- The crypto market shed 6.48% (roughly $240 billion) yesterday as Bitcoin’s fall from $101,000 to a daily low of $93,000 sparked $750 million in liquidations.

- Major cryptos have begun to recover, with some alts already logging double-digit price increases.

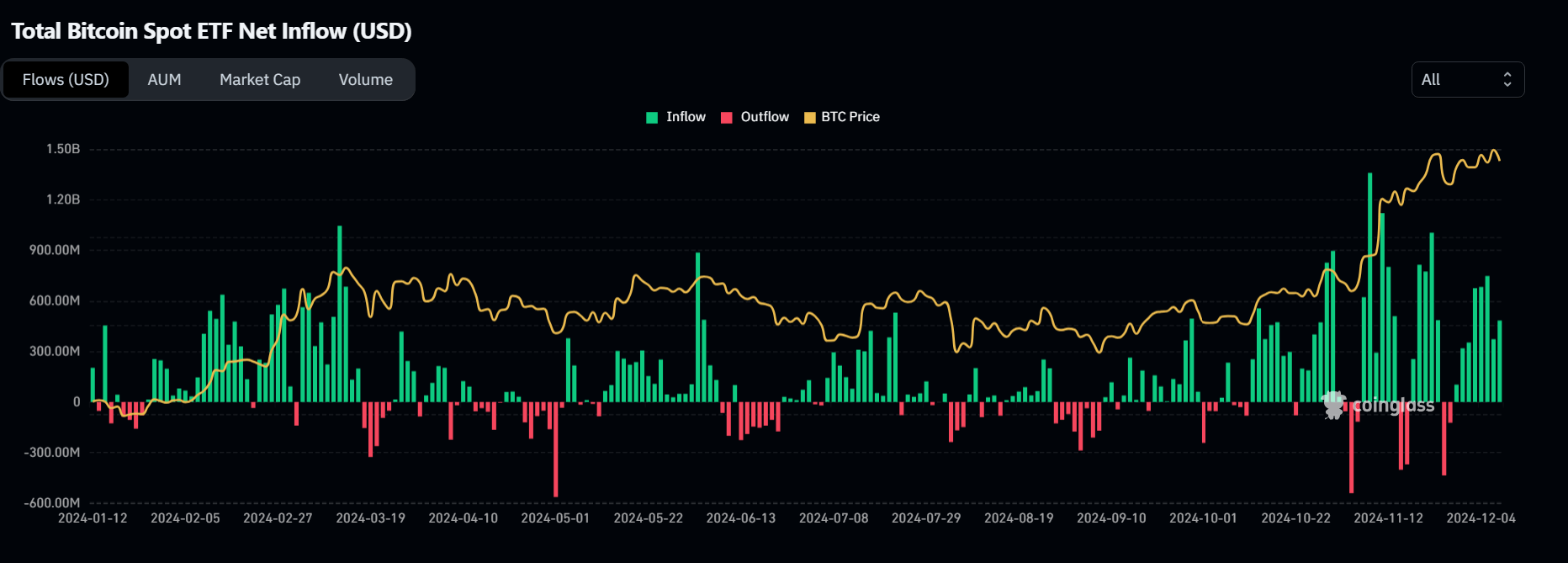

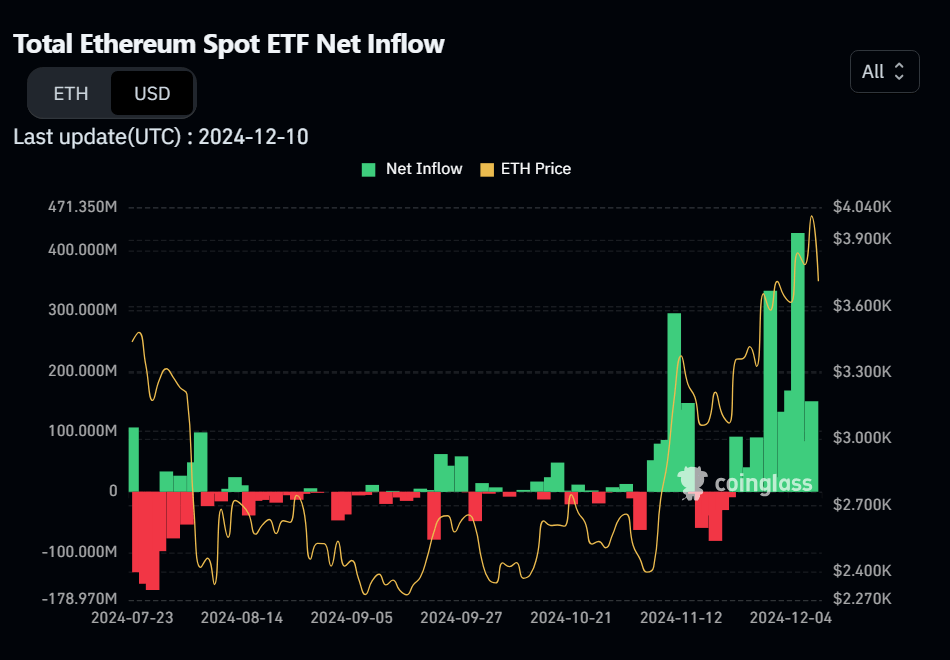

- Meanwhile, Bitcoin and Ethereum spot ETFs continue to log positive inflows.

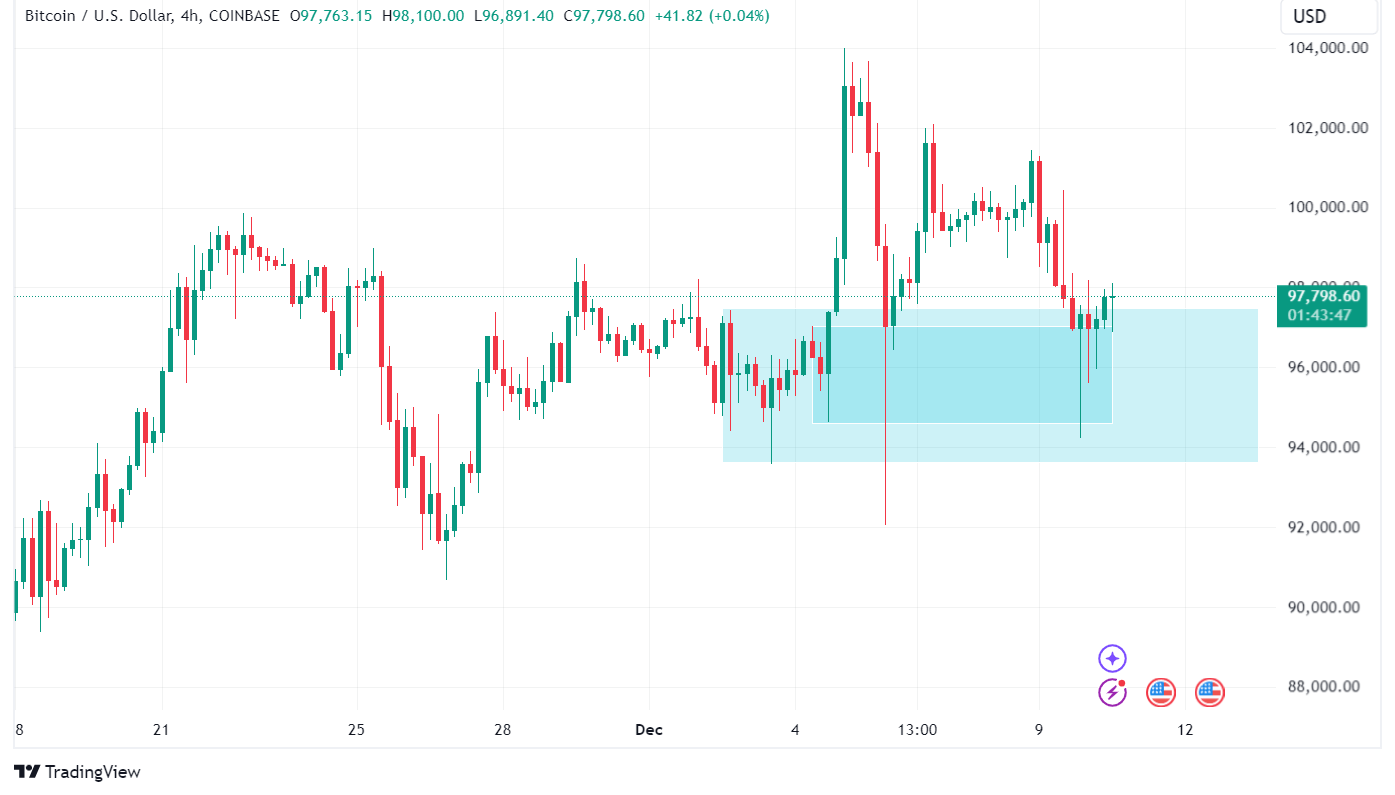

Bitcoin bled in yesterday’s trading session, falling from a daily opening price of $101,151 to a low of $94,270 during the US afternoon session before closing higher at $97,314. With a market dominance above 56%, the largest crypto by market cap weighed on the entire market as major altcoins logged double-digit losses.

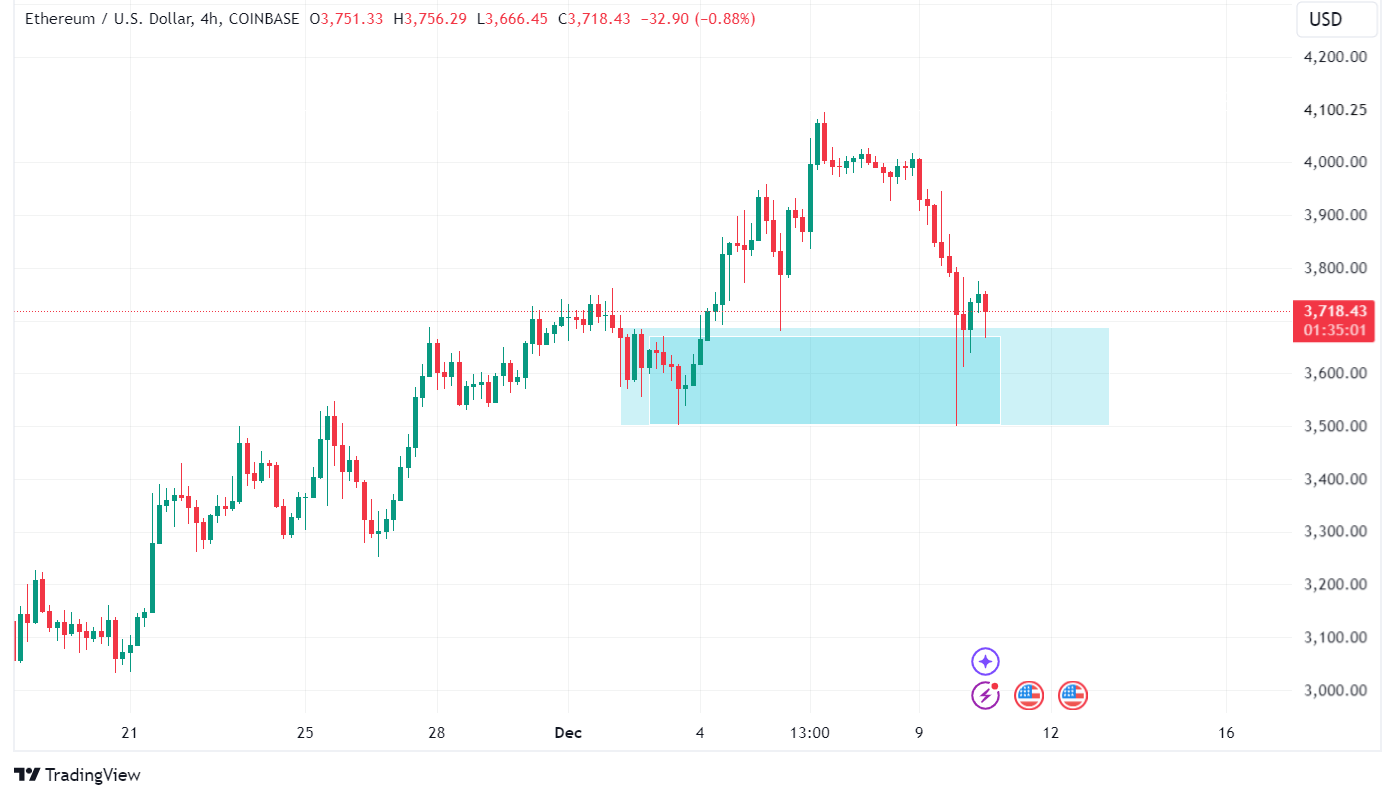

However, at the start of today’s US trading session, some major altcoins appear to have found support. Ethereum reached a daily low of $3,506 yesterday and is up 5% from that level as of writing, while Solana is up 6.9% from yesterday’s lows.

Is the selling over?

Bitcoin’s price pushed down to a support zone with an upper boundary of $97,463 and while most of the selling pressure appears to have abated, its price still hovers around the support as definitive initiative buy action is yet to occur.

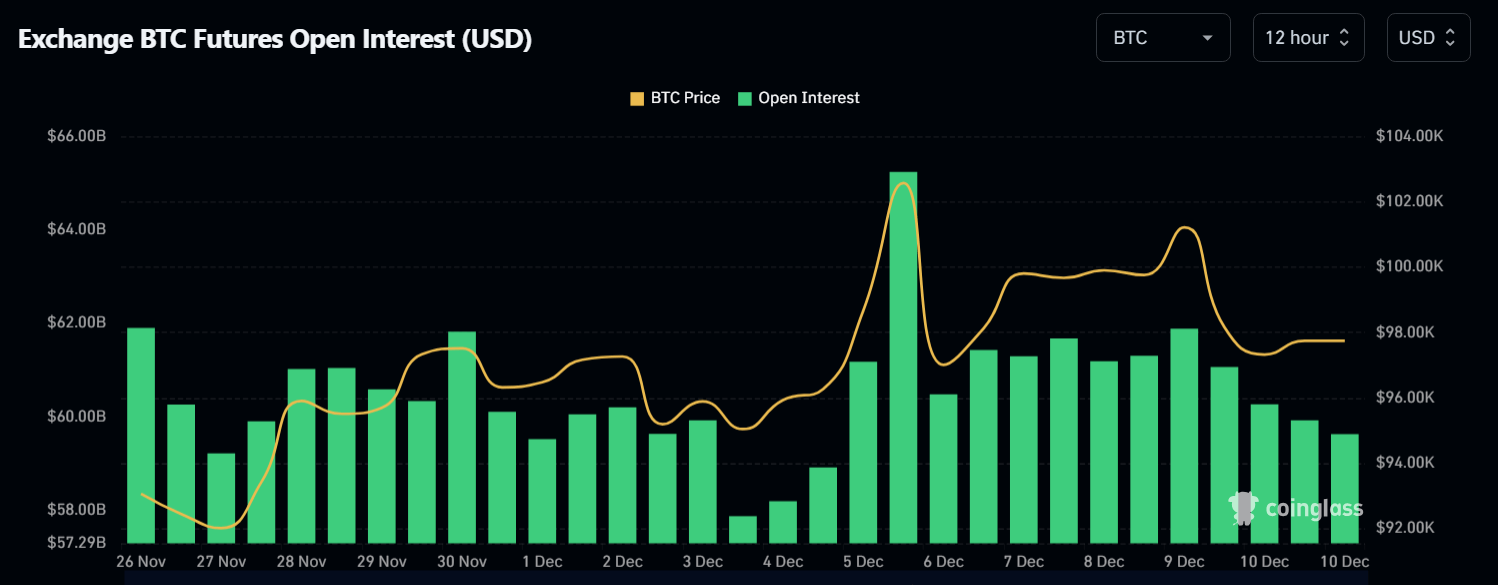

Open Interest trended lower since yesterday as liquidations and taking profit led to more positions being closed. However, a tell-tale sign of a resumption in the uptrend would be mounting open interest combined with positive price action, indicating new positions being opened.

Ethereum’s price action is similar as the second largest cryptocurrency by market cap hovers around a support level awaiting either initiative buy action to push prices higher or sellers to push price lower.

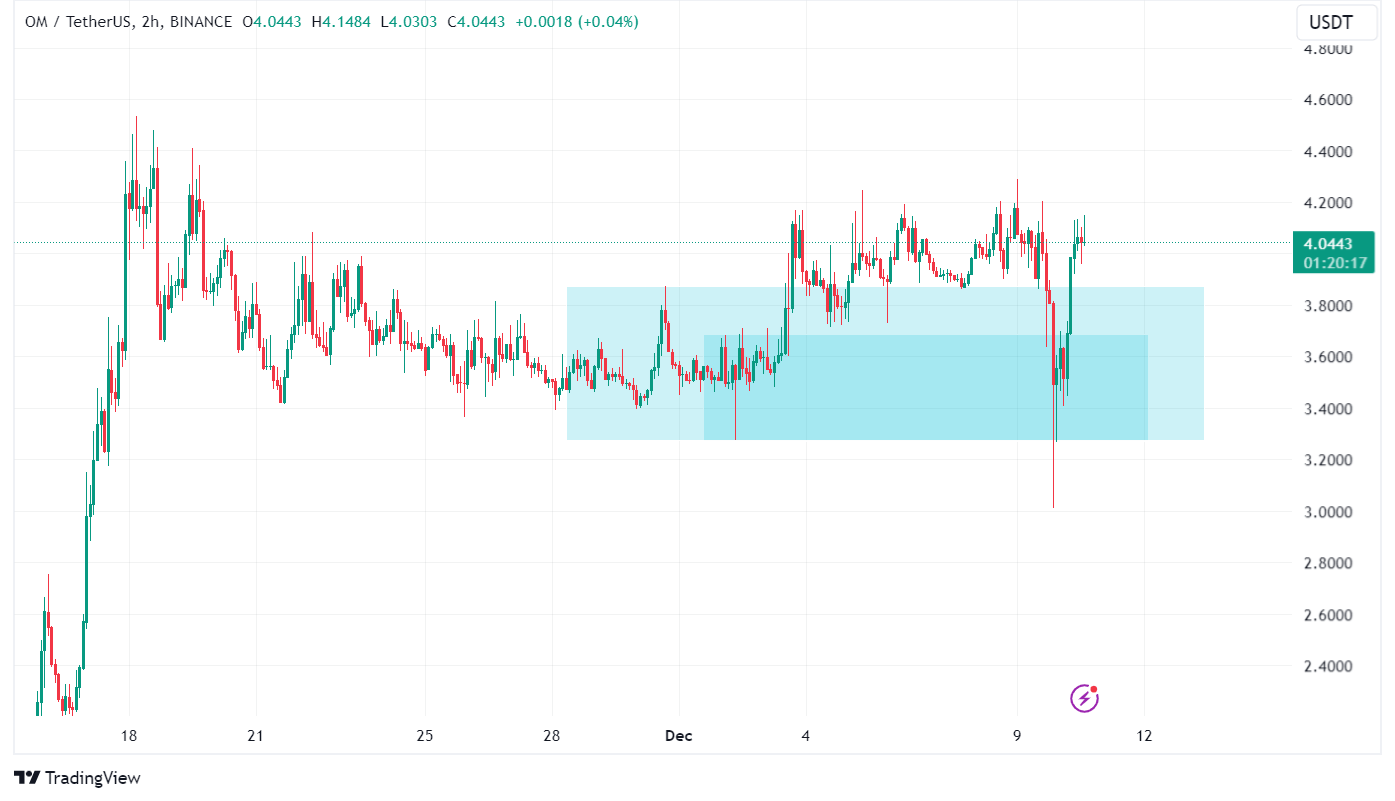

Elsewhere, some altcoins have almost completely shaken off yesterday’s slump, logging double-digit daily gains as of writing. Mantra is a great example of this as its price has climbed 14.11% since yesterday’s close as of writing.

Spot crypto ETF inflows remain steady

Yesterday’s slump is not indicative of a wider bearish sentiment as inflows into US crypto spot ETFs remain positive. US spot Bitcoin ETFs recorded $2.77 billion in inflows last week and $483.60 million yesterday.

Ethereum ETFs followed a similar pattern, recording weekly inflows of $836.8 million and $149.80 million yesterday.

Bitcoin trades at $97,900 as at publishing while Ethereum trades at $3,600.