- The SEC announced a potential change in operational status.

- Advocate Jeremy Hogan advised the SEC to file a stay on all non-fraud litigation.

- XRP has dropped to the 4th position in the market and trades at $2.28.

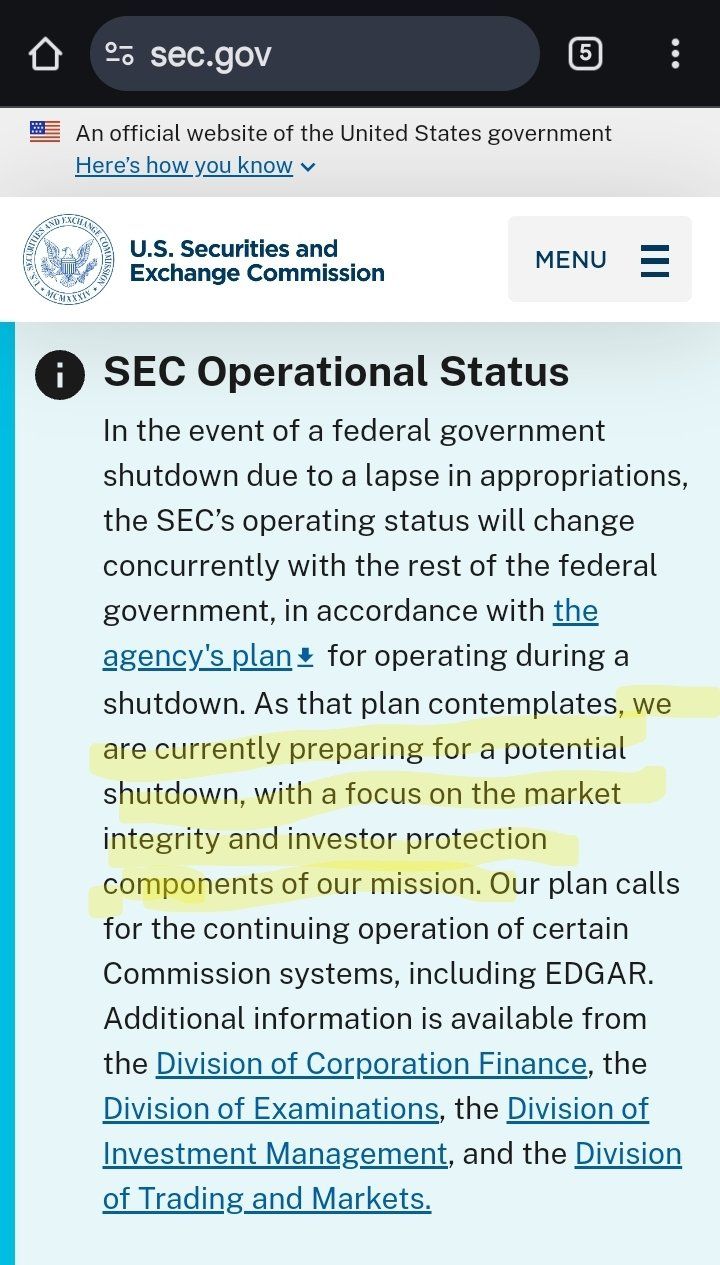

The lawsuit filed by the United States Securities and Exchange Commission (SEC) against Ripple regarding the sale of XRP tokens may be approaching its conclusion. The SEC recently announced changes to its operating status, which will align with federal government directives during a potential government shutdown caused by budgetary constraints.

With Donald Trump elected as the next U.S. president and his appointment of Paul Atkins as the SEC’s new Chair, the agency is set for significant changes. Pro-crypto leadership at the SEC could reshape regulatory dynamics and have substantial implications for the cryptocurrency market.

Jeremy Hogan, a partner at Hogan & Hogan, urged the SEC via X (formerly Twitter) to “file for stays on all non-fraud litigation that poses no immediate risk to investors.” Hogan argued this approach would be appropriate given the looming government shutdown and the incoming crypto-friendly administration.

Timeline of the Ripple-SEC Lawsuit

The SEC initiated the lawsuit in 2020 against Ripple and its executives over XRP’s sales during the project’s early stages. A landmark 2023 ruling by Judge Analisa Torres cleared Ripple executives of certain charges, but a final verdict is still pending.

Changes in the SEC’s operational status could delay approvals for spot cryptocurrency exchange-traded funds (ETFs) in the U.S. Currently, Solana (SOL) and other ETFs remain under review. However, the arrival of a new crypto-friendly SEC Chair raises the possibility of expedited decisions.

XRP Price Performance

XRP climbed to the third-largest cryptocurrency by market capitalization following the launch of Ripple’s highly anticipated RLUSD stablecoin. However, after a sharp market downturn, XRP fell to fourth place with a market cap of $110 billion.

Read also: Ripple Launches RLUSD: A Compliant Alternative to Tether

As of this writing, XRP trades at $2.28 , a 2.80% drop in 24 hours. Despite the dip, XRP has surged 275.8% since December 2023, reaching multi-year highs.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.