Glassnode Co-Founders Say Fed’s Hawkishness Triggered Bitcoin Dip, Predict BTC Recovery – Here’s Why

The co-founders of the crypto analytics platform Glassnode are predicting a Bitcoin ( BTC ) recovery after they say the Fed’s hawkishness triggered a correction Wednesday.

Jan Happel and Yann Allemann, who go by the handle Negentropic, tell their 63,300 followers on the social media platform X that the Fed’s decision to forecast less than previously expected rate cuts next year led to Bitcoin dipping below $100,000.

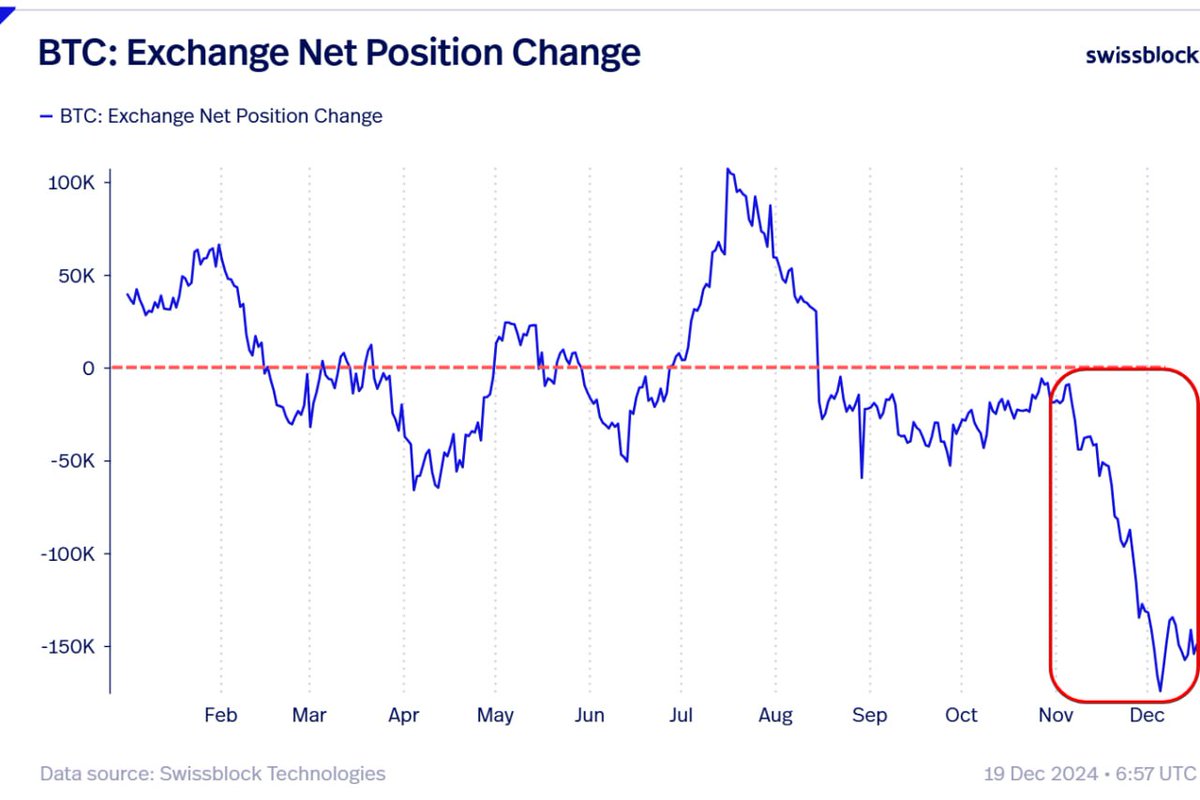

However, they say that the Bitcoin exchange net position change metric, which tracks the 30-day supply held in exchange wallets, continues to signal bullishness.

“Another dip, another buy. [Fed chair Jerome] Powell’s hawkish tone triggered a dip to $99,000, but Bitcoin quickly rebounded to $100,000. Meanwhile, BTC is leaving exchanges at record rates, marking the third-best outflow day this year. The November accumulation wave shows no signs of stopping, which makes the potential for a recovery more likely.”

Source: Negentropic/X

Source: Negentropic/X

Bitcoin is trading for $100,426 at time of writing, down 3.5% in the last 24 hours.

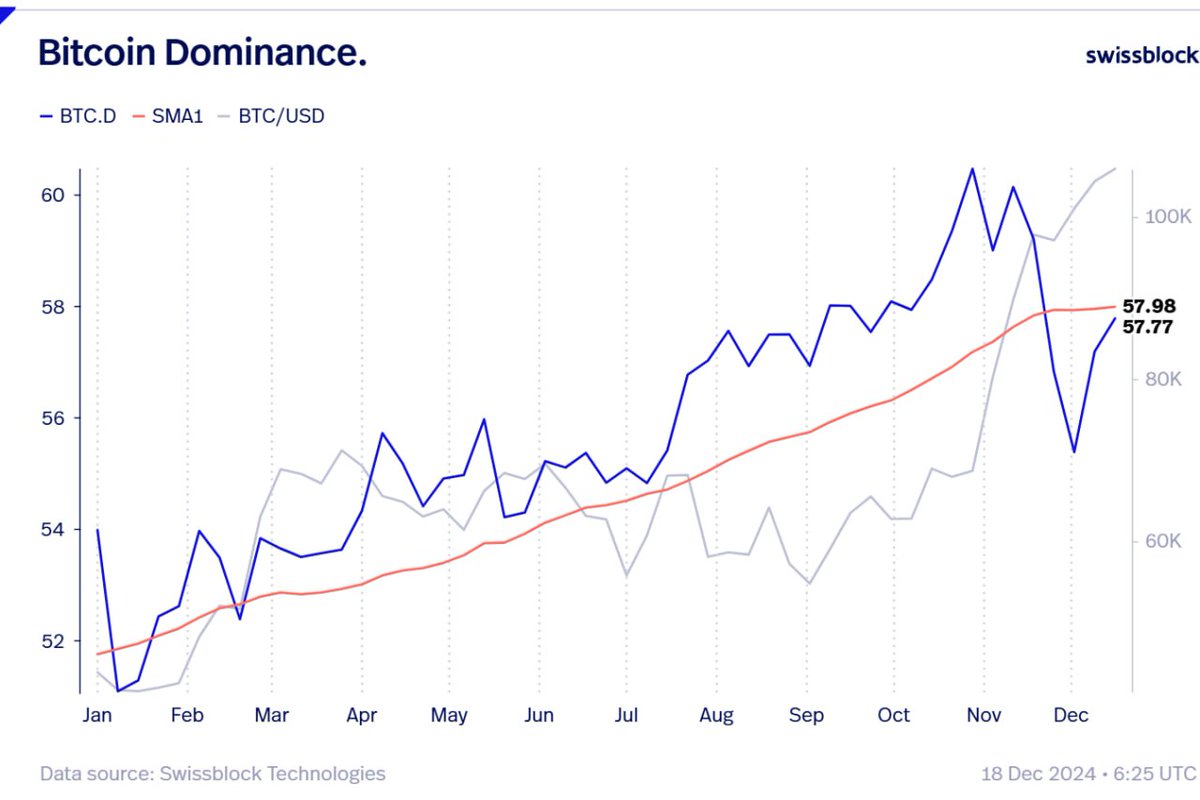

The analysts also say that Bitcoin’s dominance level (BTC.D), the ratio between the market cap of BTC versus the market cap of all crypto assets combined, could signal within days if altcoins start to outperform the flagship digital asset.

“Bitcoin dominance at a crossroads: key year-end decision.

Bitcoin dominance is on the verge of resuming the uptrend it began earlier this year. Will it break higher, or face rejection at this level and continue declining?

This is a crucial moment for year-end dynamics:

- If dominance rises, we could see a Bitcoin-focused rally, leaving most altcoins lagging behind (with a few exceptions).

- If dominance falters, it opens the door for a potential altcoin resurgence.

The next few days are pivotal for shaping the direction of dominance and determining whether the altcoin season can make a comeback.”

Source: Negentropic/X

Source: Negentropic/X

At time of writing, BTC.D is at 58.44%.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Sensvector/Ruslan Kim Studio

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x POWER: Trade to share 4,387,500 POWER

New users get a 100 USDT margin gift—Trade to earn up to 1888 USDT!

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!