-

FET’s recent price action suggests bullish momentum, with a potential target looming amid significant liquidity risks and rising market interest.

-

Despite a substantial 11% drawdown this week, FET remains fundamentally bullish, bolstered by technical patterns and increased trading volumes.

-

According to COINOTAG, “The recent bullish wick under this week’s candle points to upcoming upward trends, suggesting market resilience.”

This article discusses FET’s bullish outlook amid trading volatility and potential liquidation risks, focusing on key price levels and market trends.

Market Resilience: FET’s Recent Trading Patterns

FET’s market performance has been characterized by significant volatility this week, with a notable drawdown of over 11%. However, the overall outlook remains strong as FET’s price has not dipped below the crucial $1.74 threshold. This price point is pivotal, as it marks a transition between bearish and bullish market conditions, serving as a potential support area that could dictate future price movements.

Understanding the Price Dynamics and Liquidation Risks

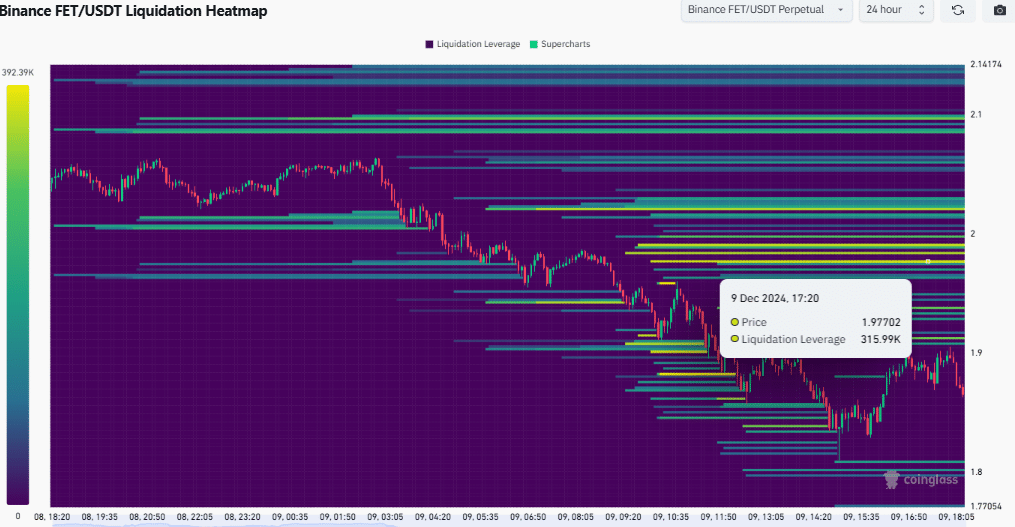

Recent trading data reveals that if FET’s price approaches the $2.00 mark, more than $1.2 billion in leveraged positions may face liquidation. The $1.8 level is identified as key support, while the resistance sits near $2.1. These dynamics could induce significant market activity, suggesting that traders should be vigilant about these critical thresholds. Market sentiment can shift rapidly, indicating a need for astute monitoring of price behavior within these ranges.

Source: Trading View

Key Liquidation Zones for Strategic Trading

The liquidity heatmap for FET/USDT reveals significant liquidation zones that traders should note. With the price near $2.00, the potential risk of liquidation can lead to sharp price corrections, especially if FET is unable to maintain support at $1.8. Such liquidations could create a domino effect in the market, further exacerbating price volatility.

Source: Coinglass

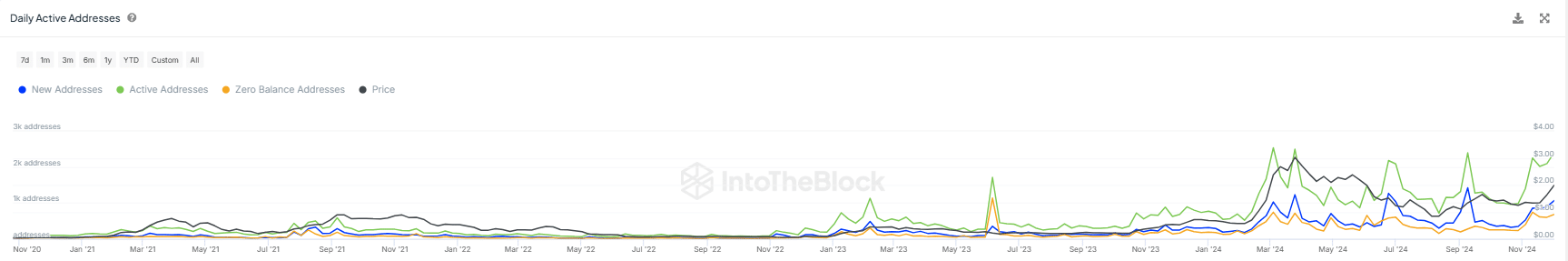

Trends in Daily Active Addresses

Examining on-chain data reveals a notable increase in FET’s daily active addresses, indicating a growing interest in the cryptocurrency. The correlation between peaks in active addresses and price rises supports the notion that trading activity is fostering upward momentum in FET’s value.

Source: IntoTheBlock

Conclusion

In conclusion, FET currently exhibits strong bullish signals despite recent volatility. The resistance levels at $2.1 and liquidation risks around $2 highlight the need for strategic trading approaches. Monitoring network activity and price movements around these pivotal zones is essential for navigating potential market shifts effectively. Traders should remain vigilant and prepared for any sudden changes in market sentiment, enhancing their ability to capitalize on FET’s outlined bullish potential.