The proposal for Japan's 2025 tax reform states "considering a review on taxing virtual currencies"

On December 20, the Tax Committee and Tax Research Committee of Japan's Liberal Democratic Party and Komeito finalized the outline for fiscal year 2025 (Reiwa 7) tax reform at their plenary meeting. Hiroshi Hirai, the first Minister of Digital Affairs from LDP’s digital headquarters, visited the Financial Bureau and submitted an "urgent proposal to make cryptocurrency assets contribute to the national economy" to them. The following three points were identified as key in the proposal: Profits and losses from cryptocurrency transactions must be taxed separately; A regulatory framework related to cryptocurrencies should be established; Efforts should be made to make cybersecurity a contributing asset to the national economy. Representative Hirai stated that he had received widespread approval from Minister Kato, so it is expected that progress on specific system design will accelerate. This time, including taxes related to cryptocurrency transactions in LDP's tax reform outline has paved way for future adjustments in tax rates, establishment of profit-loss consolidation rules, changes in types of taxes etc., which will become apparent soon. Therefore, both Financial Bureau and National Tax Agency will start designing specific systems while businesses such as cryptocurrency exchanges can also begin necessary preparations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Barcelona Football Club criticized for signing a $22 million sponsorship deal with crypto company ZKP

Swedish payment giant Klarna's first stablecoin, KlarnaUSD, has been launched ahead of schedule

Bitcoin OG opens 5x ETH short position worth $15.04 million

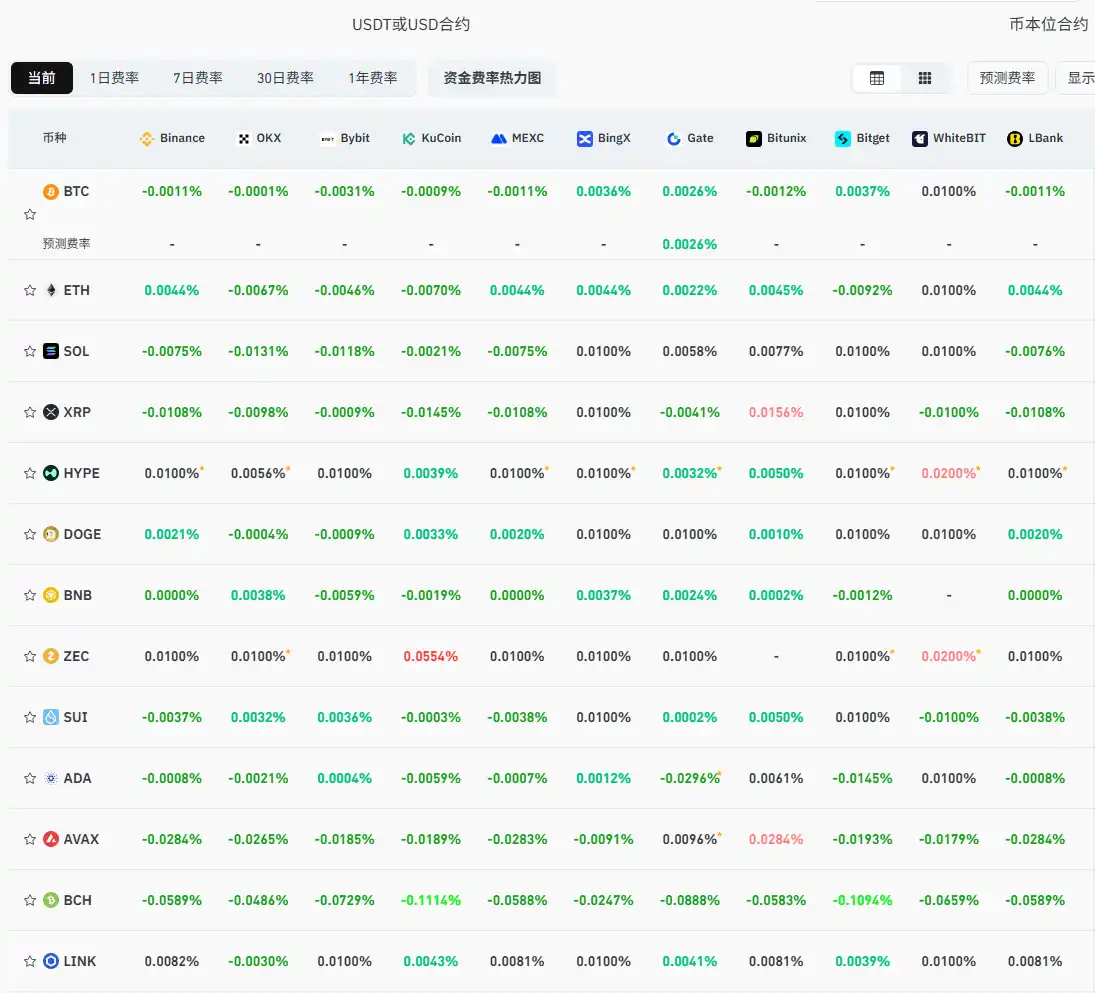

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish