Volume 213: Digital Asset Fund Flows Weekly Report

From CoinShares Research Blog by James Butterfill

Year-to-date inflows quadruple any other year at US$44.5bn

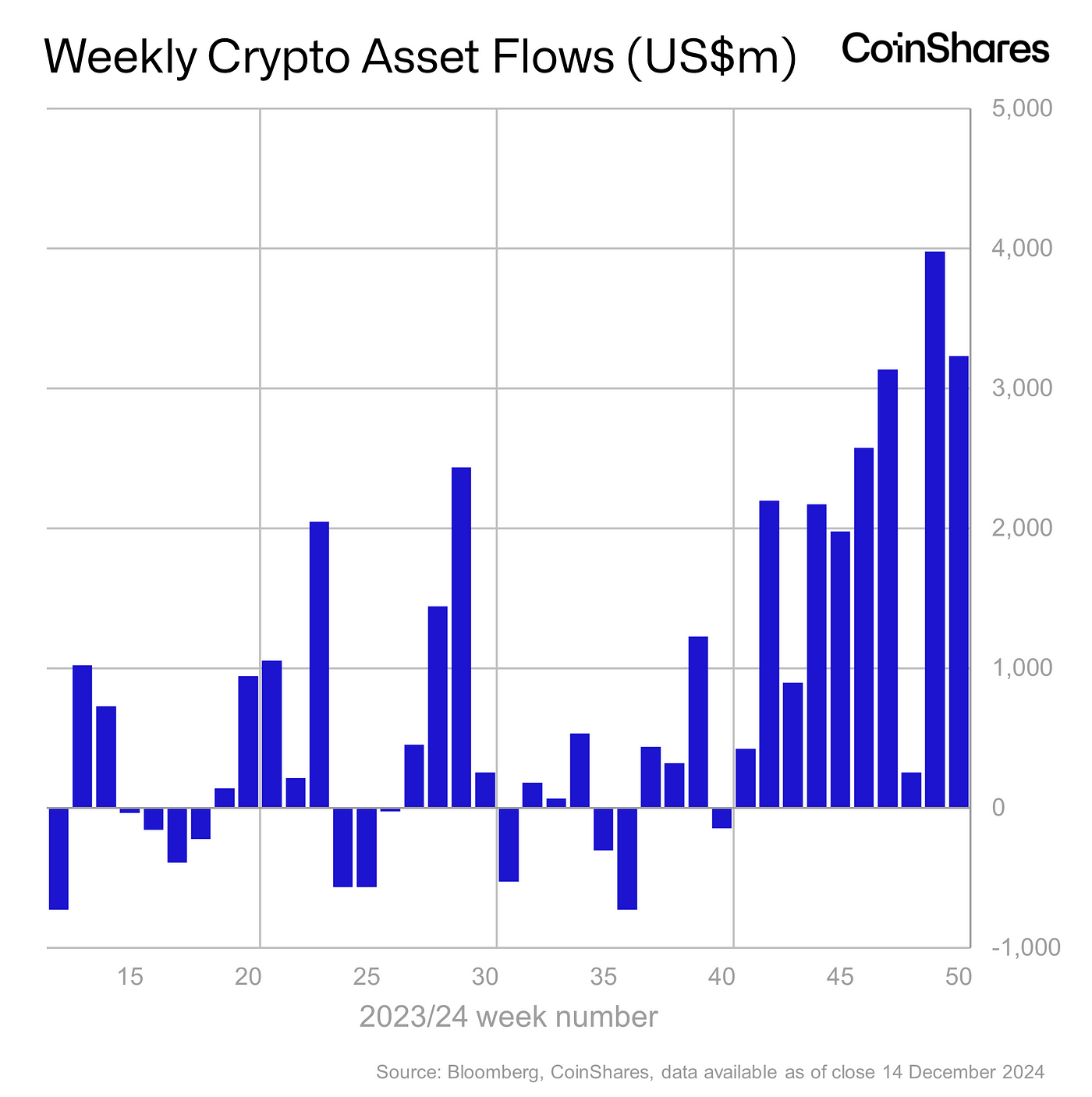

- Digital asset investment products saw a continuation of inflows last week totalling US$3.2bn, the 10th consecutive week, with inflows this year so far now totalling an astonishing US$44.5bn.

- Bitcoin investment products saw inflows totalling US$2bn, bringing total inflows since the US election to US$11.5bn.

- Ethereum saw its 7th consecutive week of inflows of US$1bn, with inflows over those 7 weeks totalling US$3.7bn.

Digital asset investment products saw a continuation of inflows last week totalling US$3.2bn, the 10th consecutive week, with inflows this year so far now totalling an astonishing US$44.5bn, more than quadruple that of any other year. Trading volumes in ETPs have averaged US$21bn a week, comprising 30% of the bitcoin traded on trusted exchanges. Bitcoin volumes on trusted exchanges (all investment types) is highly liquid, having averaged US$8.3bn a day this year, double that of the FTSE 100.

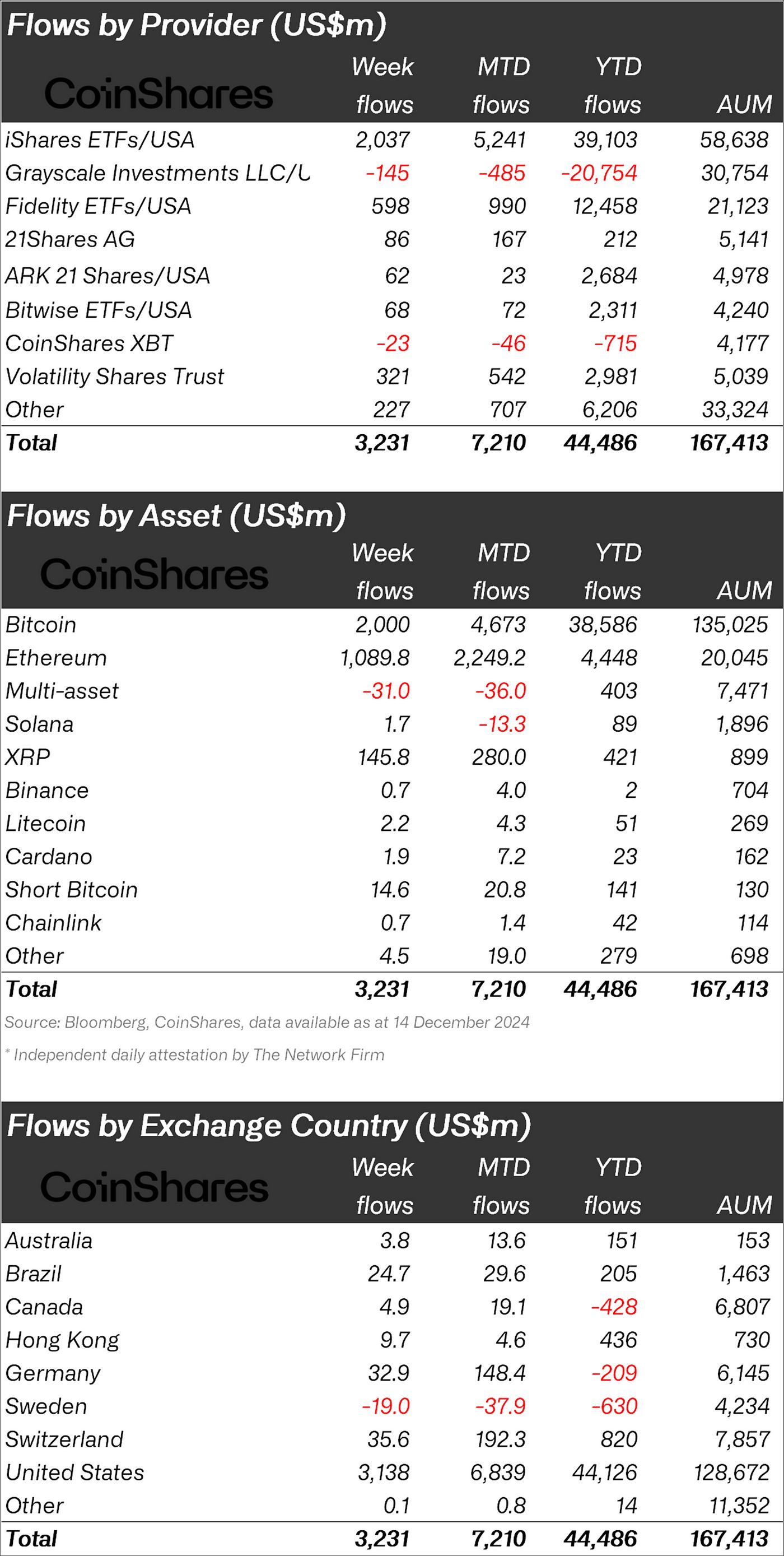

Regional flows highlighted broad positive sentiment, with all regions seeing inflows, most notable being the US, Switzerland, Germany and Brazil, with inflows totalling US$3.1bn, US$36m, US$33m and US$25m respectively.

Bitcoin investment products saw inflows totalling US$2bn, bringing total inflows since the US election to US$11.5bn. Short Bitcoin saw US$14.6m inflows after recent price gains, although total AuM remains low at US$130m.

Ethereum saw its 7th consecutive week of inflows of US$1bn, with inflows over those 7 weeks totalling US$3.7bn, a dramatic improvement in sentiment.

Altcoin XRP saw inflows of US$145m as hopes rise for a US listed ETF, while Polkadot and Litecoin saw inflows of US$3.7m and US$2.2m respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.