Bitwise CIO downplays price ‘hiccup’ amid Bitcoin bull trend after FOMC shakes markets

Bitwise CIO reassures investors with optimism rooted in technological progress and policy support for Bitcoin.

Bitcoin’s price experienced a sharp pullback following the US Federal Reserve’s recent rate cut, but market experts like Bitwise CIO Matt Hougan remain optimistic about the asset’s long-term trajectory.

On Dec. 18, the Federal Reserve announced a 25-basis-point rate cut , scaling back its outlook for 2024 to two cuts instead of the previously expected four.

Also, and perhaps more significantly for Bitcoin, Chair Jerome Powell added that the Fed cannot hold BTC under current regulations while responding to inquiries about President-elect Donald Trump’s strategic reserve plans .

This triggered significant market reactions, with Bitcoin’s price falling to as low as $98,839 before stabilizing at $101,586 earlier today. Similarly, other top digital assets like Ethereum , XRP, and Solana also recorded losses of around 5%, 5.5%, and 3%, respectively.

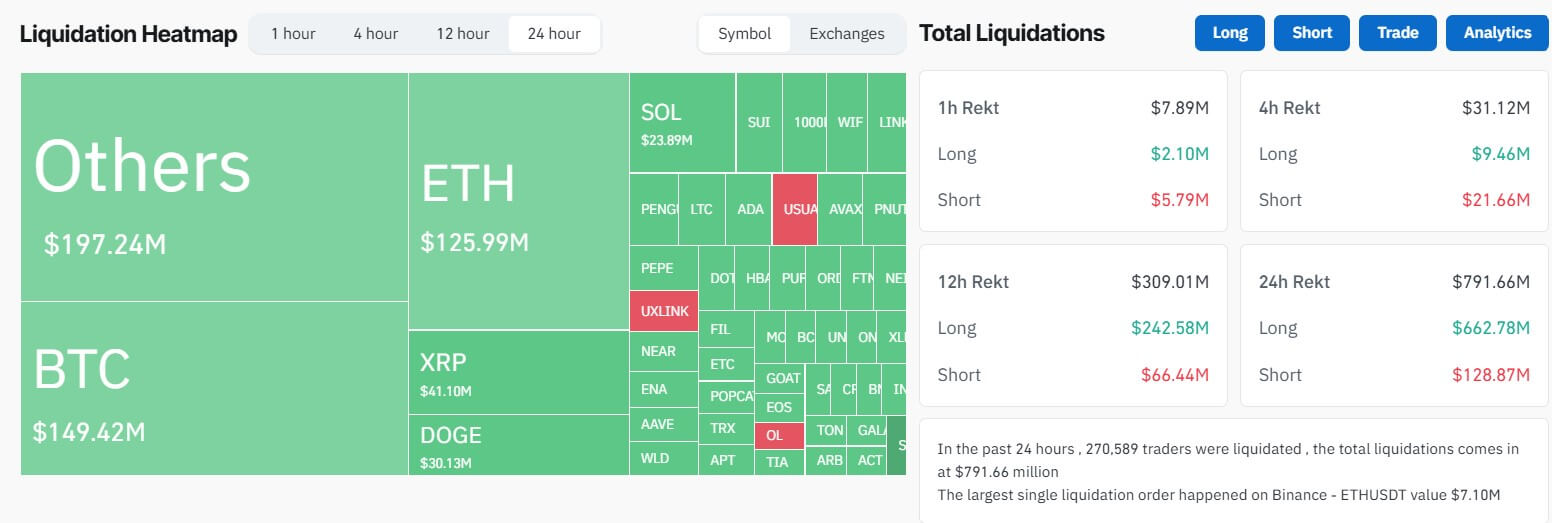

Data from CoinGlass shows that this red market performance led to around $800 million in liquidation, impacting more than 270,000 traders. Traders speculating on upward price movement suffered the most losses, losing $662 million during the last 24 hours.

Crypto Market Liquidation (Source: CoinGlass)

Crypto Market Liquidation (Source: CoinGlass)

Beyond crypto, traditional markets like the SP 500 and the Russell 2000 Index experienced 3% and 4.4% declines, respectively.

Bitcoin’s long-term trajectory

Despite this pullback, Hougan reassured investors that Bitcoin’s fundamentals remain strong.

The Bitwise CIO explained that Bitcoin’s recent resilience stems from internal crypto-specific factors, such as growing institutional adoption, pro-crypto shifts in US policy, and government and corporate Bitcoin purchases.

He also highlighted significant blockchain advancements and increasing ETF flows as additional drivers of market strength.

Moreover, Bitcoin’s technical indicators remain favorable, with its 10-day exponential moving average ($102,000) still above the 20-day exponential moving average ($99,000). Hougan views this as a bullish signal, reinforcing his belief that the current dip is a short-term fluctuation rather than the end of the ongoing bull market.

Despite external pressures, Hougan predicted that Bitcoin would continue its multi-year upward trajectory, buoyed by strong adoption trends and technological advancements in the crypto space.

He concluded:

“Crypto’s in a multi-year bull market. 50bps of projected rate cuts won’t change that.”

Mentioned in this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x POWER: Trade to share 4,387,500 POWER

New users get a 100 USDT margin gift—Trade to earn up to 1888 USDT!

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!