-

Avalanche (AVAX) may be poised to regain bullish momentum as increasing market activity catches the attention of crypto enthusiasts.

-

Current metrics indicate a significant uptick in both active and new addresses, signaling growing interest and participation in the AVAX ecosystem.

-

According to COINOTAG, enhanced whale activity is likely a driving force behind the recent surge in market engagement.

AVAX shows signs of potential rebound as whale participation increases and active address metrics surge, setting the stage for a possible bullish trend.

Growing addresses show increased market interest

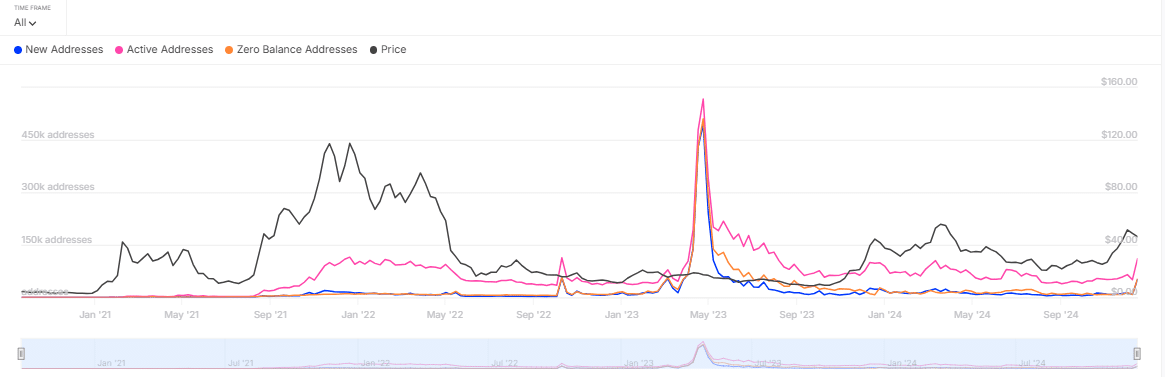

The market interest in Avalanche (AVAX) is on the rise, as both Active Addresses (AA) and New Addresses (NA) have surged significantly. In the past week alone, active addresses have observed a substantial increase of 44.50%, reflecting heightened transaction activity among existing users. Meanwhile, new addresses experienced an impressive rise of 142.90%, indicating that more investors are discovering and adopting AVAX.

Source: IntoTheBlock

This combination of increasing market participation and a surge in new addresses creates a bullish sentiment, suggesting that the AVAX market could be on the brink of a potential upswing.

In fact, according to COINOTAG, the increase in demand may predominantly stem from whales accumulating significant amounts of AVAX, propelling the overall activity levels in the market.

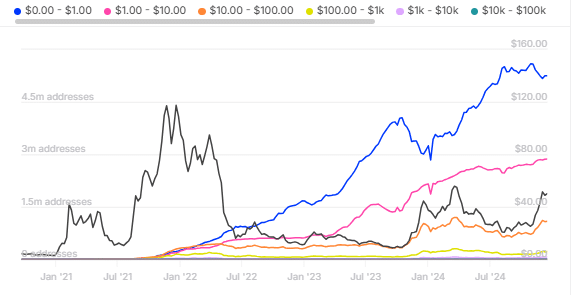

Large holders are accumulating AVAX

A noticeable trend is emerging where large AVAX holders, often referred to as whales, are significantly increasing their holdings. In particular, accounts holding between $1 million and $10 million in AVAX have drawn attention, as this category saw a 24.08% increase over the past week. Similar trends were observed across various address metrics, with addresses holding between $100,000 and $1 million also seeing a 20.13% growth, and those with balances between $10,000 and $100,000 climbing by 23.56%.

Source: IntoTheBlock

The collective accumulation observed among these large traders suggests a potentially bullish outlook for AVAX. A cohesive sentiment among these key market participants typically signals a healthy buying trend, which could act as a catalyst for price recovery if the overall market sentiment shifts positively.

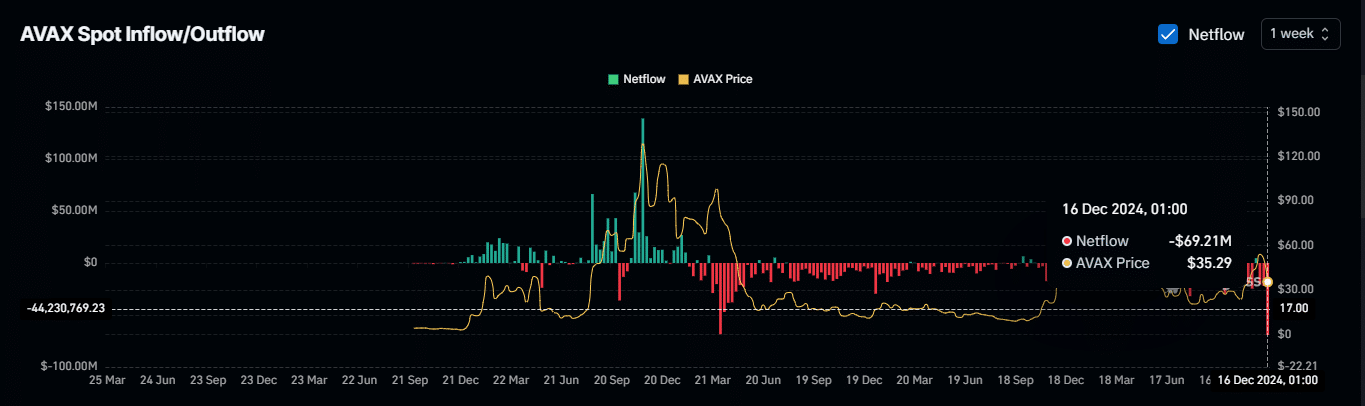

Supply of AVAX is gradually declining

Another important factor to consider is the continued decline in the available supply of AVAX in the market. Recent data highlights a significant drop in exchange net outflows, with $9.61 million worth of AVAX being withdrawn from exchanges within just the past 24 hours. This substantial outflow brings the total weekly net outflow to $69.21 million, marking the highest level since early April 2022.

Source: Coinglass

Moreover, the positive shift in the Open Interest Weighted Funding Rate indicates that sophisticated traders are strategically positioning themselves for a potential rally. As market conditions evolve, the combination of declining supply and increased market interest may signal a forthcoming bullish phase for AVAX.

If the prevailing market sentiment begins to trend towards a bullish outlook, AVAX could experience a substantial price resurgence, potentially recovering from its recent decline.

Conclusion

In summary, while AVAX has faced recent price challenges, the signs of increasing market interest through rising address metrics and significant whale accumulation present a compelling narrative for potential recovery. If these trends continue, it is likely that AVAX could see a resurgence in its market performance, particularly as supply dynamics shift. Investors should monitor these developments closely for further insights into AVAX’s potential trajectory.