Global crypto investment product YTD inflows quadruple any other year: CoinShares

Crypto investment products registered $3.2 billion worth of net inflows globally last week, led by the U.S. spot Bitcoin ETFs, according to CoinShares.The funds’ year-to-date net inflows reached a fresh record of $44.5 billion — quadruple any other year, Head of Research James Butterfill said.

Global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered a 10th consecutive week of net inflows, adding $3.2 billion, according to CoinShares.

The positive flows also bring the year-to-date figure to a new record of $44.5 billion — more than quadruple that of any other year — CoinShares Head of Research James Butterfill noted in a Monday report.

“Trading volumes in ETPs have averaged $21 billion a week, comprising 30% of the bitcoin traded on trusted exchanges,” Butterfill added. “Bitcoin volumes on trusted exchanges (all investment types) are highly liquid, having averaged $8.3 billion a day this year, double that of the FTSE 100.”

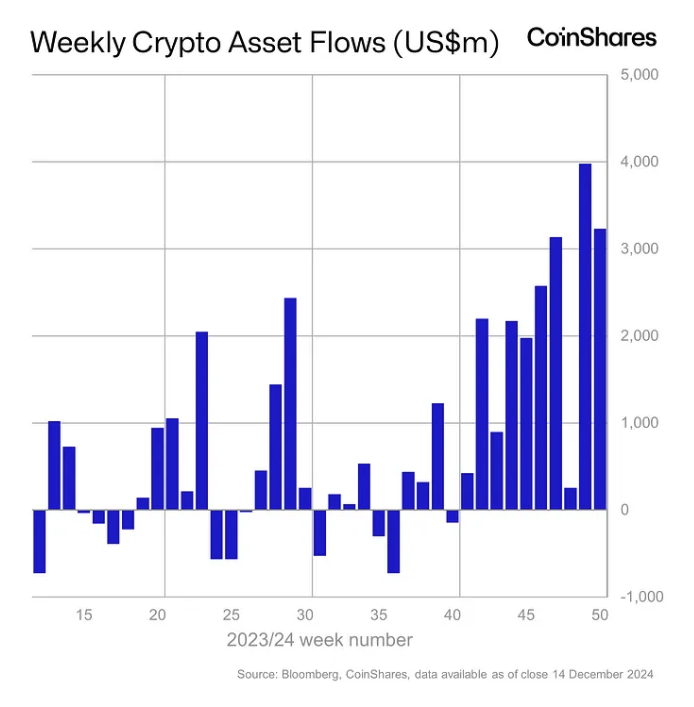

Weekly crypto asset flows. Images: CoinShares .

US spot Bitcoin ETFs add $2.2 billion in weekly inflows

The 12 U.S. spot Bitcoin exchange-traded funds added $2.17 billion in net inflows alone last week, according to data compiled by The Block. The funds’ positive streak now extends to 12 trading days, totaling $5.3 billion — 15 % of the $35.8 billion worth of cumulative net inflows they have generated since their January launch.

“Bitcoin ETF demand has been relentless with over $2 billion of inflows clocked last week,” analysts at research and brokerage firm Bernstein wrote in a Monday note to clients. “Seven out of the last nine weeks, Bitcoin ETF inflows have exceeded $2 billion.”

U.S.-based funds also dominated overall, with $3.14 billion worth of net inflows offset slightly by net outflows of $19 million from crypto investment products in Sweden. Funds in Switzerland, Germany and Brazil also saw notable weekly net inflows of $35.6 million, $32.9 million and $24.7 million, respectively — highlighting broad positive sentiment, according to Butterfill.

Globally, bitcoin-based funds registered net inflows of $2 billion, bringing the total since pro-crypto Donald Trump’s election win to $11.5 billion, Butterfill noted. However, higher prices also prompted a further $14.6 million worth of inflows into short-bitcoin products.

Meanwhile, Ethereum-based funds witnessed their seventh consecutive week of net inflows, adding another $1 billion to a total of $3.7 billion for the period amid a “dramatic improvement in sentiment,” Butterfill said.

The U.S. spot Ethereum ETFs contributed $854.8 million to this amount last week, extending their own positive streak to 15 trading days totaling $2.25 billion, according to data compiled by The Block.

“Ethereum ETF inflows have exceeded $800 million/week since the last two weeks, reflecting an accelerating trend,” the Bernstein analysts led by Gautam Chhugani said.

XRP investment products also saw net inflows of $145 million last week as hopes rise for an ETF in the U.S. Polkadot and Litecoin-based funds generated inflows of $3.7 million and $2.2 million, respectively.

Bitcoin all-time highs

Bitcoin’s price registered a new all-time high above $106,600 late Sunday before correcting. The foremost cryptocurrency is currently trading for $104,514, according to The Block’s Bitcoin Price Page , having gained 54% in less than six weeks since the U.S. elections and around 150% year-to-date.

Bitcoin mining difficulty also reached a new all-time high of 109 trillion early Monday, jumping 4.4% amid record average hash rate levels for the network, according to blockchain explorer Mempool .

“With BTC consolidating above $100,000, ETHs growing momentum and huge ETF inflows could signal the onset of a broader altcoin Santa rally,” Coinstash co-founder Mena Theodorou said. “Combined with the pro-crypto Trump administration, easing inflation, and a likely Fed rate cut, the conditions to support potential crypto market growth couldn't be more favourable.”

Meanwhile, the GMCI 30 index, which represents a selection of the top 30 cryptocurrencies, is trading flat over the past week, having gained 113% in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From the Only Survivor of Crypto Social to "Wallet-First": Farcaster’s Misunderstood Shift

Wallets are an addition, not a replacement; they drive social interaction, not encroach upon it.

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.