- Franklin Templeton’s and Hashdex’s spot BTC-ETH ETFs were approved by the SEC.

- Bitcoin dropped as low as $95.5K while ETH dipped to $3.3K in the past day.

- Spot BTC and ETH ETFs recorded $680 million and $60.4 million in outflows on Thursday, respectively.

Bitcoin’s price dropped below $100,000 after a 4% decline over 24 hours, just as the U.S. Securities and Exchange Commission (SEC) gave its approval to Hashdex and Franklin Templeton’s spot BTC/ETH combination exchange-traded funds (ETFs). Ethereum’s price saw an 8.4% decrease during this period.

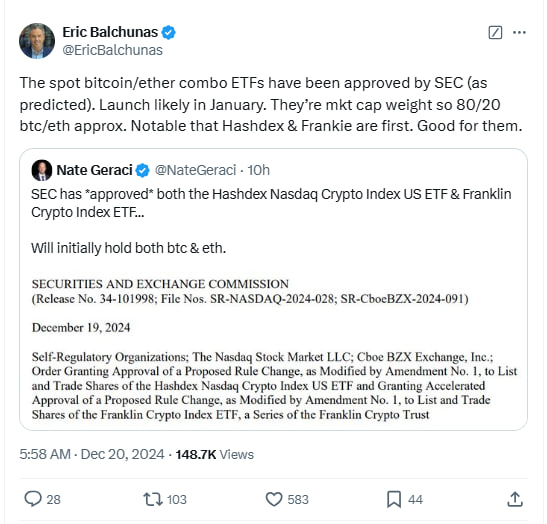

The SEC announced on December 19 that it had authorized Hashdex and Franklin Templeton to list their BTC-ETH investment products on the Nasdaq stock market and Cboe BZX Exchange. These new offerings are named Hashdex’s Nasdaq Crypto Index US ETF and Franklin Crypto Index ETF.

These ETFs will track spot prices of Bitcoin and Ether. Franklin Templeton’s ETF follows the Institutional Digital Asset Index, which reflects the price movements of cryptocurrencies like BTC and ETH. Hashdex’s ETF monitors the Nasdaq Crypto US Settlement Price Index.

The SEC issued a separate filing that confirmed Franklin Templeton’s application received “accelerated basis” approval. Eric Balchunas, Senior ETF Analyst at Bloomberg, predicts these investment products could launch in January. The ETFs share substantial similarities with other Bitcoin and Ether ETPs that received approval earlier this year.

Record Outflows Hit BTC and ETH ETFs

SoSoValue data shows U.S. spot Bitcoin ETFs recorded a total net outflow of $680 million on December 19, marking the highest single-day outflow in history and the first single-day net outflow in 15 days. Spot Ethereum ETFs experienced a total net outflow of $60.4677 million, their first net outflow in 18 days.

Read also: El Salvador Scales Back Bitcoin Adoption Under IMF Loan Terms

Bitcoin fell to $95.5K despite the new ETF approvals, while Ethereum declined to a daily low of $3,330.87 from $3,717.66. Ethereum’s trading volume increased by 11.55% to $57.8 billion, according to CoinMarketCap data , but the cryptocurrency has struggled to maintain prices above $4,000 in past weeks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.