Bitcoin Could Become Neutral Reserve Asset As BTC Now a National Security Issue, Says Investor Luke Gromen

Macro guru Luke Gromen believes the US has minimal choice but to seriously consider elevating Bitcoin ( BTC ) as a neutral reserve asset.

In a new interview with Bitcoin firebrand Robert Breedlove, Gromen says the country is facing a national security crisis after Russia crushed US and NATO forces in Ukraine.

Gromen believes that the defeat has changed the rules of the game, forcing the Department of Defense and the national security apparatus to abandon the fiat currency system. According to the macro guru, the US dollar system drove the country to shutter its factories, crippling America’s ability to manufacture armaments for national defense.

But Gromen says the national defense and intelligence establishment now sees an opportunity to revitalize its industries by debasing the dollar and using Bitcoin to back the Treasury market.

“The game theory has changed around this: for national political stability, for bringing back the middle and working class for defense base re-establishment. All of these things are pointing to a neutral reserve asset…

Bitcoin has gone from an eye-roll laugh in this sentence a year ago… but I don’t think there should be.

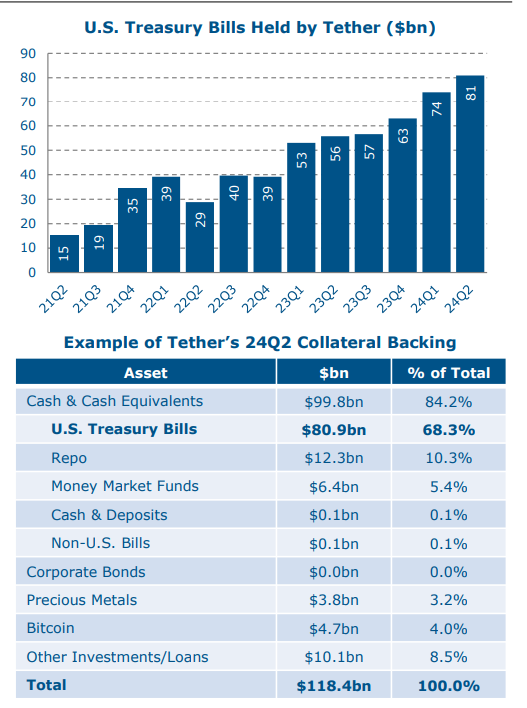

Treasury [Department] is talking about how to use stablecoins to create a balance sheet basically for T-bills to finance deficits. Paul Ryan, former speaker of the House [and] VP candidate, [wrote an] op-ed about how stablecoins could be used to create demand for T-bills. Trump saying Bitcoin is the new oil, reportedly, [and] the strategic [Bitcoin] reserve.”

Gromen says the statements of politicians and the Treasury Department tell him that the US is gearing up to massively boost the market cap of Bitcoin, similar to what happened to oil in 1973 when it surged 400%.

“What that oil price did by moving up that way was it effectively made oil big enough to back the dollar, to back the US deficits.”

According to Gromen, elevating Bitcoin as a neutral reserve asset will allow the US to finance the re-establishment of its industries for national defense without making Americans poor.

“The Treasury Borrowing Advisory Committee report has a chart: here’s the market cap of crypto, here’s the market cap of stablecoins, here’s how many T-bills stablecoins have bought, and it’s linear. That’s how they’re looking at it…

When you think about it that way in the context of political stability issues that you need to address, the national defense issues you need to address, the game theory is turned on its head…

Bitcoin isn’t a threat that is rising. It needs to go up faster so that we have more balance sheet capacity and so that our people, as we reinflate to re-shore all of this stuff because it is going to be inflationary, that’s not a bad thing to compensate your people to keep them whole on a real basis while that happens.”

Source: Treasury Department

Source: Treasury Department

At time of writing, Bitcoin is trading for $105,063.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services