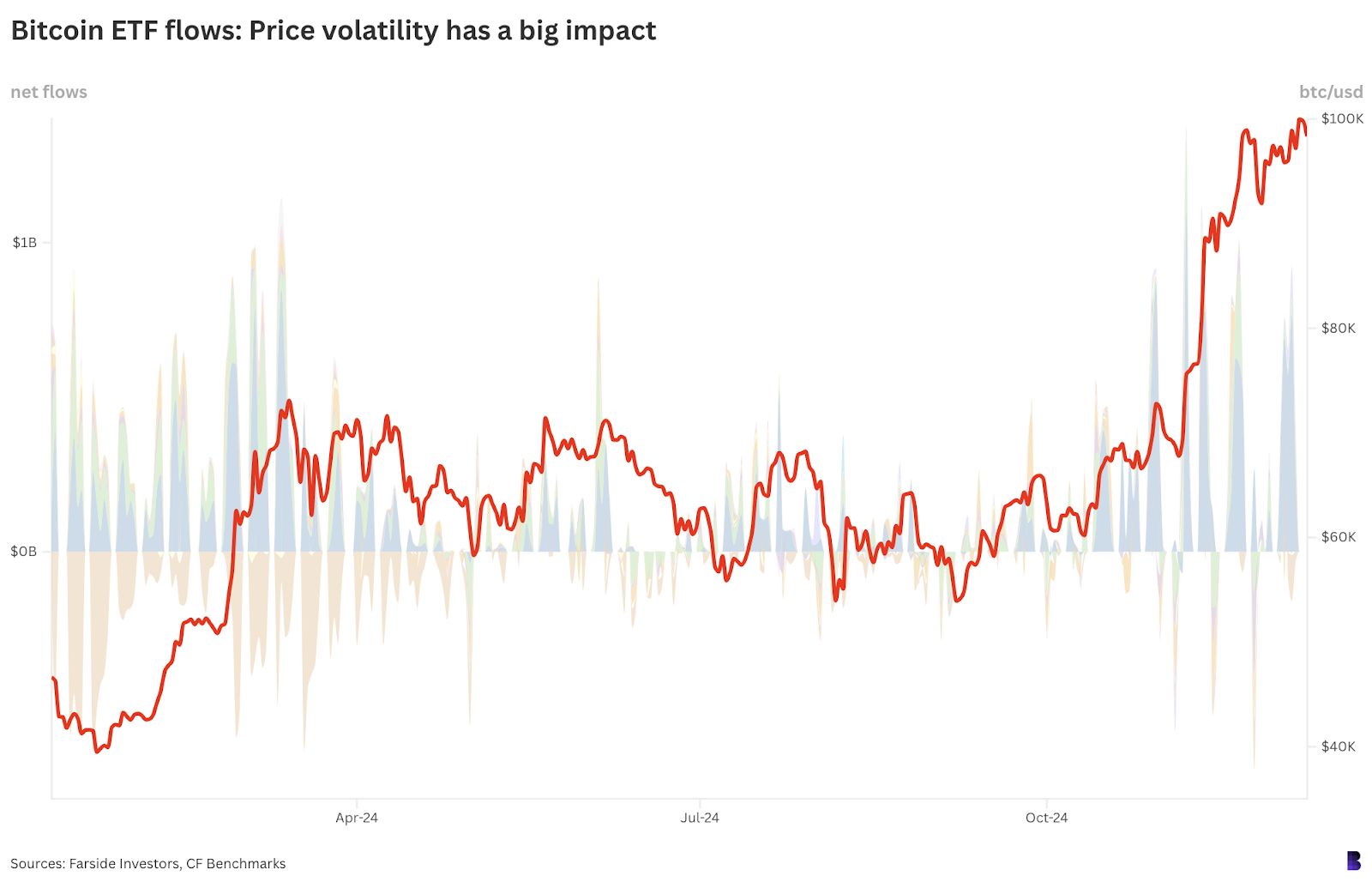

It goes without saying: What’s good for bitcoin is good for bitcoin ETFs.

No surprise then that almost $10 billion net has now flowed into US-listed spot funds since Trump’s win — about 83% going to BlackRock’s IBIT.

Some ETFs are still doing better than others.

To be clear: Share prices for the ETFs, by design, closely track the price of bitcoin. But share prices don’t reflect whether the funds themselves are up or down on their bitcoin purchases to date.

Blue is IBIT, orange is GBTC. Notice that flows relaxed when bitcoin’s price trended sideways

Blue is IBIT, orange is GBTC. Notice that flows relaxed when bitcoin’s price trended sideways

Every stock market trading day, the funds must spend the cash flowing into them on an equivalent amount of BTC. And vice versa: They must offload coins when net flows are negative.

Newsletter

Subscribe to Empire Newsletter

So, it’s possible to calculate an estimate for how much BTC each fund buys and sells per day, by dividing the daily US dollar flow figures by the price of bitcoin (per CF Benchmark reference rate , which all the major funds use).

Tally those BTC-denominated flows together and you get their cumulative current holdings: over 855,000 BTC ($84.2 billion), not counting Grayscale’s GBTC and BTC, and more than 1.1 million BTC ($108.3 billion) when included. That’s about 5.6% of the circulating supply.

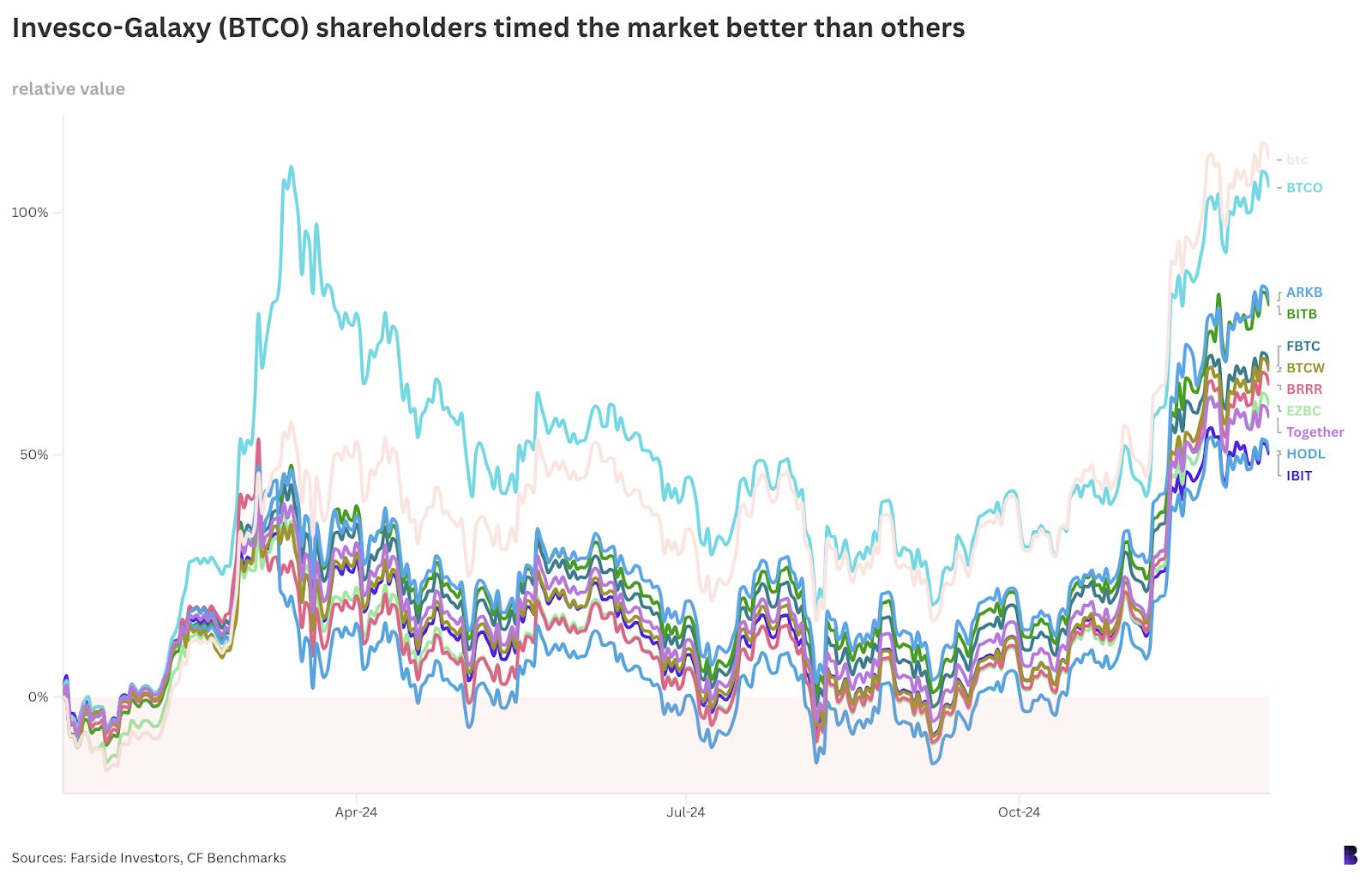

But what we’re after is the value of each fund’s BTC stash compared to how much they paid for all those coins, what I’ve called relative value on the chart below.

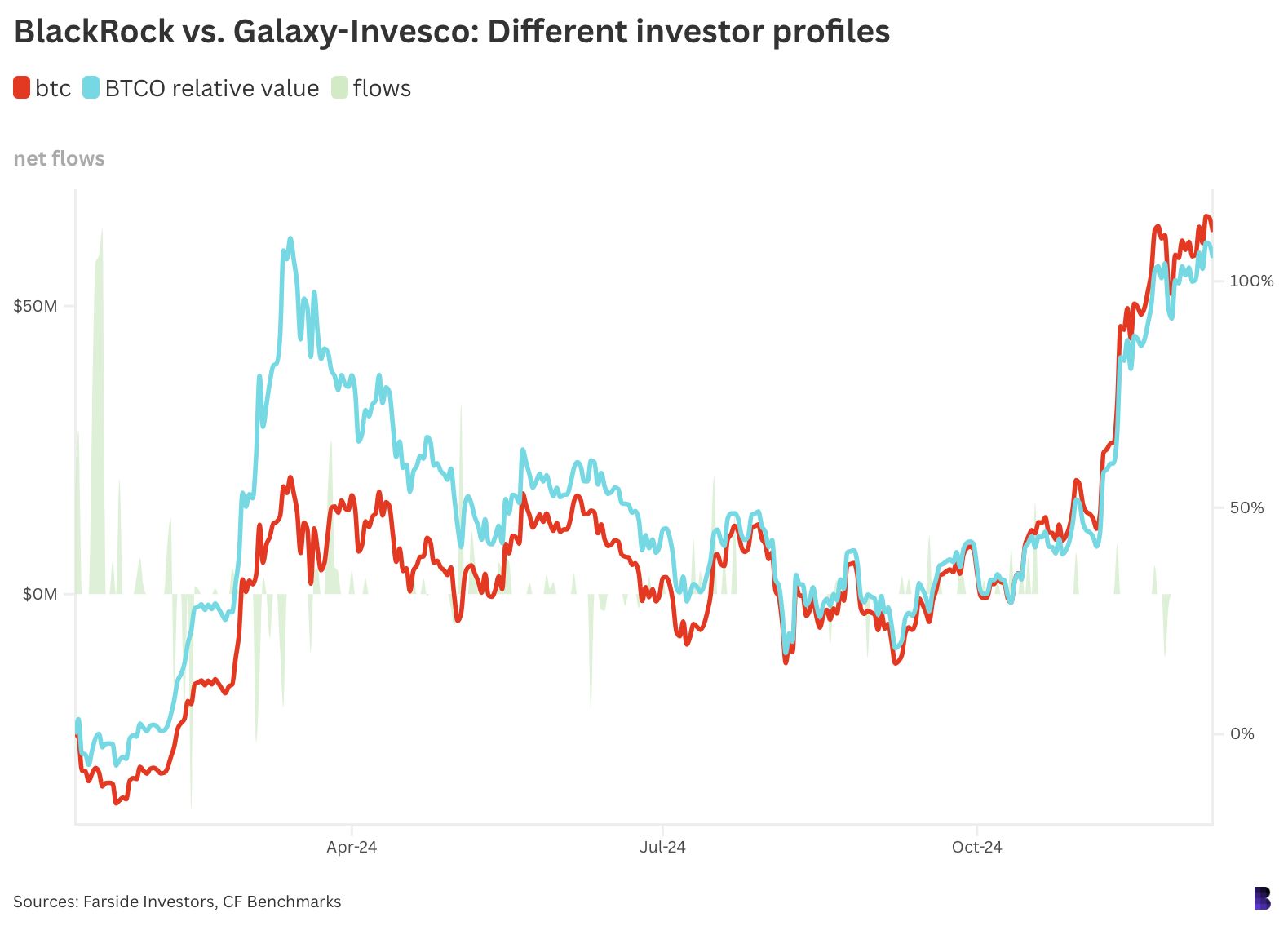

It turns out that Invesco-Galaxy’s BTCO is far ahead of the rest of the pack — it has acquired around 8,740 BTC net for $418.9 million so far. As of this morning, BTCO’s bitcoin would fetch $860.6 million, putting its shareholder collective ahead by more than 100%.

As you can see on the next chart, three-quarters of BTCO’s net flows to date came in the first two weeks of live trading, when bitcoin was changing hands for under $43,000.

BTCO’s average estimated purchase price per coin: $47,930.

Compare that to BlackRock’s IBIT. It has maintained more steady flows over the past 11 months — acquiring roughly 523,935 BTC from $34.4 billion net flows.

That means the ETF has effectively dollar-cost averaged its bitcoin stash to date, giving it an average coin price of $65,600.

IBIT is about 50% ahead on its BTC purchases to date and has timed the market worse than any other fund in the cohort.

Of course, IBIT’s BTC has appreciated much more than BTCO’s in raw dollar terms, on account of the sheer size of the fund by comparison.

Still, hats off to BTCO’s contributors. Now let’s see how long they can hold.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter .

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the Forward Guidance newsletter .

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

- bitcoin etf

- BlackRock

- BTC

- Empire Newsletter

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Devcon 8 Coming to Mumbai in 2026: Ethereum Chooses India for Flagship Event

Does DeFi's security dilemma have to compromise with "unlimited authorization" and "trusted third parties"?

The security challenges faced by DeFi have never been unsolvable problems.

TRON Industry Weekly: "Increased Probability of a December Rate Cut?" Could This Ease Market Downturn? Detailed Analysis of the Privacy DA ZK Engine Orochi Network

TRON Industry Weekly Report Summary

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $1.216 billion; US Ethereum spot ETFs saw a net outflow of $500 million

BlackRock has registered the iShares Ethereum Staking ETF in Delaware.