-

Cardano (ADA) is facing significant challenges as indicators suggest a potential drop below the crucial $1 level, raising concerns among investors.

-

The recent decline in the number of ADA holders implies a wave of profit-taking, which is often a precursor to further price decreases in volatile markets.

-

A spokesperson from COINOTAG noted, “The ongoing selling pressure and declining holders’ count paint a concerning picture for Cardano’s immediate future.”

Cardano (ADA) faces intense selling pressure with a noticeable decline in holders, risking a drop below $1 amidst profit-taking trends.

Cardano’s Short-Term Outlook: Analyzing Current Trends

The Cardano ecosystem is currently exhibiting bearish signals as the price struggles to maintain stability. According to on-chain metrics, the trend in large holders’ netflow indicates a shift from accumulation to distribution. Specifically, the percentage of netflow for large addresses has decreased significantly, indicating greater selling than buying in recent days.

As reported by IntoTheBlock, this netflow fell to 142% over the past week, reflecting growing concerns among large investors. This trend suggests that further price drops may be imminent, especially as younger or smaller holders continue to book profits from previous gains.

Declining Holder Counts: Implications for ADA Price

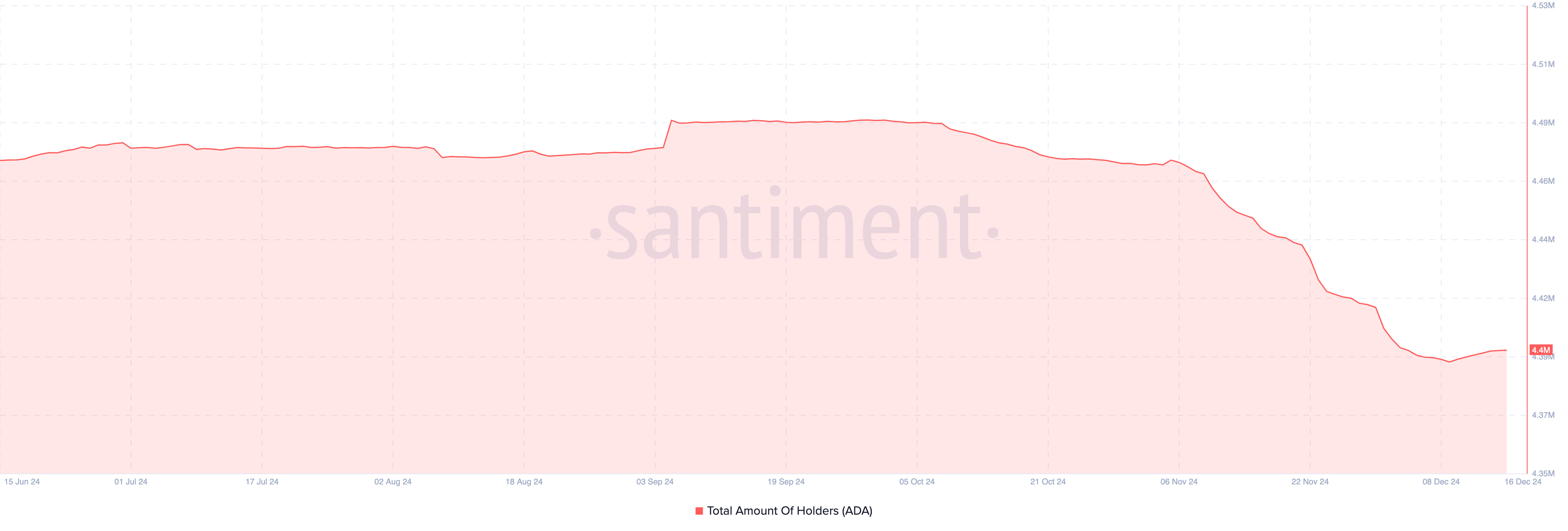

Another alarming trend is the noticeable decline in the total number of ADA holders, which dropped from approximately 4.47 million in early November to about 4.40 million recently. This reduction signals a lack of confidence among users, as many smaller investors may be liquidating their positions following recent price fluctuations.

This decline in holder count typically correlates with reduced demand, which can thwart any potential bullish movements. If this trend continues, the lack of new funds entering the market could exert further downward pressure on ADA’s price.

Cardano (ADA) Price Projections: Risks and Opportunities

On the technical side, ADA appears to have notably breached both the 20 and 50 Exponential Moving Averages (EMA). According to analysis from reputable trading platforms, such as TradingView, this trend is indicative of potential support levels being tested.

If ADA continues to experience bearish momentum, it could descend towards the immediate support at or below $1.05. In light of this analysis, a further drop to the $0.95 mark seems plausible in the near term. Conversely, should bulls emerge to push the price above these moving averages, ADA could potentially rebound, with an upward target around $1.19 being plausible.

Conclusion

In summary, Cardano’s immediate outlook is complicated by declining large holder activity and a drop in overall owner numbers. Investors should tread carefully, focusing on market dynamics that could influence ADA’s trajectory. While a rebound is possible if momentum shifts favorably, the prevailing bearish indicators suggest vigilance is warranted for holders and potential investors alike.