-

Aave continues to dominate the decentralized finance (DeFi) lending landscape, recently achieving a historic Total Value Locked (TVL) milestone exceeding $21 billion.

-

The platform’s robust performance is further underscored by its 45% market share, showcasing investor confidence in Aave’s innovative lending solutions.

-

A recent statement from a COINOTAG analyst highlighted, “Aave’s unique value proposition in DeFi has attracted both retail and institutional investors in unprecedented numbers.”

This article delves into Aave’s remarkable achievements in DeFi, including its 45% market share, $21 billion TVL milestone, and bullish price momentum.

Aave’s market share reflected in TVL surge

Recent data from DeFiLlama illustrates a historic surge in Aave’s TVL, marking it as a major player in the decentralized lending market. The current TVL exceeds $21 billion, indicating a decisive lead over its competitors and reinforcing Aave’s influence in the DeFi sector.

Source: DefiLlama

Analysis from the past year reveals a consistent upward trajectory in Aave’s TVL, particularly notable since the start of 2024. This upward trend aligns with escalating liquidity inflows stemming from heightened interest in decentralized lending.

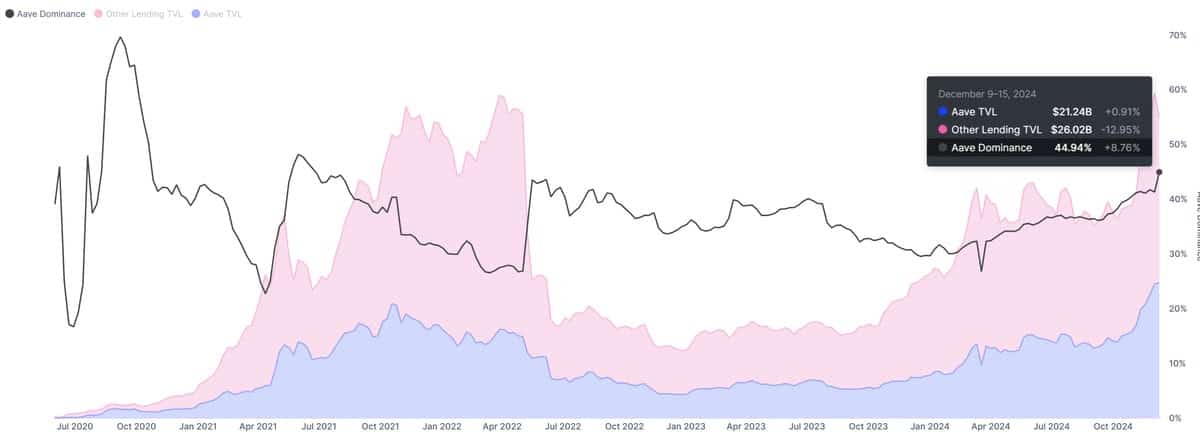

Charts from IntoTheBlock indicate that while other platforms have fluctuated, Aave’s growth has remained steady, securing its dominance in a competitive market. This trend shows Aave as a stable choice for users engaged in decentralized borrowing and lending.

Source: IntoTheBlock

AAVE price analysis: Bulls in control

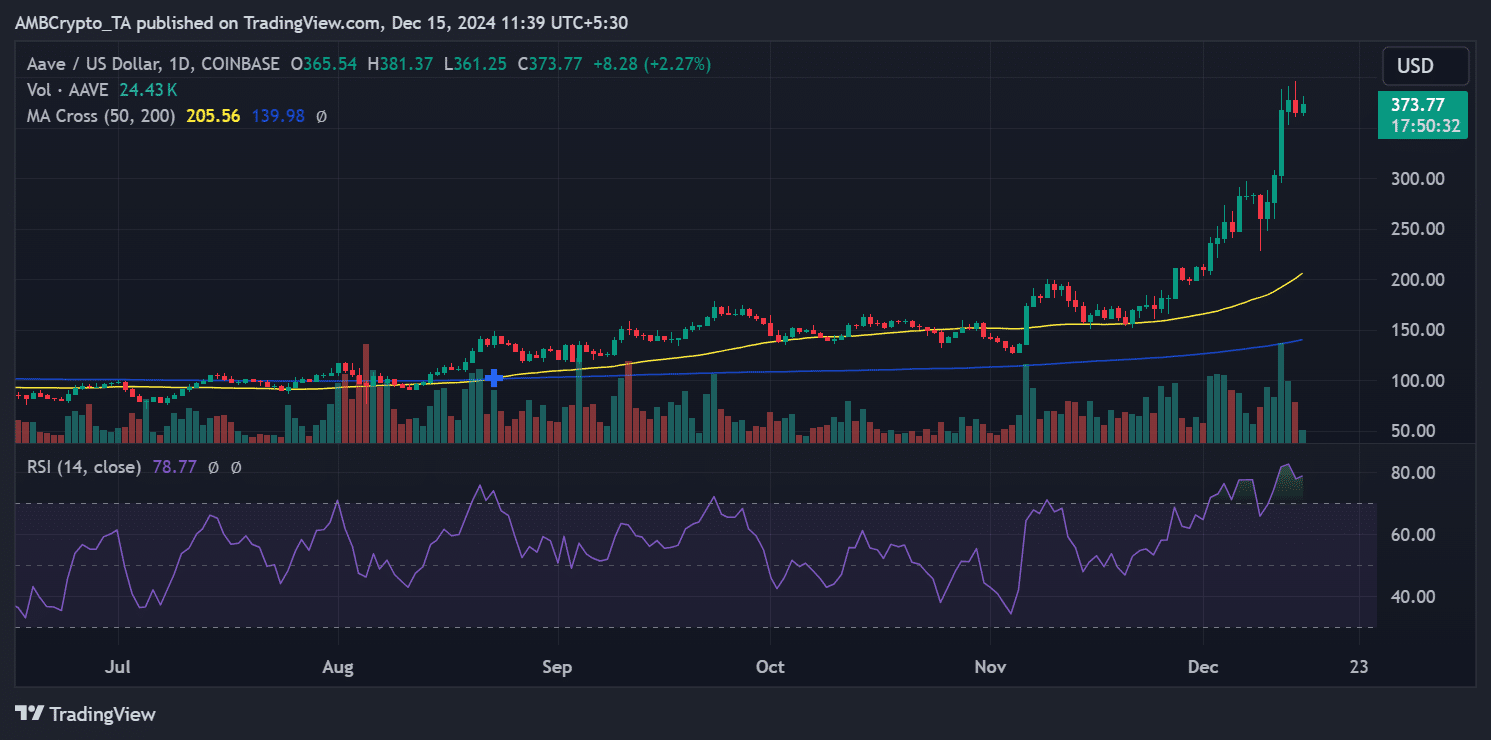

The recent surge in Total Value Locked is mirrored in AAVE’s price performance. Current trading data shows the token priced at $373.77, reflecting a notable increase amidst a bullish trend observed over the last few days.

On December 12, AAVE experienced a significant 21.20% price spike, signaling a robust bullish trend that has been consistent since November. Breaking through key resistance levels has positioned AAVE favorably for further growth.

Source: TradingView

Increased trading volumes further validate AAVE’s price surge, underscoring strong market demand. Should the bullish momentum persist, attention will turn to potential resistance levels, particularly the psychological mark of $400.

Can it maintain its momentum?

Aave’s significant market share positions it advantageously to leverage the ongoing momentum in the DeFi sector. The rising Total Value Locked and positive token performance suggest a potentially prosperous future.

Is your portfolio green? Evaluate your gains with the AAVE Profit Calculator.

While current overbought market conditions might suggest imminent corrections, Aave’s ongoing liquidity influx and robust investor confidence are likely to support continued growth in the foreseeable future.

Conclusion

Aave’s strong fundamentals and market positioning indicate a promising trajectory as it leads the decentralized lending space. Growing interest and liquidity, alongside bullish price trends, reflect an optimistic outlook for stakeholders in the ecosystem. Only time will tell if Aave can sustain this impressive performance, but the signs are undoubtedly favorable.