BlackRock’s Bitcoin ETF Surpasses Over 50 European Funds Combined

BlackRock's IBIT has outpaced European ETFs in assets, dominating Bitcoin ETF inflows and highlighting the crypto market’s rapid growth.

BlackRock’s Bitcoin ETF (IBIT) now has more assets under management (AUM) than all 50+ regional ETFs in the European market combined. Some of these products have existed for 20 years, highlighting IBIT’s unprecedented rise.

Bitcoin ETFs have been enjoying record-high inflows in the past month, and BlackRock is comfortably leading the cohort.

BlackRock’s IBIT: A Historic Success

This surprising stat was revealed earlier today by ETF analyst Todd Sohn, and his analysis centered on the viability of these regional ETFs and their comparison to the runaway success of Bitcoin products.

“IBIT already has as much in assets as the 50 European focused ETFs (region + single country) COMBINED, and they’ve been around for 20 years,” said Bloomberg analyst Eric Balchunas.

“Outflows, no new products, generational type underperformance for Europe… makes you wonder if it can work,” Sohn responded, referencing the regional ETFs’ lackluster performance.

BlackRock’s IBIT has been leading the surging Bitcoin ETF market since its launch in January. Quickly after Donald Trump’s election victory, IBIT surpassed its previous all-time high and was worth more than BlackRock’s gold-based ETF.

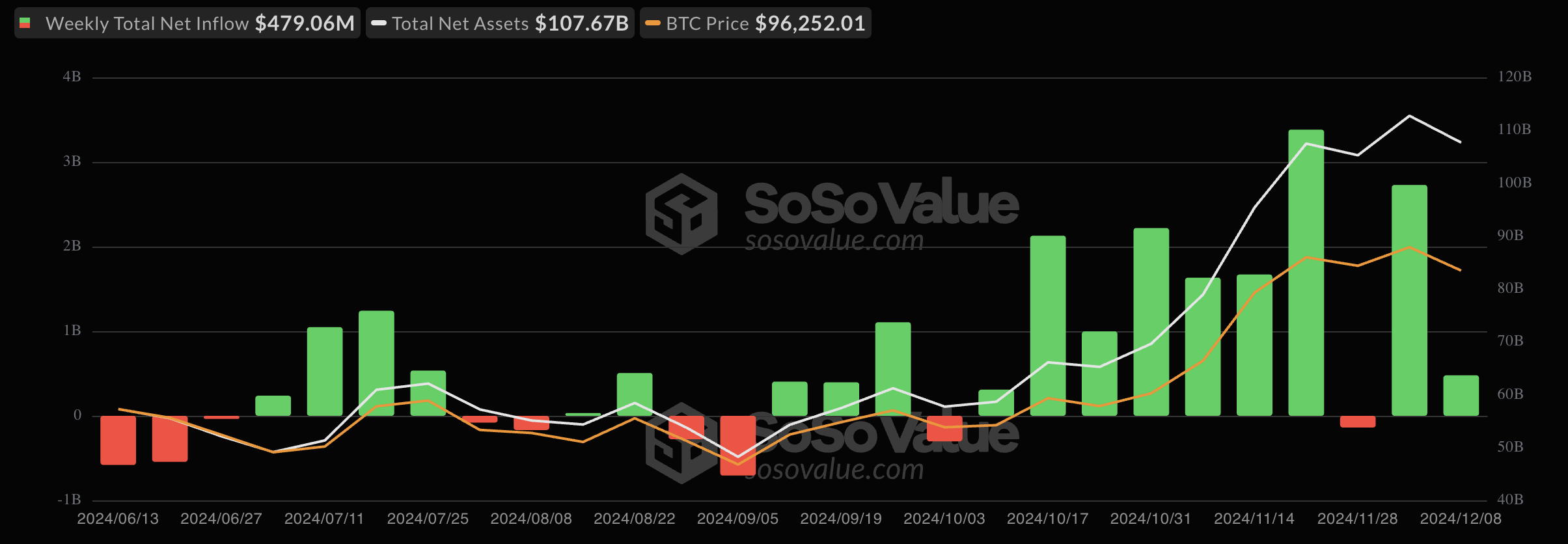

This momentum has generally stayed consistent. Bitcoin ETFs had the highest net inflow in November, reaching a record $6.1 billion, and the largest inflow came from BlackRock’s IBIT. In the first week of December, Bitcoin ETFs already saw the second-largest weekly inflow, led by IBIT.

Currently, BlackRock’s fund has over $51 billion in net assets, which represents nearly half of the entire spot Bitcoin ETF market size in the US.

Bitcoin ETF Weekly Inflows. Source:

SoSo Value

Bitcoin ETF Weekly Inflows. Source:

SoSo Value

The firm has been a dominant force in several metrics besides weekly inflows. For example, last week, all 12 spot ETFs collectively owned more Bitcoin than Satoshi Nakamoto. Of these holdings, nearly half belongs to BlackRock alone, and the firm has continued purchasing at a high rate.

Overall, these ETFs represent the growing institutional acceptance of Bitcoin and crypto in general. For those institutions slow to adapt, however, change can sweep them away. In late October, European Central Bank economists suggested price controls on Bitcoin. The EU has been comparatively harsh to crypto lately, and its ETF underperformance reflects this.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services